FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

May I get correct and complete answer for all with all work thanks

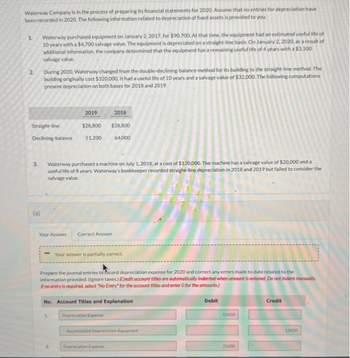

Transcribed Image Text:Waterway Company is in the process of preparing its financial statements for 2020. Assume that no entries for depreciation have

been recorded in 2020. The following information related to depreciation of fixed assets is provided to you.

1 Waterway purchased equipment on January 2, 2017, for $90.700. At that time, the equipment had an estimated useful life of

10 years with a $4,700 salvage value. The equipment is depreciated on a straight-line basis. On January 2, 2020, as a result of

additional information, the company determined that the equipment has a remaining useful life of 4 years with a $3.100

salvage value.

2

Straight-line

During 2020, Waterway changed from the double-declining-balance method for its building to the straight-line method. The

building originally cost $320,000. It had a useful life of 10 years and a salvage value of $32,000. The following computations

present depreciation on both bases for 2018 and 2019.

3.

Declining-balance 51,200

(a)

2019

2018

$28,800 $28,800

64,000

Waterway purchased a machine on July 1, 2018, at a cost of $120,000. The machine has a salvage value of $20,000 and a

useful life of 8 years. Waterway's bookkeeper recorded straight-line depreciation in 2018 and 2019 but failed to consider the

salvage value.

Your Answer Correct Answer

1

2

Your answer is partially correct.

Prepare the journal entries to record depreciation expense for 2020 and correct any errors made to date related to the

information provided. (Ignore taxes) (Credit account titles are automatically indented when amount is entered. Do not indent manually

If no entry is required, select "No Entry for the account titles and enter O for the amounts)

No. Account Titles and Explanation

Depreciation Expense

Accumulated Depreciation Equipment

Depreciation Expense

Debit

"

15450

Credit

15450

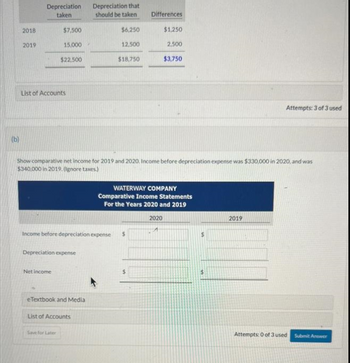

Transcribed Image Text:(b)

2018

2019

Depreciation

taken

$7,500

15,000

List of Accounts

$22,500

Net income

Depreciation expense

eTextbook and Media

Save for Later

Depreciation that

should be taken

List of Accounts

$6,250

Income before depreciation expense $

12.500

$18,750

Show comparative net income for 2019 and 2020. Income before depreciation expense was $330,000 in 2020, and was

$340,000 in 2019. (Ignore taxes)

Differences

$

$1,250

WATERWAY COMPANY

Comparative Income Statements

For the Years 2020 and 2019

2,500

$3,750

2020

A

$

Attempts: 3 of 3 used

2019

Attempts: 0 of 3 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Instructions: 1. Make a double-entry journal about the different ethical principles. Write at least three ethical principles you like the most and your own ethical thoughts/ examples about them. Ethical Principles you like the most Your own ethical thought/descriptions about it. 2. Write your answer- own ethical thought in not less than 100 words per item. answer both question, thanks.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardQ.1 Usually, in contract management, contractual deliverables are spelled out even before the project is implemented. As an expert in this field, make a three (3) paged presentation describing how you can prepare for contract management and why?arrow_forward

- Acounting Questions • If the chance to go back in time and change anything about acounting Professionexperience, what would that be?• Do you agree with Donald Schön's teachings that “reflecting-in-practice is essentialfor life-long learning and professional development”?arrow_forwardTitle 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful Description 1. Complete a search of online resources for grieving individuals. Which ones might you find helpful in your work with clients? Which ones might be helpful for your clients? 2. What do you think should be the minimum level of education, training, and experience for individuals who assist bereaved individuals?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education