FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

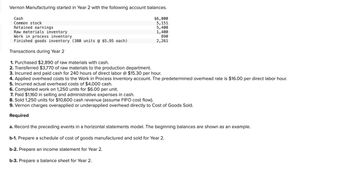

Transcribed Image Text:Vernon Manufacturing started in Year 2 with the following account balances.

Cash

Common stock

Retained earnings

$6,000

5,151

5,400

1,400

890

2,261

Raw materials inventory

Work in process inventory

Finished goods inventory (380 units @ $5.95 each)

Transactions during Year 2

1. Purchased $2,890 of raw materials with cash.

2. Transferred $3,770 of raw materials to the production department.

3. Incurred and paid cash for 240 hours of direct labor @ $15.30 per hour.

4. Applied overhead costs to the Work in Process Inventory account. The predetermined overhead rate is $16.00 per direct labor hour.

5. Incurred actual overhead costs of $4,000 cash.

6. Completed work on 1,250 units for $6.00 per unit.

7. Paid $1,160 in selling and administrative expenses in cash.

8. Sold 1,250 units for $10,600 cash revenue (assume FIFO cost flow).

9. Vernon charges overapplied or underapplied overhead directly to Cost of Goods Sold.

Required

a. Record the preceding events in a horizontal statements model. The beginning balances are shown as an example.

b-1. Prepare a schedule of cost of goods manufactured and sold for Year 2.

b-2. Prepare an income statement for Year 2.

b-3. Prepare a balance sheet for Year 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lawson Manufacturing Company has the following account balances at year end: Office supplies Raw materials Work-in-process $ 4,000 25,000 61,000 Finished goods 109,000 Prepaid insurance 6,000 What amount should Lawson report as inventories in its balance sheet?arrow_forwardCash Accounts receivable Raw materiala inventory Work in process inventory Finished goods inventory Prepaid rent Accounts payable Notes payable Common stock Retained earnings (prior year) Sales Coat of goods sold Factory overhead General and administrative expenses Totals Debit Credit $ 71,000 40,000 25,000 0 12,000 4,000 $ 10,000 13,000 112,000 24,000 40,000 40,000 94,000 171,000 $ 328,000 $ 328,000 These six documents must be processed to bring the accounting records up to date. Materials requisition 10: Materiala requisition 111 Materials requisition 121 Labor time ticket 521 Labor time ticket 53: Labor time ticket 541 $ 4,800 direct materials to Job 402 $ 7,400 direct materials to Job 404 $ 2,100 indirect materiala $ 6,000 direct labor to Job 402 $ 14,000 direct labor to Job 404 $ 5,000 indirect labor Jobs 402 and 404 are the only jobs in process at year-end. The predetermined overhead rate is 100% of direct labor cost. Problem 19-3A (Algo) Parts 4 and 5 4. Prepare an income…arrow_forwardSelected financial information for Shadyside Manufacturing is presented in the following table (000s omitted). Sales revenue $5,000 Purchases of direct materials $480 Direct labor $510 Manufacturing overhead $690 Operating expenses $680 Beginning raw materials inventory $260 Ending raw materials inventory $180 Beginning work in process inventory $360 Ending work in process inventory $450 Beginning finished goods inventory $300 Ending finished goods inventory $230 What was the cost of direct materials used? $740 $440 $560 $480arrow_forward

- At the beginning of 2012, Conway Manufacturing Company had the following account balances: WIP Inventory 2,000 During the year, the following transactions took place: Direct materials placed in production: Direct labor incurred: FG Inventory 8,000 Select one: Oa. debit of $67,000 $80,000 $190,000 Manufacturing overhead incurred $300,000 Manufacturing overhead allocated to production: $295,000 Cost of Jobs Completed $500,000 Selling Price of Jobs Sold $750,000 Cost of Jobs Sold $440,000 After these transactions have been recorded, the balance in the Work in process account is a: O b. credit of $63,000 O c. debit of $72,000 O d. debit of $70,000* Manufacturing O/H 0arrow_forwardPrepare Statements for a Manufacturing CompanyThe following balances are from the accounts of Hill Components:January 1 (Beginning) December 31 (Ending)Direct materials inventory ............... $48,100 $44,200Work-in-process inventory .............. 67,730 71,500Finished goods inventory ................ 15,600 18,200Direct materials used during the year amount to $59,800, and the cost of goods sold for the year was $68,900.RequiredFind the following by completing a cost of goods sold statement:a. Cost of direct materials purchased during the year.b. Cost of goods manufactured during the year.c. Total manufacturing costs incurred during the year.arrow_forwardints) The following data have been taken from the accounting records of Larder Corporation for the just completed year. Sales. $2,100,000 $350,000 $385,000 $390,000 $225,000 $210,000 $210,000 $190,000 $135,000 $120,000 $195,000 $140,000 Purchases of raw materials Direct labor. Applied Manufacturing overhead Administrative expenses. Selling expenses. Raw materials inventory, beginning. Raw materials inventory, ending Work in process inventory, beginning. Work in process inventory, ending. Finished goods inventory, beginning.. Finished goods inventory, ending.. Required: a. Prepare a Schedule of Cost of Goods Manufactured in good form. b. Compute the Cost of Goods Sold. c. Using data from your answers above, prepare an Income Statement (using the traditional format).arrow_forward

- The following data (in thousands of dollars) have been taken from the accounting records of Karlana Corporation for the just completed year. Sales ........... Raw materials inventory, beginning........... Raw materials inventory, ending. $910 $80 $20 $100 $130 $200 $160 Selling expenses.......... $140 Work in process inventory, beginning....... $40 Work in process inventory, ending....... $10 Finished goods inventory, beginning......... $130 Finished goods inventory, ending.... $150 The cost of goods sold for the year (in thousands of dollars) was: Purchases of raw materials.... Direct labor........... Manufacturing overhead. Administrative expenses........ O $670 O $500 $540 O $650arrow_forwardZachary Manufacturing Corporation was started with the issuance of common stock for $70,000. It purchased $7,600 of raw materials and worked on three job orders during Year 1 for which data follow. (Assume that all transactions are for cash unless otherwise indicated.) Direct Raw Materials Used Direct Labor Job 1 $ 1,100 $ 2,100 Job 2 2,000 3,700 Job 3 3,400 2,100 Total $ 6,500 $ 7,900 Factory overhead is applied using a predetermined overhead rate of $0.70 per direct labor dollar. Jobs 2 and 3 were completed during the period and Job 3 was sold for $11,070 cash. Zachary paid $700 for selling and administrative expenses. Actual factory overhead was $6,130. Required a. Record the preceding events in a horizontal statements model. The first event for Year 1 has been recorded as an example.arrow_forwardAnsdwearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education