FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

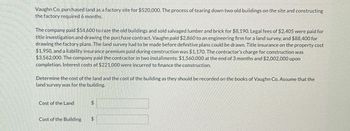

Transcribed Image Text:Vaughn Co. purchased land as a factory site for $520,000. The process of tearing down two old buildings on the site and constructing

the factory required 6 months.

The company paid $54.600 to raze the old buildings and sold salvaged lumber and brick for $8,190. Legal fees of $2.405 were paid for

title investigation and drawing the purchase contract. Vaughn paid $2,860 to an engineering firm for a land survey, and $88,400 for

drawing the factory plans. The land survey had to be made before definitive plans could be drawn. Title insurance on the property cost

$1,950, and a liability insurance premium paid during construction was $1,170. The contractor's charge for construction was

$3,562,000. The company paid the contractor in two installments: $1,560,000 at the end of 3 months and $2,002,000 upon

completion. Interest costs of $221.000 were incurred to finance the construction.

Determine the cost of the land and the cost of the building as they should be recorded on the books of Vaughn Co. Assume that the

land survey was for the building.

Cost of the Land

Cost of the Building

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 17, Advanced Technologies developed a patent related to laser surgery techniques. They spent $1,200,000 to develop the patent internally, consisting of personnel ($800,000), equipment ($300,000), and materials ($100,000). The company also had the following additional costs: $20,000 in legal fees associated with the purchase and filing of the patent, $35,000 to advertise its new laser surgery techniques, and $45,000 to train employees. What is the recorded cost of the patent?arrow_forwardThe Madison Sign Company purchased land as a factory site for $72,000. Prior to construction of the new building, the land had to be cleared of trees and brush. Construction costs incurred during the first year are listed below: Land clearing costs $3,200 Sale of firewood to a worker (580) Architect fees (for new building) 12,000 Title investigation of land 1,700 Property taxes on land (for the first year) 1,200 220,000 Building construction costs Required: Determine the amounts that the company should record in the Land and the Building accounts. (Amounts to be deducted should be indicated by a minus sign.) Totals $ Land Buildingarrow_forwardPeace Co. purchased land as a factory site for P300,000. Peace paid P30,000 to tear down two building on the land. Salvage was sold for P2,700. Legal fees of P1,740 were paid for title investigation and making the purchase. Architect's fees were P15,600. Land Title insurance cost P1,200. Liability insurance during construction cost, P1300. Excavation cost P5,220. The contractor was paid P1,100,000. An assessment made by the city for pavement was P3,200. Interest costs during construction were P85,000. The cost of the land is a. 330,240b. 333,440c. 306,140d. none of thesearrow_forward

- Anchor Company purchased a manufacturing machine with a list price of $88,000 and received a 2% cash discount on the purchase. The machine was delivered under terms free on board (FOB) shipping point, and transportation costs amounted to $2,800. Anchor paid $3,900 to have the machine installed and tested. Insurance costs to protect the asset from fire and theft amounted to $5,000 for the first year of operations. What is the cost of the machine? Multiple Choice O O O O $92,940 $97,940 $89,040 $86,240arrow_forwardOn March 17, Advanced Technologies purchased a patent related to laser surgery techniques. The purchase price of the patent is $1,250,000. The patent is expected to benefit the company for the next five years. The company had the following additional costs: $25,000 in legal fees associated with the purchase and filing of the patent, $40,000 to advertise its new laser surgery techniques, and $ 50,000 to train employees. None of these additional costs were included in the purchase price or paid to the seller. What is the recorded cost of the patent?arrow_forwardMiller Corp. purchased a new machine for its factory. The following lists shows the various expenditures for the machine during its first year: • Base purchase price, $75.000 • Sales tax incurred at the time of purchase, $4,000 • Installation charges for the machine, $700 • Insurance costs incurred while the machine was being shipped, $200 • Insurance costs for the first year of the machine's service life, $500 • Ordinary repairs and maintenance costs during the first year of the machine's service life, $1,200 Question: What should be the capitalized cost of the machine? Answer: $ (do not use commas or a decimal in the answer)arrow_forward

- On March 17, Advanced Technologies purchased a patent related to laser surgery techniques. The purchase price of the patent is $1,360,000. The patent is expected to benefit the company for the next five years. The company had the following additional costs: $36,000 in legal fees associated with the purchase and filling of the patent, $51,000 to advertise its new laser surgery techniques, and $61,000 to train employees. None of these additional costs were included in the purchase price or paid to the seller. Now assume that instead of purchasing the patent, Advanced Technologies spent $1,360,000 to develop the patent internally, consisting of personnel ($880,000), equipment ($348,000), and materials ($132,000). All additional costs were incurred for the same amount. What is the recorded cost of the patent? Total capitalized costarrow_forwardCrane Corp. purchased land as a factory site for $280000. They paid $12200 to tear down two buildings on the land, and the salvage from these old buildings was sold for $1310. Legal fees of $830 were paid for title investigation and making the purchase. Architect's fees were $10370. Title insurance cost $610, and liability insurance during construction cost $650. Excavation costs were $2970. A contractor was paid $677000 to construct the new building. An assessment made by the city for pavement was $1740. Interest costs during construction were $43300. The cost of the land should be recorded at $292330. O $294770. O $296510. O $294070.arrow_forwardCarla Vista Corp. purchased land as a factory site for $330000. They paid $10400 to tear down two buildings on the land, and the salvage from these old buildings was sold for $1330. Legal fees of $840 were paid for title investigation and making the purchase. Architect's fees were $10490. Title insurance cost $620, and liability insurance during construction cost $650. Excavation costs were $3430. A contractor was paid $657000 to construct the new building. An assessment made by the city for pavement was $1690. Interest costs during construction were $43000. The cost of the land should be recorded at Select answer from the options below $342930. $344620. $340530. $342220.arrow_forward

- Lavoie Corporation acquired new equipment at a cost of $100,000 plus 7% provincial sales tax and 5% GST. (GST is a recoverable tax.) The company paid $1,700 to transport the equipment to its plant. The site where the equipment was to be placed was not yet ready and Lavoie Corporation spent another $500 for one month's storage costs. When installed, $300 in labour and $200 in materials were used to adjust and calibrate the machine to the company's exact specifications. The units produced in the trial runs were subsequently sold to employees for $400. During the first two months of production, the equipment was used at only 50% of its capacity. Labour costs of $3,000 and material costs of $2,000 were incurred in this production, while the units sold generated $5,500 of sales. Lavoie paid an engineering consulting firm $11,000 for its services in recommending the specific equipment to purchase and for help during the calibration phase. Borrowing costs of $800 were incurred because of the…arrow_forwardCompany I purchased a piece of land for its natural resources at a cost of $1,500,000. The land is expected to have a salvage value of $250,000. A lumber expert visited the property and estimated the property to have 500,000 pounds of timber. The first year, the company logged 350,000 pounds of timber, and the second year, another 250,000 pounds of timber were logged. Calculate the depletion expense rate AND calculate the depletion expense the company should recognize in Year 1 and Year 2:arrow_forwardShelton Company purchased a parcel of land six years ago for $869,500. At that time, the firm invested $141,000 in grading the site so that it would be usable. Since the firm wasn't ready to use the site itself at that time, it decided to lease the land for $52,000 a year. The company is now considering building a warehouse on the site as the rental lease is expiring. The current value of the land is $921,000. What value should be included in the initial cost of the warehouse project for the use of this land? Multiple Choice A. $1,010,500 B. $869,500 C. $1,062,000 D. $921,000 E. SOarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education