FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

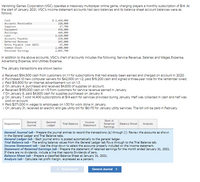

Transcribed Image Text:Vanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a monthly subscrlptlon of $14. At

the start of January 2021, VGC's Income statement accounts had zero balances and Its balance sheet account balances were as

follows:

Cash

Accounts Receivable

Supplies

Equipment

Buildings

Land

Accounts Payable

$ 2,418, e08

218,e00

17,780

950, e00

440, e00

1,620, e00

150, e00

145,e00

65, e00

2,408,800

2,895,700

Deferred Revenue

Notes Payable (due 2025)

Connon Stock

Retained Earnings

In addition to the above accounts, VGC's chart of accounts Includes the following: Service Revenue, Salarles and Wages Expense.

Advertising Expense, and Utilitles Expense.

The January transactions are shown below:

a. Recelved $54.500 cash from customers on 1/1 for subscriptions that had already been earned and charged on account In 2020.

b. Purchased 10 new computer servers for $42,000 on 1/2; pald $19,200 cash and signed a three-year note for the remalnder owed.

c. Pald $16,800 for an Internet advertisement run on 1/3.

d. On January 4. purchased and recelved $4,600 of supplies on account.

e. Recelved $195.000 cash on 1/5 from customers for service revenue earned in January.

f On January 6. pald $4,600 cash for supplies purchased on January 4.

g. On January 7, sold 14,400 subscriptions at $14 each for servlces provided during January. Half was collected in cash and half was

sold on account.

h. Pald $371,000 In wages to employees on 1/30 for work done in January.

1. On January 31, recelved an electric and gas utlity bill for $6.170 for January utility services. The bll will be pald in February.

Stmt of

General

General

Income

Requirement

Trial Balance

Retained

Balance Sheet

Analysis

Journal

Ledger

Statement

Earnings

General Journal tab - Prepare the journal entries to record

in the General Ledger and Trial Balance tabs.

General Ledger tab - Each journal entry is posted automatically to the general ledger.

Trial Balance tab - The ending balance values from the General Ledger tab flows through to the Trial Balance tab.

Income Statement tab - Use the drop-down to select the accounts properly included on the income statement.

Statement of Retained Earnings tab - Prepare the statement of retained earnings for the month ended January 31, 2021.

If there are no dividends, include a line that reports Dividends of zero.

Balance Sheet tab - Prepare a classified Balance Sheet at January 31, 2021.

Analysis tab - Calculate net profit margin, expressed as a percent.

transactions (a) through (i). Revie

accounts as shown

< Requirement

General Journal >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 15 images

Knowledge Booster

Similar questions

- Use the following information about a company's receivable transactions to determine relevant balances. * Account balances at 1/1/x2 Accounts receivable $100,000 Allowance for doubtful accounts 7,000 Allowance for sales returns 2,000 During the year, 20x2, the company had the following transactions related to receivables: • Credit sales revenue of $350,000 recorded. • Cash collections from accounts of $370,000. • Customer account write-offs in the amount of $10,000 • Customer returns of credit sales in the amount of $3,500. • Bad debt expense of $5,000 recorded at the end of the period. • The company estimates sales returns at 2% of credit sales revenue for the period. Determine the net realizeable value of receivables at the end of the year as disclosed on the balance sheet.arrow_forwardAt the beginning of 2018 Evan Company had a $1,958 balance in its accounts receivable account and a $448 balance in allowance for doubtful accounts. During 2018, Evan experienced the following events. (1) Earned $4,577 of revenue on account. (2) Collected $1,505 cash from accounts receivable. (3) Wrote-off $339 of accounts receivable as uncollectible. Evan estimates uncollectible accounts to be 3% of sales. Based on this information, the December 31, 2018 adjusted balance in the allowance for doubtful accounts isarrow_forwardDuring July 2022, Midtown Catering recorded the following: - Catering services of $86,400 were provided ($64,500 on account, $21,900 for cash) - Collections on account, $58,950 - Write-offs of uncollectible receivables, $2,560 - Recovery of receivable previously written off, $1,000 Journalize Midtown's transactions during July, assuming Midtown uses the allowance method. Omit explanations. Prepare the journal entry for the write off of the accounts receivable.arrow_forward

- The Richard’s Red Company maintains a checking account at the Bank of the North. The bank statement for the month of October 2024 indicated the following: balance on October 1, 2024 was $32,690, deposits for October totaled $86,000, checks paid in October totaled $75,200, service charges for October totaled $350; October NSF checks totaled $1,600; a monthly loan payment deducted by the bank directly from the company’s bank account totaled $3,400; and the ending balance on October 31, 2024 totaled $38,140. At the end of October 2024, Richard’s accounting records indicated a balance in its checking account of $42,544. October 31st deposits in transit were $4,224, and outstanding checks totaled $5,620. In addition, a check for $500 to purchase office furniture was incorrectly recorded by the company as a $50 disbursement. The bank correctly processed the check during October. Assuming the company has no other cash, the amount Richard’s Red would report for cash as a current asset on…arrow_forwardHarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Grandview, Incorporated uses the allowance method. At December 31, 2021, the company's balance sheet reports Accounts Receivable, Net in the amount of $27, 200. On January 2, 2022, Grandview writes off a $ 2,400 customer account balance when it becomes clear that the customer will never pay. What is the amount of Accounts Receivable, Net after the write-off? a $27, 200 b $2,400 c $29, 600 d $24, 800arrow_forwardVanishing Games Corporation (VGC) operates a massively multiplayer online game, charging players a monthly subscription of $11. At the start of January 2021, VGC's income statement accounts had zero balances and its balance sheet account balances were as follows: Cash Accounts Receivable Supplies Equipment Buildings Land $ 1,630,000 208,000 15,400 936,000 516,000 1,600,000 Accounts Payable Deferred Revenue Notes Payable (due 2025) Common Stock Retained Earnings 160,000 166,000 150,000 2,700,000 1,729,400 In addition to the above accounts, VGC's chart of accounts includes the following: Service Revenue, Salaries and Wages. Expense, Advertising Expense, and Utilities Expense. The following transactions occurred during the January month: a. Received $62,500 cash from customers on 1/1 for subscriptions that had already been earned and charged on account in 2020. b. Purchased 10 new computer servers for $41,100 on 1/2; paid $12,200 cash and signed a three-year note for the remainder owed.…arrow_forwardplease provide correct and complete answer in text form with narration explanation calculation formulaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education