FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

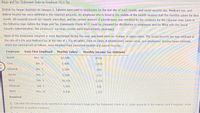

Transcribed Image Text:Wage and Tax Statement Data on Employer FICA Tax

Ehrlich Co. began business on January 2. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and

federal income tax were withheld in the required amounts. An employee who is hired in the middle of the month receives half the monthly salary for that

month. All required payroll tax reports were filed, and the correct amount of payrol taxes was remitted by the company for the calendar year. Early in

the following year, before the Wage and Tax Statements (Form W-2) could be prepared for distribution to employees and for filing with the Social

Security Administration, the employees' earnings records were inadvertently destroyed.

None of the employees resigned or were discharged during the year, and there were no changes in salary rates. The social security tax was withheld at

the rate of 6.0% and Medicare tax at the rate of 1.5% on salary, Data on dates of employment, salary rates, and emplovees' income taxes withheld,

which are summarized as follows, were obtained from personnel records and payroll records:

Employee Date First Employed Monthly Salary

Monthly Income Tax Withheld

Arnett

Nov. 16

$3,500

$518

Cruz

Jan. 2

5,400

1,015

Edwards

Oct. 1

2,300

285

Harvin

Dec. 1

2,200

273

Nicks

Feb. 1

10,100

2,273

Shjancoe

Mar. 1

3,500

536

Ward

Nov. 16

8,900

1,922

Required:

1. Calculate the amounts to be reported on each employee's Wage and Tax Statement (Form W-2). Enter amounts to the nearest cent if required. Enter

all amounts as positive numbers.

Transcribed Image Text:2. Calculate the following employer payroll taxes for the year: (a) social security; (b) Medicare; (c) state unemployment compensation at 5,.4% on the

first $10,000 of each employee's earnings; (d) federal unemployment compensation at 0.8% on the first $10,000 of each employee's earnings: (e) total.

Round your answers to two decimal places.

(a)

(b)

(c)

(d)

(e)

Feedback

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Instructions The payroll register of Heritage Co. indicates $13,320 of social security withheld and $3,330 of Medicare tax withheld on total salaries of $222,000 for the period. Federal withholding for the period totaled $43,180. Retirement savings withheld from employee paychecks were $2,040 for the period. Journalize the entry to record the period's payroll. General Journal On December 31, journalize the entry to record the period's payroll. General Journal Instructions How does grading work? DATE 1 Dec. 31 Salaries Expense 2 3 DESCRIPTION Social Security Tax Payable Medicare Tax Payable Employees State Income Tax Payable 4 5 Employees Federal Income Tax Payable 6 Retirement Savings Deductions Payable Check My Work 1 more Check My Work uses remaining. JOURNAL Score: 49/73 POST. REF. DEBIT CREDIT Shaded cells have feedback. PAGE 1 ACCOUNTING EQUATION ASSETS LIABILITIES EQUITY 13,320.00 ↑ 3,330.00 ✓ ↑ 2,040.00 ↑ Next>arrow_forwardAssuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15-31. Use this information to answer the question that follow. Gross payroll Social security rate Medicare rate Federal income tax withheld Federal unemployment tax rate State unemployment tax rate Assuming that all wages are subject to federal and state unemployment taxes, the employer's payroll tax expense would be a. $2,870 b. $1,370 c. $750 Od. $620 $10,000 6.0% 1.5% $1,800 0.8% 5.4%arrow_forwardCALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL TAXES Earnings for several employees for the week ended March 12, 20--, are as follows: Calculate the employer’s payroll taxes expense and prepare the journal entry as of March 12, 20--, assuming that FUTA tax is 0.6%, SUTA tax is 5.4%, Social Security tax is 6.2%, and Medicare tax is 1.45%.arrow_forward

- devratarrow_forwardThe payroll register for D. Salah Company for the week ended May 18 indicated the following: Salaries $693,000 Federal income tax withheld 138,600 The salaries were all subject to the 6.0% social security tax and the 1.5% Medicare tax. In addition, state and federal unemployment taxes were calculated at the rate of 5.4% and 0.8%, respectively, on $13,000 of salaries. If an amount box does not require an entry, leave it blank. Question Content Area a. Journalize the entry to record the payroll for the week of May 18. May 18 _______ ________ Question Content Area b. Journalize the entry to record the payroll tax expense incurred for the week of May 18. May 18 ________ __________arrow_forwardAirline Temporary Services (ATS) pays employees monthly. Payroll information is listed below for January, the first month of ATS’s fiscal year. Assume that none of the employees exceeds the federal unemployment tax maximum salary of $7,000 in January. Salaries expense $400,000 Federal and state income tax withheld 80,000 Federal unemployment tax rate 0.80% State unemployment tax rate (after FUTA deduction) 5.40% Social Security (FICA) tax rate 7.65% Required: Record salaries expense and payroll tax expense for the January pay period. Record the employee salary, withholdings, and salaries payable. Record the employer payroll tax expense.arrow_forward

- Selected information from the payroll register of Barbara's Stables for the week ended September 28, 20--, is as follows: Social Security tax is 6.2% on the first $128,400 of earnings for each employee. Medicare tax is 1.45% of gross earnings, FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings. Cumulative Pay Current Taxable Earnings Employee Name Before CurrentEarnings GrossPay UnemploymentCompensation SocialSecurity Carlosi, Peggy $ 84,240 $2,350 Sanchez, Carmela 81,900 2,100 Delaney, Roger 109,800 3,320 Weitz, Alana 6,300 1,100 Dunhill, Craig 6,800 1,000 Bella, Stephen 42,330 1,850arrow_forwardThe following information about the weekly payroll was obtained from the records of Boltz Co.: Salaries: Sales salaries Deductions: $540,000 Income tax withheld $160,000 Warehouse salaries 155,000 U.S. savings bonds 10,500 Office salaries 85,000 Group insurance $780,000 9,000 Tax rates assumed: Social security 6% State unemployment (employer only) 5.4% Medicare 1.5% Federal unemployment (employer only) 0.8% Required: 1. Assuming that the payroll related to the first full week of the year and was paid on January 7, journalize the following entries: a. January 7, to record the payroll. b. January 7, to record the employer's payroll taxes on the payroll for the first week of the year. Since it is a new fiscal year, all $780,000 in salaries is subject to unemployment compensation taxes. 2. Assuming that the payroll related to the last week of the year and was paid on December 31, journalize the following entries: a. December 31, to record the payroll. b. December 31, to record the…arrow_forwardCalculating Payroll Taxes Expense and Preparing Journal Entry Selected information from the payroll register of Ebeling's Dairy for the week ended July 7, 20--, is shown below. The SUTA tax rate is 5.4%, and the FUTA tax rate is 0.6%, both on the first $7,000 of earnings. Social Security tax on the employer is 6.2% on the first $128,400 of earnings, and Medicare tax is 1.45% on gross earnings. Taxable Earnings Employee Name Cumulative PayBefore CurrentEarnings CurrentWeekly Earnings UnemploymentCompensation SocialSecurity Click, Katelyn $6,660 $850 Coombs, Michelle 6,380 750 Fauss, Erin 23,010 1,220 Lenihan, Marcus 6,900 980 McMahon, Drew 125,200 5,260 Newell, Marg 25,150 1,110 Stevens, Matt 28,970 1,240arrow_forward

- Payroll entries Widmer Company had gross wages of $350,000 during the week ended June 17. The amount of wages subject to social security tax was $350,000, while the amount of wages subject to federal and state unemployment taxes was $52,500. Tax rates are as follows: Social security Medicare State unemployment Federal unemployment June 7 Wages Expense 6.0% 1.5% 5.4% The total amount withheld from employee wages for federal taxes was $70,000. If an amount box does not require an entry, leave it blank. a. Journalize the entry to record the payroll for the week of June 17. June 7 Payroll Tax Expense 0.8% Social Security Tax Payable Medicare Tax Payable Employees Federal Income Tax Payable Wages Payable Social Security Tax Payable Medicare Tax Payable 350,000 THEA b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. ✓ 21,000 5,250 HOW! 88arrow_forwardWage and tax statement data on employer FICA tax Obj. 2 Ehrlich Co. began business on January 2. Salaries were paid to employees on the last day of each month, and social security tax, Medicare tax, and federal income tax were withheld in the required amounts. An employee who is hired in the middle of the month receives half the monthly salary for that month. All required payroll tax reports were filed, and the correct amount of payroll taxes was remitted by the company for the calendar year. Early in the following year, before the Wage and Tax Statements (Form W-2) could be prepared for distribution to employees and for filing with the Social Security Administration, the employees’ earnings records were inadvertently destroyed. None of the employees resigned or were discharged during the year, and there were no changes in salary rates. The social security tax was withheld at the rate of 6.0% and Medicare tax at the rate of 1.5% on salary. Data on dates of employment, salary rates, and…arrow_forwardCalculation of Taxable Earnings and Employer Payroll Taxes and Preparation of Journal Entry Selected information from the payroll register of Joanie's Boutique for the week ended September 14, 20--, is as follows: Social Security tax is 6.2% on the first $128,400 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.6% and SUTA tax is 5.4% on the first $7,000 of earnings.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education