FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Note:-

- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.

- Answer completely.

- You will get up vote for sure.

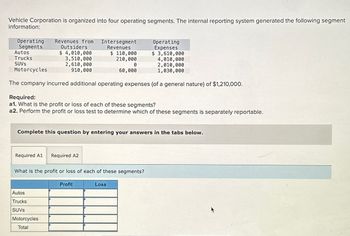

Transcribed Image Text:Vehicle Corporation is organized into four operating segments. The internal reporting system generated the following segment

information:

Operating Revenues from

Segments

Outsiders

Operating

Expenses

$ 3,610,000

$ 4,010,000

3,510,000

4,010,000

2,610,000

910,000

2,010,000

Motorcycles

1,030,000

The company incurred additional operating expenses (of a general nature) of $1,210,000.

Autos

Trucks

SUVS

Required:

a1. What is the profit or loss of each of these segments?

a2. Perform the profit or loss test to determine which of these segments is separately reportable.

Required A1

Complete this question by entering your answers in the tabs below.

Intersegment

Revenues

$ 110,000

210,000

Autos

Trucks

SUVS

Required A2

Motorcycles

Total

What is the profit or loss of each of these segments?

0

60,000

Profit

Loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide best Answer As per posible fastarrow_forwardpart b is incorrect. Can you rework it?arrow_forwardCritically evaluate how the breach of ethics by auditors could contribute to expand the audit expectation gap. Your report should include/address the following concerns: 1. Introduce/analyze ethical aspect of auditors and audit expectation gap. 2. Critically examine how different threats to ethics enlarge the audit expectation gap. 3. Propose ways to minimize the threats to ethics and thus the expectation gap of audits. 4. Determine the current developments and future direction of ethical aspects of auditors, and explain how such developments contribute to safeguard the audit profession as a concluding remarks. Include a cover page, an executive summary, a table of contents and references. You may include an appendix if necessary.arrow_forward

- Urgent Please answer a soon as possible. Answer must be plagirism free What is the role of auditors and explain the importance of the role.arrow_forwardNeed urgent answer please. (1) Is COSO relevant for internal control? This is a full question and not any essay question. Need brief and plagirism free answer. Answer should not be too short.arrow_forwardSearch Google images for bad data visualizations. Post a link to the image.Describe what is inaccurate or misleading about the visualization. Replace the inaccurate and misleading information with what you think makes the image a good visualization.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education