EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

please answer fast i give upvote

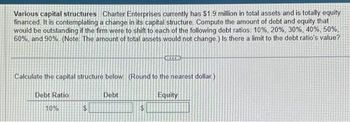

Transcribed Image Text:Various capital structures Charter Enterprises currently has $1.9 million in total assets and is totally equity

financed. It is contemplating a change in its capital structure. Compute the amount of debt and equity that

would be outstanding if the firm were to shift to each of the following debt ratios: 10%, 20%, 30%, 40%, 50%,

60% and 90% (Note: The amount of total assets would not change.) Is there a limit to the debt ratio's value?

Calculate the capital structure below: (Round to the nearest dollar)

Debt Ratio

10%

$

Debt

LA

Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Charter Enterprises currently has $1.5 million in total assets and is totally equity financed. It is contemplating a change in its capital structure. Compute the amount of debt and equity that would be outstanding if the firm were to shift to each of the following debt ratios: 10%, 20%, 30%, 40%, 50%, 60%, 90%. (Note: The amount of total assets would not change.) Is there a limit to the debt ratio's value?arrow_forward(Capital structure analysis) The liabilities and owners' equity for Campbell Industries is found here: LOADING... . a. What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If Campbell were to purchase a new warehouse for $1.1 million and finance it entirely with long-term debt, what would be the firm's new debt ratio? Accounts payable $519,000 Notes payable $248,000 Current liabilities $767,000 Long-term debt $1,101,000 Common equity $4,647,000 Total liabilities and equity $6,515,000arrow_forwardPlease see image to solve question. Please ensure answers are clearly stated.arrow_forward

- Please see image to answer question.arrow_forwardB Company stated that its optimal capital structure consists of debt taking up 30% of its total capital. B Company's existing and target capital structure is as shown. Source of Capital Target Weights Existing Weights Cost of Source Long Term Debt 30% 10% 8% Preferred Stock 15% 15% 13% Common Stock Equity 55% 75% 15% 1. Calculate target and existing WACC 2a. Should B Company continue moving towards its target WACC? Why or why not? 2b. How could increasing debt be beneficial for B Comp?arrow_forwardRichmond Clinic has obtained the following estimates for its costs of debt and equity at various capital structures: After-Tax Percent Cost of Cost of Debt Debt Equity 0% 16% 20% 6.6% 17% 40% 7.8% 19% 60% 10.2% 22% 80% 14.0% 27% What is the firms optimal capital structure? Please provide your answers in the following format: xx% Note: no decimals required. What percent equity? 15% What percent debt? 40%arrow_forward

- Review this situation: Transworld Consortium Corp. is trying to identify its optimal capital structure. Transworld Consortium Corp. has gathered following financial information to help with the analysis. Debt Ratio 30% 40% 50% 60% 70% Equity Ratio 70% 60% 50% 40% 30% WACC 9.71% 9.55% 10.02% 7.55% 11.30% 10.78% 8.24% 12.80% 11.45% rd Is 6.02% 9.40% 6.75% 9.750% 7.15% 10.60% Which capital structure shown in the preceding table is Transworld Consortium Corp.'s optimal capital structure? Debt ratio= 30%; equity ratio = 70% Debt ratio = Debt ratio = 70%; equity ratio = 30% Debt ratio= 50%; equity ratio = 50% 60%; equity ratio = 40% Debt ratio = 40%; equity ratio = 60%arrow_forwardPlease show all work on excel Cartwright Communications is considering making a change to its capital structure to reduce its cost of capital and increase firm value. Right now, Cartwright has a capital structure that consists of 20% debt and 80% equity, based on market values. (Its D/E ratio is 0.25.) The risk-free rate is 6% and the market risk premium, rM – rRF, is 5%. Currently the company's cost of equity, which is based on the CAPM, is 12% and its tax rate is 40%. A. What would be Cartwright's estimated cost of equity if it were to change its capital structure to 50% debt and 50% equity?arrow_forwardReview this situation: Universal Exports Inc. is trying to identify its optimal capital structure. Universal Exports Inc. has gathered the following financial information to help with the analysis. Debt Ratio 30% 40% 50% 60% 70% Equity Ratio 70% 60% 50% 40% 30% Id 7.00% 7.20% 7.70% 11.40% 8.90% 12.20% 10.30% 13.50% Is WACC 10.50% 8.61% 10.80% 8.21% 8.01% 8.08% 8.38% Which capital structure shown in the preceding table is Universal Exports Inc.'s optimal capital structure? Debt ratio = 70%; equity ratio = 30% Debt ratio 50%; equity ratio = 50% Debt ratio = 30%; equity ratio = 70% Debt ratio = 40%; equity ratio = 60% Debt ratio= 60%; equity ratio = 40%arrow_forward

- Review this situation: Universal Exports Inc. is trying to identify its optimal capital structure. Universal Exports Inc. has gathered the following financial information to help with the analysis. Debt Ratio Equity Ratio rdrd rsrs WACC 30% 70% 7.00% 10.50% 8.61% 40% 60% 7.20% 10.80% 8.21% 50% 50% 7.70% 11.40% 8.01% 60% 40% 8.90% 12.20% 8.08% 70% 30% 10.30% 13.50% 8.38% Consider this case: Globex Corp. currently has a capital structure consisting of 35% debt and 65% equity. However, Globex Corp.’s CFO has suggested that the firm increase its debt ratio to 50%. The current risk-free rate is 3%, the market risk premium is 7%, and Globex Corp.’s beta is 1.10. If the firm’s tax rate is 25%, what will be the beta of an all-equity firm if its operations were exactly the same? Now consider the case of another company: US Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 6%,…arrow_forwardReview this situation: Universal Exports Inc. is trying to identify its optimal capital structure. Universal Exports Inc. has gathered the following financial information to help with the analysis. Debt Ratio Equity Ratio rdrd rsrs WACC 30% 70% 7.00% 10.50% 8.61% 40% 60% 7.20% 10.80% 8.21% 50% 50% 7.70% 11.40% 8.01% 60% 40% 8.90% 12.20% 8.08% 70% 30% 10.30% 13.50% 8.38% Which capital structure shown in the preceding table is Universal Exports Inc.’s optimal capital structure? Debt ratio = 70%; equity ratio = 30% Debt ratio = 50%; equity ratio = 50% Debt ratio = 60%; equity ratio = 40% Debt ratio = 40%; equity ratio = 60% Debt ratio = 30%; equity ratio = 70% Consider this case: Globex Corp. is an all-equity firm, and it has a beta of 1. It is considering changing its capital structure to 70% equity and 30% debt. The firm’s cost of debt will be 10%, and it will face a tax rate of 40%. What will Globex…arrow_forwardAssume the total market value of General Motors (GM)’s capital structure is $10 billion. GM has a market value of $6 billion of equity and a face value of $12 billion of debt. What are the weights in equity and debt that are used for calculating the WACC? A. 0.30 equity, 0.70 debt B. 0.60 equity, 0.40 debt C. 0.40 equity, 0.60 debt D. Cannot be determinedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning