FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

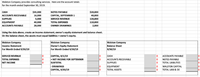

Transcribed Image Text:Walston Company provides consulting services. Here are the account totals

for the month ended September 30, 2019.

CASH

$35,000

NOTES PAYABLE

$20,000

16,000

5,000

ACCOUNTS RECEIVABLE

CAPITAL, SEPTEMBER 1

40,000

SUPPLIES

SERVICE REVENUE

120,000

EQUIPMENT

40,000

TOTAL EXPENSES

110,000

ACCOUNTS PAYABLE

28,000

OWNER DRAWINGS

2,000

Using the data above, create an income statement, owner's equity statement and balance sheet.

On the balance sheet, the assets must equal liabilities + owner's equity.

Walston Company

Income Statement

For Month Ended 9/30/19

Walston Company

Walston Company

Balance Sheet

9/30/19

Owner's Equity Statement

For Month Ended 9/30/19

CAPITAL, 9/1/19

+ NET INCOME FOR SEPTEMBER

SUBTOTAL

CASH

ACCOUNTS RECEIVABLE

SUPPLIES

EQUIPMENT

TOTAL ASSETS

SERVICE REVENUE

10

ACCOUNTS PAYABLE

TOTAL EXPENSES

NET INCOME

10

NOTES PAYABLE

10

TOTAL LIABILITIES

DRAWINGS

10

WALSTON CAPITAL

lo

CAPITAL, 9/30/19

TOTAL LIAB & OE

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Below are the titles of a number of debit and credit accounts as they might appear on the statement of financial position of Hayduke ASA as of October 31, 2022. Select the Current Asset, Current Liability, Borderline, and Not a Current Item from among these debit and credit accounts. Debit Interest Accrued on Government Securities Notes Receivable Petty Cash Fund Government Securities Treasury Shares Current Asset Current Liability Borderline Not a Current Item Credit Share Capital-Preference 6% First Mortgage Bonds, due in 2029 Preference Dividend, payable Nov. 1,2022 Allowance for Doubtful Accounts Customers' Advances (on contracts to be completed next year)arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardFrom the details given below prepare aTrial Balance as at March 31, 2018. Purchases 80,000 Salaries & Wages 42,500 Discount (Dr.) . 6,500 Sales 1,50,000 Travelling Expenses 2,500 Carriage Outwards 225 Carriage Inwards 1,375 Repairs 1,500 Insurance 750 Miscellaneous Expenses 275 Commission Paid 1,625 Buildings 20,000 Rent and Rates 2,500 Machinery 7,500 Cash in hand 125 Horses and Carts 2,500 Cash at bank 13,625 Stock in Trade (1-4-2017) 29,500 Sundry Debtors 16,025 Capital 68,525 Sundry Creditors 10,500 (Answer: Total of Trial Balance Rs. 2,29,025.) PreviousNextarrow_forward

- 1. Prepare a Classified Statement of Assets & Liabilities as at 30th June 2023 Cash receipts and payments for the year ended 30th June 2023: Cash Receipts: Subscriptions 11,000 Bar sales Hire of function room $ Bank Bar inventory 30,000 5,300 Assets & Liabilities as at $46,300 Subscription in arrears Subscription in advance Bar equipment - at cost Accumulated depreciation bar equipment Bank Loan (Due 30/6/17) Accounts payable (bar) Accrued bar wages Prepaid rent expense Cash Payments: Bar purchases 12,000 Payments to accounts payable Telephone Insurance Cleaner's wages Electricity Bar wages Bank Loan interest Rent paid 1 July 2022 15,000 2,600 220 800 35,000 5,000 16,000 1,000 O 0 $ ? 6,000 900 1,200 1,500 800 5,000 2,900 10,000 $40,300 30 June 2023 2,400 880 270 35,000 6,000 16,000 2,000 100 500arrow_forwardPlease SHOw your workarrow_forwardAccountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education