FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

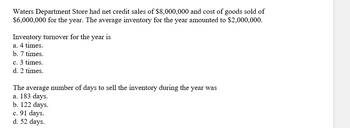

Transcribed Image Text:Waters Department Store had net credit sales of $8,000,000 and cost of goods sold of

$6,000,000 for the year. The average inventory for the year amounted to $2,000,000.

Inventory turnover for the year is

a. 4 times.

b. 7 times.

c. 3 times.

d. 2 times.

The average number of days to sell the inventory during the year was

a. 183 days.

b. 122 days.

c. 91 days.

d. 52 days.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gibson's has sales for the year of $538,900, cost of goods sold equal to 73 percent of sales, and an average inventory of $78,300. The profit margin is 7 percent and the tax rate is 21 percent. How many days, on average, does it take the company to sell an inventory item? Assume 365 days per year.arrow_forwardThe Blue Moon Corporation has ending inventory of $400,000, account receivable of $330,000, and cost of goods sold for the year just ended was $2,700,000. The company's inventory turnover ratio is _______. Round it to two decimal places.arrow_forwardUniversal Sports Supply began the year with an inventory balance of $65,000 and a year-end balance of $75,000. Sales of $750,000 generate a gross profit of $250,000. Calculate the inventory turnover ratio for the year.arrow_forward

- In the current year, Borden Corporation had sales of $2,000,000 and cost of goods sold of $1,200,000. Borden expects returns in the following year to equal 8% of sales. The unadjusted balance in Inventory Returns Estimated is a debit of $6,000, and the unadjusted balance in Sales Refund Payable is a credit of $10,000. The adjusting entry or entries to record the expected sales returns is (are): (A) Accounts Receivable 2,000,000 Sales 2,000,000 (B) Sales returns and allowances 150,000 Sales 150,000 Cost of Goods Sold 90,000 Inventory Returns Estimated 90,000 (C) Sales 2,000,000 Sales Refund Payable 160,000 Accounts receivable 1,840,000 Sales Refund Payable 150,0000 Accounts receivable 150,000 (D) Sales Returns and Allowances 150,000 Sales Refund Payable 150,000 Inventory Returns Estimated 90,000 Cost of goods sold 90,000arrow_forwardA concrete corporation had cost of goods sold of $1,550,000 for the third quarter. The beginning inventory at cost was $155,000, and the ending inventory at cost amounted to $180,900. The inventory turnover rate published as the industry standard for a business of this size is 9.5 times. Round inventories to the nearest cent and inventory turnovers to the nearest tenth. (a) Calculate the average inventory (in $) and actual inventory turnover rate for the company. average inventory $ inventory turnover times (b) If the turnover rate is less than 9.5 times, calculate the target average inventory (in $) needed to theoretically come up to industry standards. If the turnover rate is greater than 9.5 times, enter "above".arrow_forwardOn January 1, The Parts Store had a $370.000 Inventory at cost. During the first quarter of the year, It purchased $1,510,000 of merchandise, returned $19,100, and pald frelght charges on purchased merchandise totalling $33,600. During the past several years, the store's gross profit on sales has averaged 30%. Under the assumption the store had $1,920,000 of sales during the first quarter of the year, use the gross profit method to estimate its Inventory at the end of the first quarter. Ending inventoryarrow_forward

- Dabble, Inc., has sales of $975,000 and cost of goods sold of $476,000. The firm had a beginning inventory of $33,500 and an ending inventory of $43,500. What is the length of the days' sales in inventory? (Use 365 days a year. Use ending inventory rather than average inventory. Round your answer to 2 decimal places.) Days' sales in inventory daysarrow_forwardDetermine the stockturn rate of a retailer carrying an average inventory at cost of $850,000, with a cost of goods sold of $1,800,000.arrow_forwardBeginning inventory was $28,000 and ending inventory was $22,000. Cost of goods sold was $190,000 and net sales were $360,000. Inventory turnover for the year was closest to: O 7.6 8.64 6.79 14.4arrow_forward

- BL Industries has ending inventory of $201,700, annual sales of $1.24 million, and annual cost of goods sold of $1.04 million. On average, how long did a unit of inventory sit on the shelf before it was sold?arrow_forwardTarmac Co made sales of $1,930,200 during the year ended 31st March X3. Inventory decreased by $132,000 over the year and all sales were made at a mark-up of 45%.What was the cost of purchases during the year, to the nearest $100?arrow_forwardOver the past several years, Landmark Supplies has averaged a gross profit of 34%. At the end of 20--, the income statement of the company included the information shown below: Sales $1,100,000 Cost of goods sold: Merchandise inventory, January 1, 20-- $67,000 Purchases 840,000 Goods available for sale $907,000 Less merchandise inventory, December 31, 20-- 130,000 Cost of goods sold 777,000 Gross profit on sales $323,000 Investigation revealed that employees of the company had not taken an actual physical count of the inventory on December 31, 20--. Instead, they had merely estimated the inventory. Required: Under the gross profit method of inventory estimation, determine the following items to check the accuracy of the employees' estimates. Gross profit on sales ? Cost of goods sold ? Ending inventory ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education