Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

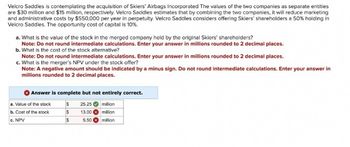

Transcribed Image Text:Velcro Saddles is contemplating the acquisition of Skiers' Airbags Incorporated The values of the two companies as separate entities

are $30 million and $15 million, respectively. Velcro Saddles estimates that by combining the two companies, it will reduce marketing

and administrative costs by $550,000 per year in perpetuity. Velcro Saddles considers offering Skiers' shareholders a 50% holding in

Velcro Saddles. The opportunity cost of capital is 10%.

a. What is the value of the stock in the merged company held by the original Skiers' shareholders?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.

b. What is the cost of the stock alternative?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.

c. What is the merger's NPV under the stock offer?

Note: A negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in

millions rounded to 2 decimal places.

Answer is complete but not entirely correct.

S 25.25 million

S 13.00 million

S

5.50 million

a. Value of the stock

b. Cost of the stock

c. NPV

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- You are contemplating the purchase of a one-half interest in a corporate airplane to facilitate the expansion of your business into two new geographic areas. The acquisition would eliminate about $220,000 in estimated annual expenditures for commercial flights, mileage reimbursements, rental cars, and hotels for each of the next 10 years. The total purchase price for the half-share is $6 million, plus associated annual operating costs of $100,000. Assume the plane can be fully depreciated on a straight-line basis for tax purposes over 10 years. The company’s weighted average cost of capital (commonly referred to as WACC) is 8%, and its corporate tax rate is 40%. Does this endeavor present a positive or negative net present value (NPV)? If positive, how much value is being created for the company through the purchase of this asset? If negative, what additional annual cash flows would be needed for the NPV to equal zero? To what phenomena might those additional positive cash flows be…arrow_forwardSystems has 6.45 billion shares outstanding and a share price of $17.25. Quisco is considering developing a new networking product in-house at a cost of $497 million. Alternatively, Quisco can acquire a firm that already has the technology for $899 million worth (at the current price) of Quisco stock. Suppose that absent the expense of the new technology, Quisco will have EPS of $0.828. a. Suppose Quisco develops the product in-house. What impact would the development cost have onQuisco's EPS? Assume all costs are incurred this year and are treated as an R&D expense, Quisco's tax rate is 40 %, and the number of shares outstanding is unchanged. b. Suppose Quisco does not develop the product in-house but instead acquires the technology. What effect would the acquisition have on Quisco's EPS this year? (Note that acquisition expenses do not appear directly on the income statement. Assume the firm was acquired at the start of the year and has no revenues or expenses of its own, so that the…arrow_forward(Defining capital structure weights) Templeton Extended Care Facilities, Inc. is considering the acquisition of a chain of cemeteries owned by the Rosewood Corporation for $370 million. Since the primary asset of this business is real estate, Templeton's management has determined that they will be able to borrow the majority of the money needed to buy the business. The Rosewood Corporation has no debt financing, but Templeton plans to borrow $90 million and invest only $280 million in equity in the acquisition. What weights should Templeton use for debt and equity in computing the WACC for this acquisition? .... The appropriate weight of debt, w, is%. (Round to one decimal place.)arrow_forward

- Company A is preparing a deal to acquire company B. One analyst estimated that the merger would produce 85 million dollars of annual cost savings, from operations, general and administrative expenses and marketing. These annual cost savings are expected to begin two years from now, and grow at 2.5% a year. In addition the analyst is assuming an after-tax integration cost of 0.1 billion, and taxes of 20%. Assume that the integration cost of 0.1 billion happens one year after the merger is completed (year 1). The analyst is using a cost of capital of 10% to value the synergies. Company B’s equity is trading at 2.3 B dollars (market value of equity). Company A is planning to pay a 32% premium for company B. a) Compute the value of the synergy as estimated by the analyst. b) does the estimate of synergies justify the premium? Could you show me how to work this out in an excel sheet?arrow_forwardIvanhoe Company is considering these two alternatives for financing the purchase of a fleet of airplanes: 1. 2. Issue 52,500 shares of common stock at $44 per share. (Cash dividends have not been paid nor is the payment of any contemplated.) Issue 10%, 10-year bonds at face value for $2,310,000. It is estimated that the company will earn $809,200 before interest and taxes as a result of this purchase. The company has an estimated tax rate of 30% and has 92,000 shares of common stock outstanding prior to the new financing. Determine the effect on net income and earnings per share for (a) issuing stock and (b) issuing bonds. Assume the new shares or new bonds will be outstanding for the entire year. (Round earnings per share to 2 decimal places, e.g. 2.66.) O î (a) Plan One Issue Stock $ (b) Plan Two Issue Bondsarrow_forwardRiverRocks (whose WACC is 12.7%) is considering an acquisition of Raft Adventures (whose WACC is 15.3%). The purchase will cost $100.5 million and will generate cash flows that start at $14.1 million in one year and then grow at 4.2% per year forever. What is the NPV of the acquisition? The net present value of the project is $ million. (Round to two decimal places.)arrow_forward

- Cullumber Company is considering these two alternatives for financing the purchase of a fleet of airplanes. 1. Issue 63,000 shares of common stock at $48 per share. (Cash dividends have not been paid nor is the payment of any contemplated.) 2. Issue 13%, 15-year bonds at face value for $3,024,000. It is estimated that the company will earn $825,000 before interest and taxes as a result of this purchase. The company has an estimated tax rate of 40% and has 94,100 shares of common stock outstanding prior to the new financing.Determine the effect on net income and earnings per share for issuing stock and issuing bonds. Assume the new shares or new bonds will be outstanding for the entire year. (Round earnings per share to 2 decimal places, e.g. $2.66.)arrow_forwardMotoSport is buying an asset that costs $730,000 and can be depreciated at 20 percent per year (Class 8) over its eight-year life. The asset is to be used in a three-year project at the end of the project, the asset can be sold for $740,200. The company faces a tax rate of 26% The sale of this asset will close the asset class. The from the sale of asset is Multiple Choice Capital gain; $10,200 Capital gain; $319,720 Terminal loss, $10,200 Terminal loss; $319,720 Capital gain: $11,583arrow_forwardAtlantic Corporation is considering the purchase of the linerboard mill and corrugated box plants of Royal Paper for a total price of $260 million. The estimated incremental cash flows that would result if Atlantic acquired the facilities are presented below. Atlantic's marginal tax rate is 36% and their after-tax cost of capital is 13%. I added a picture of more information attachedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education