SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer this financial accounting question

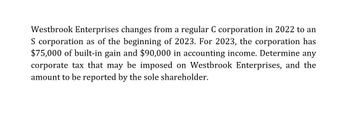

Transcribed Image Text:Westbrook Enterprises changes from a regular C corporation in 2022 to an

S corporation as of the beginning of 2023. For 2023, the corporation has

$75,000 of built-in gain and $90,000 in accounting income. Determine any

corporate tax that may be imposed on Westbrook Enterprises, and the

amount to be reported by the sole shareholder.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ironwood Corporation has ordinary taxable income of $65,000 in 2019, and a short-term capital loss of $15,000. What is the corporation's tax liability for 2019? $7,500 $5,250 $10,500 $13,650 None of the abovearrow_forwardGray, Inc., a C corporation, has taxable income from operations of 1,452,000 for 2019. It also has a net long-term capital loss of 355,000 from the sale of a subsidiarys stock. The year 2019 is the first year in the last 10 years that Gray has not had at least 500,000 per year of net long-term capital gains. What is Grays 2019 taxable income? What, if anything, can it do with any unused capital losses?arrow_forwardVirginia Corporation is a calendar-year corporation. At the beginning of 2023, its election to be taxed as an S corporation became effective. Virginia Corporation's balance sheet at the end of 2022 reflected the following assets (it did not have any earnings and profits from its prior years as a C corporation). Asset Adjusted Basis FMV Cash $ 25,250 $ 25,250 Accounts receivable 46,300 46,300 Inventory 101,550 222,050 Land 192,000 221,200 Totals $ 365,100 $ 514,800 In 2023, Virginia Corporation reported business income of $60,500 (this would have been its taxable income if it were still a C corporation). What is Virginia's built-in gains tax in each of the following alternative scenarios? During 2023, Virginia Corporation sold inventory it owned at the beginning of the year for $113,650. Assume the original facts except Virginia Corporation had a net operating loss carryover of $28,200 from its time as a C corporation. The built-in gains tax is $______arrow_forward

- Virginia Corporation is a calendar-year corporation. At the beginning of 2023, its election to be taxed as an S corporation became effective. Virginia Corporation's balance sheet at the end of 2022 reflected the following assets (it did not have any earnings and profits from its prior years as a C corporation). Asset Adjusted Basis FMV Cash $ 25,250 $ 25,250 Accounts receivable 46,300 46,300 Inventory 101,550 222,050 Land 192,000 221,200 Totals $ 365,100 $ 514,800 In 2023, Virginia Corporation reported business income of $60,500 (this would have been its taxable income if it were still a C corporation). What is Virginia's built-in gains tax in each of the following alternative scenarios? During 2023, Virginia Corporation sold inventory it owned at the beginning of the year for $113,650. Assume the original facts except Virginia Corporation is a C corporation, and its taxable income was $3,600. The built-in gains tax is $______arrow_forwardTempe Corporation is a calendar - year corporation. At the beginning of 2022, its election to be taxed as an S corporation became effective. Tempe Corporation's balance sheet at the end of 2021 reflected the following assets (it did not have any earnings and profits from its prior years as a C corporation): Asset Adjusted Basis FMV Cash $31,500 $ 31,500 Accounts receivable 46, 900 46,900 Inventory 206, 000 269,000 Land 196,000 143,000 Totals $ 480, 400 $ 490, 400 Tempe Corporation's business income for the year was $ 51,500 (this would have been its taxable income if it were a C corporation). During 2022, Tempe Corporation sold all of the inventory it owned at the beginning of the year for $ 302,000. a. What is its built - in gains tax in 2022 ? b. Assume the original facts, except that if Tempe Corporation were a C corporation, its taxable income would have been $ 8,800. What is its built - in gains tax in 2022?arrow_forwardTempe Corporation is a calendar-year corporation. At the beginning of 2022, its election to be taxed as an S corporation became effective. Tempe Corporation's balance sheet at the end of 2021 reflected the following assets (it did not have any earnings and profits from its prior years as a C corporation): Asset Adjusted Basis FMV Cash $31,500 $ 31,500 Accounts receivable 46,900 46,900 Inventory 206,000 269,000 Land 196,000 143,000 Totals $ 480, 400 $ 490,400 Tempe Corporation's business income for the year was $51,500 (this would have been its taxable income if it were a C corporation). During 2022, Tempe Corporation sold all of the inventory it owned at the beginning of the year for $ 302,000. a. What is its built-in gains tax in 2022? b. Assume the original facts, except that if Tempe Corporation were a C corporation, its taxable income would have been $8,800. What is its built-in gains tax in 2022?arrow_forward

- Tempe Corporation is a calendar-year corporation. At the beginning of 2022, its election to be taxed as an S corporation became effective. Tempe Corporation's balance sheet at the end of 2021 reflected the following assets (it did not have any earnings and profits from its prior years as a C corporation): Asset Adjusted Basis FMV Cash $ 27,000 $ 27,000 Accounts receivable 44,200 44,200 Inventory 188,000 242,000 Land 178,000 134,000 Totals $ 437,200 $ 447,200 Tempe Corporation's business income for the year was $47,000 (this would have been its taxable income if it were a C corporation). During 2022, Tempe Corporation sold all of the inventory it owned at the beginning of the year for $266,000. a. What is its built-in gains tax in 2022? b. Assume the original facts, except that if Tempe Corporation were a C corporation, its taxable income would have been $9,800. What is its built-in gains tax in 2022? c. Assume the original facts, except the land was valued at $168,000 instead of…arrow_forwarda. Reconcile book income to taxable income for Timpanogos Incorporated. Be sure to start with book income and identify all of the adjustments necessary to arrive at taxable income.arrow_forwardAssume that Puritan Corporation operates in an industry for which NOL carryback is allowed. Puritan Corporation reported the following pretax accounting income and taxable income for its first three years of operations: 2023 $ 348,000 2024 (534,000) 2025 765,000 Puritan's tax rate is 25% for all years. Puritan elected a loss carryback. As of December 31, 2024. Puritan was certain that it would recover the full tax benefit of the NOL that remained after the operating loss carryback. What would Puritan report as net income for 2025? Multiple Choice $623.554 $573,750 $143,448 $621,562arrow_forward

- P Corporation uses the calendar year as its tax year and the accrual method as its overall accounting method. S Corporation uses a fiscal year ending June 30 as its tax year and the cash method as its overall accounting method. On July 31, 2022, P acquires all of S's stock, and the P-S affiliated group elects to file a consolidated tax return for 2022. a. What tax year must the group use in filing its consolidated tax return? b. What overall accounting method(s) can P and S Corporations use? c. What tax returns must the corporations file?arrow_forwardPotter Corporation is a calendar year, accrual basis corporation. For 2022, the corporate tax returns reports $575,920 in taxable income. In addition, the corporation provides the following information: Federal Income tax liability paid Tax-exempt interest income Entertainment Expense Excess of capital losses over capital gains $ 120,940 6,250 4,750 14,000 79,000 56,000 Section 179 expense elected and deducted during 2020 for regular tax purposes 40,000 25,000 MACRS cost recovery deduction E&P depreciation (straightline depreciation using ADS) Dividends received from domestic corporations (less than 20% owned) calculate Potter Corporations E&P for the calendar year. Requirements • You may submit your answer in Excel, Word or PDF format. You may also upload a picture of your calculations if you choose to do the assignment by hand. Show your calculations for maximum points.arrow_forwardAccounting Exile Corporation has operating income of $42,000 and operating expenses of $69,000 in 2021. In 2022, it generates operating income of $85,000 and operating expenses of $74,000. What is Exile’s 2022 taxable income, as reported on its Form 1120?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you