FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

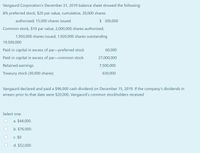

Transcribed Image Text:Vangaurd Corporation's December 31, 2019 balance sheet showed the following:

8% preferred stock, $20 par value, cumulative, 20,000 shares

authorized; 15,000 shares issued

$ 300,000

Common stock, $10 par value, 2,000,000 shares authorized;

1,950,000 shares issued, 1,920,000 shares outstanding

19,500,000

Paid-in capital in excess of par-preferred stock

60,000

Paid-in capital in excess of par-common stock

27,000,000

Retained earnings

7,500,000

Treasury stock (30,000 shares)

630,000

Vangaurd declared and paid a $96,000 cash dividend on December 15, 2019. If the company's dividends in

arrears prior to that date were $20,000, Vangaurd's common stockholders received

Select one:

a. $44,000.

b. $76,000.

C. $0

d. $52,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, Dolar Incorporated had the following account balances in its shareholders' equity accounts. Common stock, $1 par, 241,000 shares issued $241,000 Paid-in capital-excess of par, common 482,000 Paid-in capital-excess of par, preferred. 195,000 Preferred stock, $100 par, 19,500 shares outstanding 1,950,000 Retained earnings Treasury stock, at cost, 4,100 shares 3,900,000 20,500 During 2024, Dolar Incorporated had several transactions relating to common stock. January 15: February 17: April 10: July 18: December 1: December 28: Required: Declared a property dividend of 100,000 shares of Burak Company (book value $11.9 per share, fair value $9.95 per share). Distributed the property dividend. A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. (Dolar chose to reduce Paid-in capital-excess of par.) The fair value of the stock was $4 on this date.. Declared and distributed a 4% stock dividend on…arrow_forwardSupper Company Ltd., reported the following stockholders’ equity on its balance sheet at June 30, 2021: Supper Company Ltd. Stockholders’ Equity June 30,2021 Paid-in Capital Preferred stock, 10%,? par, 650,000 shares authorized, 280,000 shares issued $ 1,400,000 Common stock, par value $? per share, 5,000,000 shares authorized, 1,000,000 shares issued and outstanding 2,000,000 Paid-in capital in excess of par—common 6,000,000 Which of the following is the correct par value for the company’s preferred stock? Question 1Answer a. $140,000 b. $2.15 c. $65,000 d. $5arrow_forwardWaterway Corporation’s December 31, 2020 balance sheet showed the following: 8% preferred stock, $20 par value, 69400 shares authorized; 49400 shares issued $ 988000 Common stock, $10 par value, 6750000 shares authorized; 6650000 shares issued, 6610000 shares outstanding 66500000 Paid-in capital in excess of par—preferred stock 125500 Paid-in capital in excess of par—common stock 54000000 Retained earnings 15350000 Treasury stock (69400 shares) 1261000 Waterway’s total paid-in capital was $122874500. $121613500. $54125500. $120352500.arrow_forward

- On January 1, 2021, the stockholders’ equity section of Jayhawk Corporation’s balance sheet showed the following Preferred stock, $100 par value, 5%, 50,000 shares authorized, 5,000 shares issued and outstanding $500,000 Additional Paid-in-Capital, Preferred Stock 100,000 Common stock, $3 par value, 500,000 shares authorized, 20,000 shares issued and outstanding 60,000 Additional Paid-in-Capital, Common Stock 250,000 Total Contributed Capital 910,000 Retained Earnings 320,000 Total Stockholders' Equity $1,230,000 During the year, 2021, the following transactions occurred: February 2 Issued 2,000 shares of common stock for $22 per share. April 15 Issued 1,000 shares of preferred stock for $125 per share. July 10 Repurchased 500 shares of common stock (treasury stock) at $20 per share. Required: Prepare journal entries to…arrow_forwardBacon Inc. has the following stockholders’ equity section in its May 31, 2019, comparative balance sheets: May 31, 2019 April 30, 2019 Paid-in capital: Preferred stock, $120 par value, 9%, cumulative, 200,000 shares authorized, 140,000 shares issued and outstanding $ 16,800,000 $ 16,800,000 Common stock, $5 par value, 1,000,000 shares authorized, 600,000 and 540,000 shares issued, respectively ? 2,700,000 Additional paid-in capital 26,100,000 23,220,000 Retained earnings 36,200,000 34,640,000 Less: Treasury common stock, at cost; 72,000 shares and 68,000 shares, respectively (4,412,000 ) (4,148,000 ) Total stockholders' equity $ ? $ 73,212,000 g. Assume that instead of the stock dividend described in f, the board of directors authorized a 2-for-1 stock split on June 1 when the market price of the common stock was $70 per share.1. What will be the par value, and how many shares of common stock will be…arrow_forwardBacon Inc. has the following stockholders’ equity section in its May 31, 2019, comparative balance sheets: May 31, 2019 April 30, 2019 Paid-in capital: Preferred stock, $120 par value, 9%, cumulative, 200,000 shares authorized, 140,000 shares issued and outstanding $ 16,800,000 $ 16,800,000 Common stock, $5 par value, 1,000,000 shares authorized, 600,000 and 540,000 shares issued, respectively ? 2,700,000 Additional paid-in capital 26,100,000 23,220,000 Retained earnings 36,200,000 34,640,000 Less: Treasury common stock, at cost; 72,000 shares and 68,000 shares, respectively (4,412,000 ) (4,148,000 ) Total stockholders' equity $ ? $ 73,212,000 g. Assume that instead of the stock dividend described in f, the board of directors authorized a 2-for-1 stock split on June 1 when the market price of the common stock was $70 per share.1. What will be the par value, and how many shares of common stock will be…arrow_forward

- Bacon Inc. has the following stockholders’ equity section in its May 31, 2019, comparative balance sheets: May 31, 2019 April 30, 2019 Paid-in capital: Preferred stock, $120 par value, 9%, cumulative, 200,000 shares authorized, 140,000 shares issued and outstanding $ 16,800,000 $ 16,800,000 Common stock, $5 par value, 1,000,000 shares authorized, 600,000 and 540,000 shares issued, respectively ? 2,700,000 Additional paid-in capital 26,100,000 23,220,000 Retained earnings 36,200,000 34,640,000 Less: Treasury common stock, at cost; 72,000 shares and 68,000 shares, respectively (4,412,000 ) (4,148,000 ) Total stockholders' equity $ ? $ 73,212,000 c. What was the average cost per share of the common stock purchased for the treasury during the month?arrow_forwardCompany has two classes of capital stock outstanding: 8%, $20 par preferred and $5 par common. At December 31, 2025, the following accounts were included in the stockholders' equity. Preferred Stock, 148,200 shares $2,964,000 Common Stock, 1,991,000 shares 9,955,000 Paid-in Capital in Excess of Par--Preferred Stock 207,000 Paid-in Capital in Excess of Par--Common Stock 26,478,000 Retained Earnings 4,495,000 The following transactions affected stockholders' equity during 2026. Jan. 1 29,200 shares of preferred stock issued at $23 per share. Feb. 1 46,100 shares of common stock issued at $21 per share. June 1 2-for-1 stock split (par value reduced to $2.50). July 1 28,900 shares of common treasury stock purchased at $10 per share. Blossom uses the cost method. Sept.15 9,200 shares of treasury stock reissued at $12 per share. Dec. 31 The preferred dividend is declared, and a common dividend of 53 cents per share is declared. Dec. 31 Net income is $2,138,000. Prepare the stockholders'…arrow_forwardbBramble Corporation’s December 31, 2020 balance sheet showed the following: 7% preferred stock, $20 par value, 18300 shares authorized; 13300 shares issued $ 266000 Common stock, $10 par value, 1930000 shares authorized; 1880000 shares issued, 1860000 shares outstanding 18800000 Paid-in capital in excess of par—preferred stock 59500 Paid-in capital in excess of par—common stock 24900000 Retained earnings 7670000 Treasury stock (19800 shares) 623700 Bramble’s total stockholders’ equity was $44051800. $51695500. $52331800. $51071800.arrow_forward

- The stockholders’ equity section of Hendly Corporation appears below as of December 31, 2020. 8% preferred stock, $50 par value, authorized 100,000 shares, outstanding 90,000 shares $ 4,500,000 Common stock, $1.00 par, authorized and issued 10 million shares 10,000,000 Additional paid-in capital 20,500,000 Retained earnings (includes 2020 net income of $33,000,000) 167,000,000 Net income $202,000,000 Net income for 2020 reflects a total effective tax rate of 20%. Included in the net income figure is a loss of $18,000,000 (before tax) as a result of a non-recurring major casualty. Preferred stock dividends of $360,000 were declared and paid in 2020. Dividends of $1,000,000 were declared and paid to common stockholders in 2020. Instructions Compute earnings per share data as it should appear on the income statement of Hendly Corporation.arrow_forwardcoronado corporation has the following capital stock outstanding at december 31, 2020: 7% preferred stock, $100 par value, 15,800 shares issued and outstanding $1580000 common stock, no par, $10 stated value, 500000 shares authorized, 360000 shares issued and outstanding 3600000 the preferred stock was issued at a $130 per share. the common stock was issued at an average per share price of $14. prepare the paid-in capital section of the balance sheet at dec 31, 2020.arrow_forwardMetlock Corporation's December 31, 2020 balance sheet showed the following: 6% preferred stock, $20 par value, cumulative, 35000 shares authorized; 19000 shares issued $ 380000 Common stock, $10 par value, 3,000,000 shares authorized; 1,950,000 shares issued, 1,920,000 shares outstanding 19500000 Paid-in capital in excess of par value - preferred stock 66000 Paid-in capital in excess of par value - common stock 27900000 Retained earnings 8950000 Treasury stock (30,000 shares) 525000 Metlock's total paid-in capital was $48371000. $47846000. $27946000. $47321000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education