ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

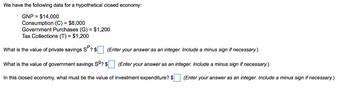

Transcribed Image Text:We have the following data for a hypothetical closed economy:

GNP = $14,000

Consumption (C) = $8,000

Government Purchases (G) = $1,200

Tax Collections (T) = $1,200

What is the value of private savings SP? $

What is the value of government savings S9? $

(Enter your answer as an integer. Include a minus sign if necessary.)

(Enter your answer as an integer. Include a minus sign if necessary.)

(Enter your answer as an integer. Include a minus sign if necessary.)

In this closed economy, what must be the value of investment expenditure? $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 31 5 points Save Answ In year 2018, the government of Qatar spent is 143 billion Qatari Riyal (the national currency of Qatar). The GDP of Qatar in the same year is 1,121 billion Qatari Riyal. Qatar's desired consumption and desired investment during the year can be summarized by the following equations: cd = 1,000 – 5,000r, || /d = 800 – 3000r, %3D cd is the desired consumption in billions of Qatari Riyal, 7º if the desired investment in billions of Qatari Riyal, and r is the real interest rate in decimal form. where What is the equilibrium real interest rate, r*, in %? Round your answer to at least 2 decimal places. (E.g. 12.3456% should be entered as 12.35)arrow_forwardSuppose Indian government borrows 50,000/- more next year than this year. Use a supply-and-demand diagram to analyze this policy. Does the interest rate rise or fall? What happens to investment? To private saving? To public saving? To national saving? Compare the size of the changes to the 50,000/- of extra government borrowing.arrow_forwardConsider country D, which is a closed economy. Suppose that D’s investment is 100, disposable income is 500 and the consumption 550. Answer D’s public saving and if government spending G is more than, less than or equal to the tax T. You need to use I = S, S = Private saving + Public saving The definition of private saving Then, you can answer how much is the public saving. Regarding G, remember the definition of public saving. Public saving: G:arrow_forward

- Consider an economy described by the following equations: Y = C + I + G Y = 6100 G = 1100 T = 1100 C = 1000 + .75(Y - T) I = 1100 - 60r in this economy compute private savings, public savings and national savings Find the equilibrium interest rate Now suppose that G rises to 1200. Compute private savings, public savings and national savings. Find the new equilibrium interest rate.arrow_forwardRefer to the figure below to answer the following questions. Real interest rate (percent per year) 4 3 2 1 0 15 20 PSLF 25 SLF DLF 30 Loanable funds (billions of 2007 dollars) In the situation above the government has a budget Private saving is $ billion. Investment is $ billion and national saving is $ billion.arrow_forwardSuppose real GDP is $5,136 billion, taxes collected by the government are $535 billion, government spending is $656 billion, and consumption spending is $3,893 billion. What is the value of private saving?arrow_forward

- At an aggregate output level of $400 billion what is aggregate savings?arrow_forwardAssume an economy with 1000 consumers. Each consumer has income in the current period of 50 units and future income of 60 units, and pays a lump-sum tax of 10 in the current period and 20 in the future period. The market real interest rate is 8%. Of the 1000 consumers, 500 consume 60 units in the future, while 500 consume 20 units in the future. a) Determine each consumer's current consumption and current saving. b) Determine aggregate private saving, aggregate consumption in each period, government spending in the current and future periods, the current-period government deficit, of the quantity of debt issued by the government in the current period. c) Suppose that current taxes increase to 15 for each consumer. Repeat parts (a) and (b) and explain your results.arrow_forwardCindy takes a summer job and earns an after-tax income of $5,000. Her living expenses during the summer were $1,000. What was Cindy's saving during the summer and the change, if any, in her wealth? >>> If your answer is negative, include a minus sign. If your answer is positive, do not include a plus sign. Cindy's saving during the summer is $arrow_forward

- Consider the following functions for consumption and investment: C = 1,000 + (2/3)*(Y – T) and I = 1,200 – 100*r. Furthermore, Y = 8,000, G = 2500, T = 2,000. Compute private, public, and national savings for this economy, and find the equilibrium real interest rate (r). Assume that G declines by 500 units. How will it change your answers in part (a)? What happens to the national savings, given everything else, if the public decides to consume less out of their disposable income (assume that the propensity of consume falls by 10 percent)? Given your answer in part (c), what happens to investment and real interest rate? Answer all four.arrow_forwardAssume an economy with 1000 consumers. Each consumer has income in the current period of 50 units and future income of 60 units, and pays a lump-sum tax of 10 in the current period and 20 in the future period. The market real interest rate is 8%. Of the 1000 consumers, 500 consume 60 units in the future, while 500 consume 20 units in the future. Determine each consumer’s current consumption and current saving. Current Consumption: Current Saving: Determine aggregate private saving, aggregate consumption in each period, government spending in the current and future periods, the current-period government deficit, and the quantity of debt issued by the government in the current period. Aggregate Private Saving Aggregate Consumption Government spending: Current Future Current period government deficit Quantity of debtarrow_forwardConsumption/Savings 1000 800 600 400 200 S 0 200 400 600 00 1000 1200 1400 1600 -200 Refer to the graph above to answer this question. What is the value of the MPS? A 0.5. B 0.4. 0.25. D 0.2. E -100. Incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education