FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

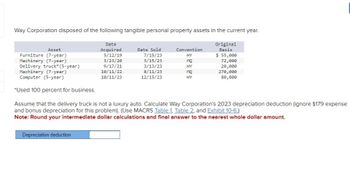

Transcribed Image Text:Way Corporation disposed of the following tangible personal property assets in the current year.

Date

Acquired

5/12/19

Original

Basis

$ 55,000

72,000

20,000

270,000

3/23/20

9/17/21

10/11/22

10/11/23

80,000

Asset

Furniture (7-year)

Machinery (7-year)

Delivery truck* (5-year)

Machinery (7-year)

Computer (5-year)

*Used 100 percent for business.

Date Sold

7/15/23

3/15/23

3/13/23

8/11/23

12/15/23

Depreciation deduction

Convention

HY

MQ

ELEGE

HY

MQ

HY

Assume that the delivery truck is not a luxury auto. Calculate Way Corporation's 2023 depreciation deduction (ignore §179 expense

and bonus depreciation for this problem). (Use MACRS Table 1. Table 2, and Exhibit 10-6.)

Note: Round your intermediate dollar calculations and final answer to the nearest whole dollar amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore §179 expense and bonus depreciation for this problem): (Use MACRS Table 1, Table 2, and Table 5.) Asset Machinery Computer equipment Delivery truck* Furniture Date Placed in Service October 25 February 3 March 17 April 22 Original Basis $ 108,000 48,000 61,000 188,000 Total $ 405,000 *The delivery truck is not a luxury automobile. In addition to these assets, Convers installed qualified real property (MACRS, 15 year, 150% DB) on May 12 at a cost of $680,000. b. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect out of bonus depreciation (but does not take §179 expense)? Note: Round your intermediate calculations to the nearest whole dollar amount. MACRS depreciation $ 868,000arrow_forwardRonny’s Red Hat Company purchased machinery on August 3, Year 1 for $150,000. Ronny, the owner, estimated that the machinery would be sold for $30,000 in 10 years. If Ronny’s red Hat Company uses straight line depreciation, what is included in the entry to record the disposition of the asset on July 31, Year 3 if the machinery is sold for $120,000 cash? Multiple Choice Dr. Loss on disposition $6,000 Cr. Gain on disposition $4,000 Dr. loss on disposition $4,000 Cannot be determined with the data provided Dr. Loss on disposition $2,500arrow_forwardGarcia Company owns equipment that cost $78,400, with accumulated depreciation of $41,600. Record the sale of the equipment under the following three separate cases assuming Garcia sells the equipment for (1) $48,200 cash, (2) $36,800 cash, and (3) $31,700 cash.arrow_forward

- Chaz Corporation has taxable income in 2023 of $1,312,250 for purposes of computing the §179 expense and acquired the following assets during the year: Placed in Asset Office furniture Computer equipment Delivery truck Qualified real property (MACRS, 15 year, 150% DB) Total Service September 12 February 10 August 21 September 30 Basis $ 790,000 940,000 78,000 1,509,000 $ 3,317,000 What is the maximum total depreciation deduction that Chaz may deduct in 2023? (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Maximum total depreciation deductionarrow_forwardGarcla Co. owns equlipment that cost $77,600, with accumulated depreclation of $41.200. Record the sale of the equipment under the following three separate cases assuming Garcla sells the equipment for (1) $47,600 cash. (2) $36,400 cash, and (3) $31.,300 cash. Vlew transaction Ilat Journal entry worksheet A Record the sale of equipment assuming Garcia sells the equipment for $47,600 cash. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry Vlew general journalarrow_forwardCoronado Industries purchased the following assets and constructed a building as well. All this was done during the current year. Assets 1 and 2: These assets were purchased as a lump sum for $300,000 cash. The following information was gathered. Description Machinery Equipment Initial Cost on Seller's Books $300,000 180,000 Depreciation to Date on Seller's Books Cost of machinery traded Accumulated depreciation to date of sale Fair value of machinery traded Cash received Fair value of machinery acquired Date 2/1 6/1 9/1 11/1 $150,000 30,000 Asset 3: This machine was acquired by making a $30,000 down payment and issuing a $90,000, 2-year, zero-interest-bearing note. The note is to be paid off in two $45,000 installments made at the end of the first and second years. It was estimated that the asset could have been purchased outright for $107,700. Payment Book Value on Seller's Books Asset 4: This machinery was acquired by trading in used machinery. (The exchange lacks commercial…arrow_forward

- Buckley, an individual, began business two years ago and has never sold a §1231 asset. Buckley has owned each of the assets since he began the business. In the current year, Buckley sold the following business assets: Original Cost Asset Computers $ 6,000 Machinery Furniture Building 10,000 20,000 100,000 Accumulated Depreciation $ 2,000 4,000 12,000 10,000 Gain/Loss $ (3,000) (2,000) 7,000 (1,000) Assuming Buckley's marginal ordinary income tax rate is 32 percent, answer the questions for the following alternative scenarios: b1. Assume that the amount realized increased so that the building was sold at a $6,000 gain instead. What is the amount and character of Buckley's gains or losses for the current year? b2. Calculate Buckley's tax liability or tax savings for the year. Complete this question by entering your answers in the tabs below. Req b1 Req b2 Assume that the amount realized increased so that the building was sold at a $6,000 gain instead. What is the amount and character of…arrow_forwardCayden Purchased the following for his rental real estate business: An apartment building; he paid $103,500 for the building ( not including the value of the land). Furniture for $8,649. Pickup truck for $27,500, used for 75% business. What is Cayden's total unadjusted basis immediately after acquisition (UBIA) of these assets? 1) $29,274 2) $112,149 3) $132,774 4) $139,649arrow_forwardpre.2arrow_forward

- Godoarrow_forwardEvergreen Corporation (calendar-year-end) acquired the following assets during the current year: (ignore §179 expense and bonus depreciation for this problem): (Use MACRS Table 1 and Table 2.) 2018 Asset Machinery Computer equipment Used delivery truck* Furniture Date Placed in Service October 25 February 3 August 17 April 22 $ Original Basis 102,000 34,000 47,000 190,000 *The delivery truck is not a luxury automobile a. What is the allowable MACRS depreciation on Evergreen's property in the current year assuming Evergreen does not elect §179 expense and elects out of bonus depreciation? (Round your intermediate calculations to the nearest whole dollar amount.) b. What would be the allowable MACRS depreciation on Evergreen's property in the current year if Evergreen does not elect out of bonus depreciation?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education