FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Making decisions about dropping a product

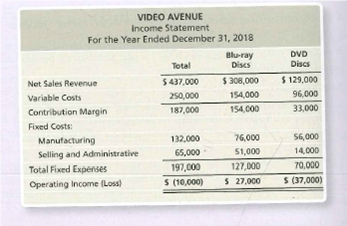

Top managers of Video Avenue are alarmed by their operating losses. They are considering dropping the DVD product line. Company accountants have prepared the following analysis to help make this decision:

Total fixed costs will not change if the company stops selling DVDs.

Requirements

- Prepare a differential analysis to show Whether Video Avenue should drop the DVD Product fins.

- Will dropping DVDs add $37,000 to operating income? Explain.

Transcribed Image Text:VIDEO AVENUE

Income Statement

For the Year Ended December 31, 2018

Blu-ray

Discs

DVD

Discs

Total

Net Sales Revenue

$ 437,000

$ 308,000

$ 129,000

Variable Costs

250,000

154,000

96,000

Contribution Margin

187,000

154,000

33,000

Fixed Costs:

Manufacturing

132,000

76,000

S6,000

Selling and Administrative

65,000

51,000

14,000

Total Fixed Expenses

197,000

127,000

70,000

Operating Income (Loss)

S (10,000)

S 27,000

5 (37,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- II. Jerry Prior, Beeler Corporation’s controller, is concerned that net income may be lower this year. He is afraid upper-level management might recommend cost reductions by laying off accounting staff including him. Prior knows that depreciation is a major expense for Beeler. The company currently uses the double-declining-balance method for both financial reporting and tax purposes, and he’s thinking of selling equipment that, given its age, is primarily used when there are periodic spikes in demand. The equipment has a carrying value of $2,000,000 and a fair value of $2,180,000. The gain on the sale would be reported in the income statement. He doesn’t want to highlight this method of increasing income. He thinks, “Why don’t I increase the estimated useful lives and the salvage values? That will decrease depreciation expense and require less extensive disclosure, since the changes are accounted for prospectively. I may be able to save my job and those of my staff.” Instructions…arrow_forwardWhich of the following are reasonable ways to deal with excess supply? (select ALL correct answers) reduce prices increase advertising use all available capacity to make the product with the highest CM per unit of capacity find special orders at a discounted price "fire" small customersarrow_forwardplease help me quickly I need your help necessaryarrow_forward

- Please don't give image based answer.. thankuarrow_forwardPart 1: Use the Value per Products Description bar chart.1. Which product has the highest profit value?2. What is the profit value for the product with the highest profit value?3. Do any of the products have a negative profit value (the company is losing money on them)?4. If there are products with a negative profit value, which products are those?5. Do you think the company should keep selling the “Shirt Girls (pink)” product? Why or whynot?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education