FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

a-2

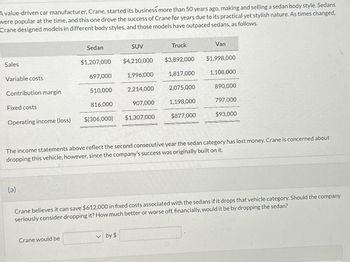

Transcribed Image Text:A value-driven car manufacturer, Crane, started its business more than 50 years ago, making and selling a sedan body style. Sedans

were popular at the time, and this one drove the success of Crane for years due to its practical yet stylish nature. As times changed,

Crane designed models in different body styles, and those models have outpaced sedans, as follows.

Sales

Variable costs

Contribution margin

Fixed costs

Operating income (loss)

(a)

Sedan

$1,207,000

Crane would be

697,000

510,000

816,000

$(306,000)

SUV

$4,210,000

by $

1,996,000

2,214,000

907,000

$1,307,000

Truck

$3,892,000

1,817,000

2,075,000

1,198,000

$877,000

Van

$1,998,000

1,108,000

890,000

The income statements above reflect the second consecutive year the sedan category has lost money. Crane is concerned about

dropping this vehicle, however, since the company's success was originally built on it.

797,000

$93,000

Crane believes it can save $612,000 in fixed costs associated with the sedans if it drops that vehicle category. Should the company

seriously consider dropping it? How much better or worse off, financially, would it be by dropping the sedan?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- A7 please help[.....arrow_forward102. Four capacitors C1-1uF, C2=2uF, C3=3uF and C4-4uF are connected as given in figure. The potential of junction O is A. 16.5 V B. 18 V C. 15.5 V D. 18.5 V 10 V 5V C₁ # H C3+ CA 20 V 30 Varrow_forwardC B A Question 2 Listen What is tane for the given triangle? 13 53 12 25 55 13 12 13 earrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education