FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

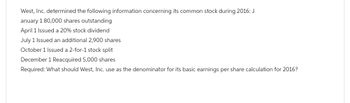

Transcribed Image Text:West, Inc. determined the following information concerning its common stock during 2016: J

anuary 1 80,000 shares outstanding

April 1 Issued a 20% stock dividend

July 1 Issued an additional 2,900 shares

October 1 Issued a 2-for-1 stock split

December 1 Reacquired 5,000 shares

Required: What should West, Inc. use as the denominator for its basic earnings per share calculation for 2016?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Per your request I am resubmitting question S-13 and adding S-12 per your request. Thanksarrow_forwardCorgi, Inc. has the following stock issued as of December 2015: 6% Preferred Stock, $100 par, 10,000 shares issued and outstanding Common Stock, $5 par, 50,000 shares issued and outstanding The preferred stock dividend is cumulative. Dividends were paid in 2013, but were not paid during 2014. On December 15, 2015, Corgi declares dividends of $210,000. How much of this dividend will be distributed to Common Stock?arrow_forwardIn 2017 Pedroni Corporation reported net income of $1,000,000. It declared and paid preferred stock a dividend of $250,000. During 2017, Pedroni had a weighted average of 190,000 shares outstanding. Compute Pedroni's Earnings Per Share.arrow_forward

- The shareholders’ equity section of the balance sheet of TNL Systems Inc. included the following accounts at December 31, 2015: Shareholders’ Equity ($ in millions) Common stock, 240 million shares at $1 par $ 240 Paid-in capital—excess of par 1,680 Paid-in capital—share repurchase 1 Retained earnings 1,100 Required: 1. During 2016, TNL Systems reacquired shares of its common stock and later sold shares in two separate transactions. Prepare the entries for both the purchase and subsequent resale of the shares assuming the shares are (a) retired and (b) viewed as treasury stock. a. On February 5, 2016, TNL Systems purchased 6 million shares at $10 per share. b. On July 9, 2016, the corporation sold 2 million shares at $12 per share. c. On November 14, 2018, the corporation sold 2 million shares at $7 per share. 2. Prepare the shareholders’ equity section of TNL Systems’ balance sheet at December 31, 2018, comparing the two approaches. Assume all net income earned in 2016–2018 was…arrow_forwardMarutzky Corporation had a net income of $2,200,000 for the year 2018. On January 1, 2018, the corporation had 300,000 shares of common stock outstanding and issued an additional 250,000 shares of common stock on October 1, 2018. Calculate the earnings per shares using the weighted-average number of common shares outstanding.arrow_forward(a) Your answer is correct. Determine the weighted-average number of shares outstanding as of December 31, 2026. (b) The weighted-average number of shares outstanding eTextbook and Media X Your answer is incorrect. Earnings per share 1751425 Assume that Ivanhoe Corp. earned net income of $3,500,000 during 2026. In addition, it had 101,000 shares of 9%, $100 par nonconvertible, noncumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2026. Compute earnings per share for 2026, using the weighted-average number of shares determined in part (a). (Round answer to 2 decimal places, e.g. 2.55.) 34.66 Attempts: 1 of 3 usedarrow_forward

- Domesticarrow_forwardListed here are data for five companies. These data are for the companies' 2017 fiscal years. The market price per share is the closing price of the companies' stock as of February 28, 2018, two months after the end of their fiscal years. Except for market price per share, all amounts are in millions. The shares outstanding number is the weighted-average number of shares the company used to compute basic earnings per share. Note that Berkshire has only 1.645 million shares outstanding, not 1,645 million. Company Amazon.com Berkshire Hathaway ExxonMobil Tepsico Verizon Communications Required: Compute the book value per share for each company. Book value per share Net Earnings $ 3,033 45,353 19,848 4,908 30,550 Amazon Berkshire Hathaway Stockholders' Equity $ 27,209 351,954 194,500 10,981 44,687 ExxonMobil Shares Outstanding 484 1.645 4,329 1,420 4,079 PepsiCo Market Price per Share $ 1,512.45 310,250.00 Verizon 75.74 109.73 47.74arrow_forwardThe following selected data were taken from the financial statements of Vidahill Inc. for December 31, 2017, 2016, and 2015: * December 31 December 31 December 31 20Y7 20Y6 2015 Total assets $259,000 $233,000 $207,000 Notes payable (8% interest) 90,000 90,000 90,000 Common stock 36,000 36,000 36,000 - Preferred 6% stock, $100 par (no change during year) 18,000 18,000 18,000 Retained earnings 102,320 68,120 54,000 The 2017 net income was $35,280, and the 20Y6 net income was $15,200. No dividends on common stock were declared between 2005 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 2017. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for the years 2016 and 2017. When required, round your answers to one decimal place. Return on total assets Return on stockholders' equity Return on common stockholders' equity 2017 20Y6 17.3 % 10.2 25.3 % 13.2 % 21.7 X % 6.4 X % ✓. Since the return on…arrow_forward

- Bonita Corporation had net income of $1,950,000 and paid dividends to common stockholders of $323,700 in 2017. The weighted average number of shares outstanding in 2017 was 500,000 shares. Bonita Corporation's common stock is selling for $45 per share on the NASDAQ. Bonita Corporation's payout ratio for 2017 is? A. $3.9 per share. B. 13.6%. C. 16.6%. D. 9.7%.arrow_forwardTriumph's has 40,000 common shares outstanding during 2018. Requirement 1. Compute earnings per share (EPS) for 2018 for Triumph's. Round to the nearest cent. Requirement 2. Compute Triumph's Companies' price/earnings ratio for 2018. The market price per share of Triumph's stock is $15.00. Triumph's Companies Income Statement Years Ended May 31, 2018 and 2017 2018 2017 Net Sales Revenue $42,400 $41,100 Cost of Goods Sold 22,500 29,300 Interest Expense 400 320 All Other Expenses 6,700 7,800 Net Income $12,800 $3,680 Triumph's Companies Balance Sheet May 31, 2018 and 2017 Assets Liabilities 2018 2017 2018…arrow_forward1. Compute Tidepool's EPS for the year. 2. Assume Tidepool's market price of a share of common stock is $ 7 per share Compute Tidepool's price / earnings ratio Tidepool Corp. earned net income of $133,340 and paid the minimum dividend to preferred stockholders for 2018. Assume that there are no changes in common shares outstanding during 2018. Tidepool's books include the following figuresarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education