FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Required:

Calculate the

Transcribed Image Text:#W #2

ans

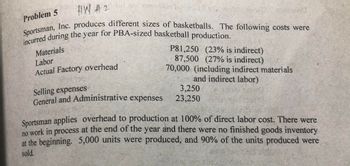

Sportsman, Inc. produces different sizes of basketballs. The following costs were

incurred during the year for PBA-sized basketball production.

P81,250 (23% is indirect)

87,500 (27% is indirect)

70,000 (including indirect materials

and indirect labor)

Problem 5

Materials

Labor

Actual Factory overhead

Selling expenses

General and Administrative expenses

3,250

23,250

Sportsman applies overhead to production at 100% of direct labor cost. There were

no work in process at the end of the year and there were no finished goods inventory

at the beginning. 5,000 units were produced, and 90% of the units produced were

sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which one is the correct answer?arrow_forwardWetherbee Tech Services (WTS) is a chain of computer maintenance technicians for households and small businesses. The following data are available for last year's services: • WTS recorded 120,900 tech calls last year. It had budgeted 126,800 calls, averaging 90 minutes each. • Standard variable labor and support costs per tech call were as follows: Direct IT specialist services: 90 minutes at $54 per hour Variable support staff, supplies, and overhead: 30 minutes at $24 per hour Fixed overhead costs: Annual budget $4,141,800 • Fixed overhead is applied at the rate of $36.00 per call. . Actual tech service call costs: Direct IT specialist services: 120,900 calls averaging 84 minutes at $56.00 per hour Variable support staff, supplies, and overhead: averaging 40 minutes per call at $22.50 per hour x 120,900 calls Fixed overhead Required: a. Prepare a cost variance analysis for each variable cost for last year. b. Prepare a fixed overhead cost variance analysis. Complete this question by…arrow_forward1.What is the labor rate variance ( indicate the effect of each variance by selecting "f" for favorable, U for unfavorable, and None for no effect and round your final answer to the nearest whole number) 2. What is the variable overhead efficiency variance ? ( indicate the effect of each variance by selecting "f" for favorable, U for unfavorable, and None for no effect and round your final answer to the nearest whole number) 3. what is the variable overhead rate variance?arrow_forward

- a. Direct materials price variance Unfavorable b. Direct materials quantity variance Favorable c. Direct materials cost variance Unfavorablearrow_forwardWhat is a materials price variance? Describe this in your own words. Writing a formula is not a sufficient answer. Provide a real world example that would result in an unfavorable materials price variancearrow_forwardThe variable overhead efficiency variance is computed and interpreted. a) the same as; the same as b) the same as; differently than c) differently than; the same as d) differently than; differently than the direct-cost efficiency variance.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education