Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

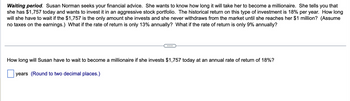

Transcribed Image Text:Waiting period. Susan Norman seeks your financial advice. She wants to know how long it will take her to become a millionaire. She tells you that

she has $1,757 today and wants to invest it in an aggressive stock portfolio. The historical return on this type of investment is 18% per year. How long

will she have to wait if the $1,757 is the only amount she invests and she never withdraws from the market until she reaches her $1 million? (Assume

no taxes on the earnings.) What if the rate of return is only 13% annually? What if the rate of return is only 9% annually?

How long will Susan have to wait to become a millionaire if she invests $1,757 today at an annual rate of return of 18%?

years (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your client is 31 years old. She wants to begin saving for retirement, with the first payment to come one year from now. She can save $14,000 per year, and you advise her to invest it in the stock market, which you expect to provide an average return of 11% in the future. If she follows your advice, how much money will she have at 65? Do not round intermediate calculations. Round your answer to the nearest cent. $ How much will she have at 70? Do not round intermediate calculations. Round your answer to the nearest cent. $ She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70. If her investments continue to earn the same rate, how much will she be able to withdraw at the end of each year after retirement at each retirement age? Do not round intermediate calculations. Round your answers to the nearest cent. Annual withdrawals if she retires at 65: $ Annual withdrawals if she retires at 70: $arrow_forwardJackie wants to retire with $ 2.1 million in savings by the time she turns 64. She is currently 23 years old. How much will she need to save each year, assuming she can get a 10% annual return on her investments? (show all inputs in your answer Training )M = N = I = PV = PMT = FV =arrow_forwardEn Sahak wants to buy a new boat in 7 years. He expects the new boat will cost RM28,000. En Sahak has RM18,000 in an investment account today. What rate of return must En Sahak earn on his investments to be able to buy the boat on time?arrow_forward

- Dont uplode image in answer, USE BAII Plus Financial Calculator to solve the TVM questions. $_____________You would like to start saving for retirement. Assuming you are now 22 years old and you want to retire at age 60, you have 38 years to watch your investment grow. You decide to invest in the stock market, which you expect it to earn about 6% per year into the future. You decide to invest $600 at the end of each month for the next 38 years (456 months). Calculate your accumulated investment at the end of 38 years. (Round to nearest whole dollar)arrow_forwardSuppose your parents deposit $4,000 into an account at the end of each year for 11 years. The account earns an annual interest rate of 1.4%. After the final deposit, they move the accumulated savings to a brokerage account and invest in the stock market, where they earn an average annual return of 6.9% for the following 16 years. How much will they have in the account at the end? O a. $131,280 O b. $404,155 O c. $137,311 O d. $296,336 e. $302,138 f. $279,603 g. $496,270 h. $249,511arrow_forwardYou want to investment for retirement. You inherited $50,000 in April 2020. The Stock Market has lost 20% of its value from its high in 2019. Should you: A. Wait for the Stock Market to go down another 10 Percent? B. Invest the entire $50,000 now? C. Invest a small amount each month starting this month. Explain why you selected one of the strategies above.arrow_forward

- Waiting period. Jamal is waiting to be a millionaire. He wants to know how long he must wait if a. he invests $26,900.46 at 21% today? b. he invests $54,970.73 at 13% today? c. he invests $142,454.62 at 8% today? d. he invests $316,572.99 at 7% today? a. How long will Jamal have to wait to become a millionaire if he invests $26,900.46 at 21% today? years (Round to the nearest whole number.)arrow_forwardSuppose you inherited $100,000 and invested it at 7% per year. What is the most you could withdraw at the end of each of the next 10 years and have a zero balance at Year 10? How would your answer change if you made withdrawals at the beginning of each year? SHOW WORK AND USE FINANCIAL CALCULATORarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education