FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

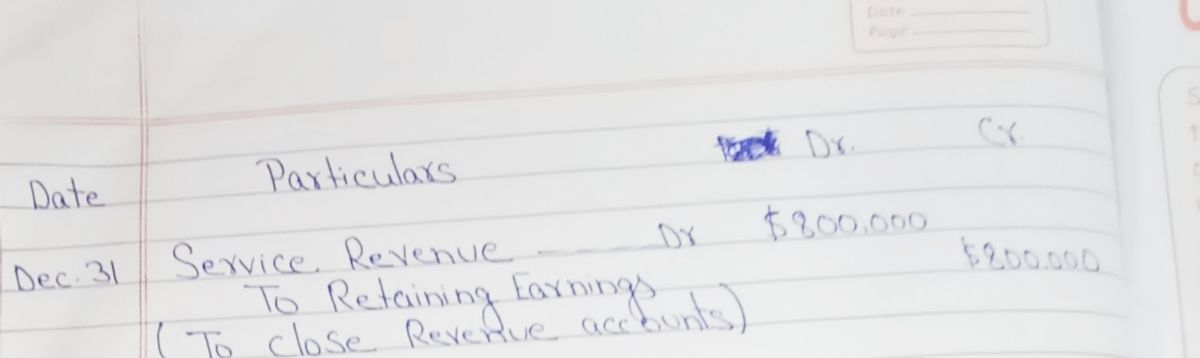

Wagner Accounting & Tax Services provides accounting and tax services in Tampa, Florida.The following account balances appear on the year-end adjusted

Expert Solution

arrow_forward

Step 1

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Romie Ltd is preparing accounts for the year ended 31 December 20X5. The company has an estimated tax charge of $35,000 for the year ended December 20X5. The trial balance includes an entry of $2,000 relating to an over provision of tax in the previous financial year. What is the charge for tax in the statement of profit or loss for the year ended December 20X5?arrow_forwardThe following monthly data are taken from Ramirez Company at July 31: Sales salaries, $360,000; Office salaries, $72,000; Federal income taxes withheld, $108,000; State income taxes withheld, $24,000; Social security taxes withheld, $26,784; Medicare taxes withheld, $6,264; Medical insurance premiums, $8,500; Life insurance premiums, $5,500; Union dues deducted, $2,500; and Salaries subject to unemployment taxes, $53,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including employee deductions, and cash payment of the net payroll (salaries payable) for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and other related employment expenses and the cash payment of all…arrow_forwardThe following monthly data are taken from Ramirez Company at July 31: Sales salaries, $380,000; Office salaries, $76,000; Federal income taxes withheld, $114,000; State income taxes withheld, $25,500; Social security taxes withheld, $28,272; Medicare taxes withheld, $6,612; Medical insurance premiums, $9,000; Life insurance premiums, $6,000; Union dues deducted, $3,000; and Salaries subject to unemployment taxes, $54,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including employee deductions, and cash payment of the net payroll (salaries payable) for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and other related employment expenses and the cash payment of all liabilities…arrow_forward

- The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: 211 Salaries Payable — 212 Social Security Tax Payable $16,302 213 Medicare Tax Payable 4,290 214 Employees Federal Income Tax Payable 26,455 215 Employees State Income Tax Payable 25,740 216 State Unemployment Tax Payable 2,717 217 Federal Unemployment Tax Payable 858 218 U.S. Saving Bond Deductions Payable 6,000 219 Medical Insurance Payable 49,800 411 Operations Salaries Expense 1,732,000 511 Officers Salaries Expense 1,130,000 512 Office Salaries Expense 287,000 519 Payroll Tax Expense 245,960 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: Dec. 2 Issued Check No. 410 for $6,000 to Jay Bank to purchase U.S. savings bonds for employees. Dec. 2 Issued Check No. 411 to Jay Bank for $47,047 in payment of $16,302 of social security tax, $4,290 of Medicare tax, and…arrow_forwardAn exempt organization, reports unrelated business income of $290,000 and unrelated business expenses of $45,000. In addition, the organization has positive adjustments of $88,000. Assume a 21% corporate income tax rate. Calculate the amount of unrelated business income tax. (Is 1,000 standard deduction applicable?)arrow_forwardA summary of the transactions of Ramstage Co, which is registered for sales tax at 15% showed the following for the month of August 20X9. Outputs $60000(exclusive of sales tax) Inputs $46000(inclusive of sales tax) At the beginning of the period Ramstage Co owed $3400 to the government tax authority,and during the period $2600 was paid to the tax authority. What was the amount owed to the government tax authorities at the end of the accounting period?arrow_forward

- The following transactions apply to Walnut Enterprises for Year 1, its first year of operations: Received $50,000 cash from the issue of a short-term note with a 6 percent interest rate and a one-year maturity. The note was made on April 1, Year 1. Received $130,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. Paid $62,000 cash for other operating expenses during the year. Paid the sales tax due on $110,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2. Recognized the accrued interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2: Paid the balance of the sales tax due for Year 1. Received $201,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. Repaid the principal of the note and applicable interest on April 1, Year 2. Paid $102,500 of other…arrow_forwardAfter making four quaterly estimated payments of $3,500, a corporation's actual income tax liability for the year is $17,200. The year-end adjusting entry would require:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education