FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

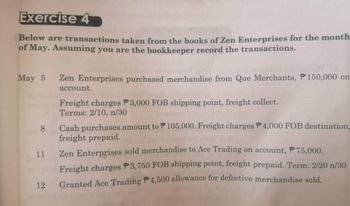

Transcribed Image Text:Exercise 4

Below are transactions taken from the books of Zen Enterprises for the month

of May. Assuming you are the bookkeeper record the transactions.

May 5

8

11

Zen Enterprises purchased merchandise from Que Merchants, P150,000 on

account.

arit al

Freight charges P3,000 FOB shipping point, freight collect.

Terms: 2/10, n/30

Zen Enterprises sold merchandise to Ace Trading on account, 75,000.

Freight charges 3,750 FOB shipping point, freight prepaid. Term: 2/20 n/30

12

Granted Ace Trading P4,500 allowance for defective merchandise sold.

stosilco ynsgrans di

Cash purchases amount to 105,000. Freight charges P4,000 FOB destination,

freight prepaid.

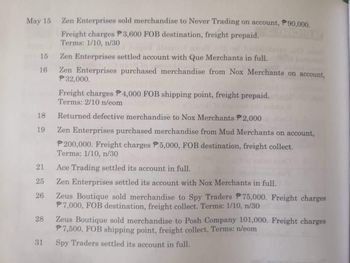

Transcribed Image Text:May 15

15

16

21

25

26

28

Zen Enterprises sold merchandise to Never Trading on account, 90,000.

921

Freight charges P3,600 FOB destination, freight prepaid.

Terms: 1/10, n/30

18 Returned defective merchandise to Nox Merchants P2,000

19

Zen Enterprises purchased merchandise from Mud Merchants on account,

P200,000. Freight charges P5,000, FOB destination, freight collect.

Terms: 1/10, n/30

Ace Trading settled its account in full.

Zen Enterprises settled its account with Nox Merchants in full.

Zeus Boutique sold merchandise to Spy Traders P75,000. Freight charges

P7,000, FOB destination, freight collect. Terms: 1/10, n/30

31

Zen Enterprises settled account with Que Merchants in full.

Zen Enterprises purchased merchandise from Nox Merchants on account,

P32,000.

Freight charges P4,000 FOB shipping point, freight prepaid.

Terms: 2/10 n/eom

Zeus Boutique sold merchandise to Posh Company 101,000. Freight charges

7,500, FOB shipping point, freight collect. Terms: n/eom

Spy Traders settled its account in full.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pierce Company sold merchandise to Stanton Company on account FOB shipping point, 1/10, net 30, for $9,500. Pierce prepaid the $285 shipping charge. Which of the following entries does Pierce make to record this sale? a.Accounts Receivable—Stanton, debit $9,785; Sales, credit $9,785 b.Accounts Receivable—Stanton, debit $9,500; Sales, credit $9,500 c.Accounts Receivable—Stanton, debit $9,500; Sales, credit $9,500, and Delivery Expense, debit $285; Cash, credit $285 d.Accounts Receivable—Stanton, debit $9,405; Sales, credit $9,405, and Accounts Receivable—Stanton, debit $285; Cash, credit $285arrow_forwardxamus - cdn.student.uae.examus.net/?rldbqn=1&sessi... ACCT101_FEX_2021_2_Male A company purchased merchandise on credit with terms Ac Payable if the company pays SR485 cash on this account within ten days? e18 3/15, n/3O. How much will be debited to 33 - 34 abe18ce33 b. Accounts Payable should be credited in а. 485 113:22 9 కోల С. 470.45 95abe18ce 33 d. 500 95abe18ce 95abe18ce33 95aber8ce33 95abe18ce33 95abe18ce33 95abe18ce33 MacBook Pro F3 888 F4 FS E 5 F7 67 7 V T. 8 A 9 Y 6. U 11 9.arrow_forwardExplainations would be apprectiated and I would also like help with formating.arrow_forward

- Sales-Related Transactions, Including the Use of Credit Cards Journalize the entries for the following transactions: a. Sold merchandise for cash, $22,060. The cost of the merchandise sold was $13,240. (Record the sale first.) fill in the blank 36fbb5ffffdef81_2 fill in the blank 36fbb5ffffdef81_3 fill in the blank 36fbb5ffffdef81_5 fill in the blank 36fbb5ffffdef81_6 fill in the blank 36fbb5ffffdef81_8 fill in the blank 36fbb5ffffdef81_9 fill in the blank 36fbb5ffffdef81_11 fill in the blank 36fbb5ffffdef81_12 b. Sold merchandise on account, $13,920. The cost of the merchandise sold was $8,350. (Record the sale first.) fill in the blank e95153f82fd6002_2 fill in the blank e95153f82fd6002_3 fill in the blank e95153f82fd6002_5 fill in the blank e95153f82fd6002_6 fill in the blank e95153f82fd6002_8 fill in the blank e95153f82fd6002_9 fill in the blank e95153f82fd6002_11 fill in the blank e95153f82fd6002_12…arrow_forwardDetermine the amount to be paid in full settlement of each of two invoices, (a) and (b), assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. If required, round the answers to the nearest dollar. a. b. a. S b. $ Merchandise (Invoice Amount) $5,550 2,600 Freight Paid by Seller $700 300 Freight Terms FOB destination, 2/10, n/30 FOB shipping point, 1/10, n/30 Returns and Allowances (Invoice Amount) $1,300 800arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education