FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

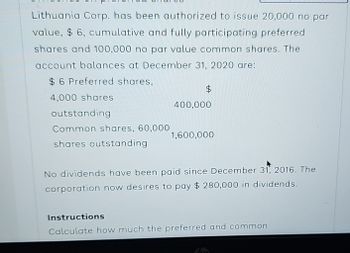

Transcribed Image Text:Lithuania Corp. has been authorized to issue 20,000 no par

value, $ 6, cumulative and fully participating preferred

shares and 100,000 no par value common shares. The

account balances at December 31, 2020 are:

$6 Preferred shares,

$

4,000 shares

outstanding

Common shares, 60,000

shares outstanding

400,000

1,600,000

No dividends have been paid since December 31, 2016. The

corporation now desires to pay $ 280,000 in dividends.

Instructions

Calculate how much the preferred and common

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- C5.5arrow_forwardOn January 1st, 2023, Jackson Corporation had 15,000, $2.60 cumulative preferred shares and 20,000 common shares. Jackson did not pay any cash dividends during the previous fiscal year-ended December 31st, 2022. The company pays $45,000 of cash dividends during 2023. Which of the following amounts represents the cash dividends that the preferred shareholders would receive in 2023? $39,000 $45,000 $15,000 $6,000 None of the above. please answer do not image.arrow_forwardYellow Enterprises reported the following ($ in thousands) as of December 31, 2024. All accounts have normal balances. Deficit (debit balance in retained earnings) $ 2,300 Common stock 3,800 Paid-in capital—share repurchase 1,800 Treasury stock (at cost) 300 Paid-in capital—excess of par 31,100 During 2025 ($ in thousands), net income was $9,700; 25% of the treasury stock was resold for $600; cash dividends declared were $630; cash dividends paid were $460. What ($ in thousands) was shareholders' equity as of December 31, 2025?arrow_forward

- Ace Corporation pays its cumulative preferred stock $1.95 per share. There are 40,000 shares of preferred and 80,000 shares of common. In 2016, 2017, and 2018, because of slowdowns in the economy, Ace paid no dividends. Now, in 2019, the board of directors has decided to pay out $600,000 in dividends. The common stockholders receive: Multiple Choice $288,000 $312,000 $444,000 $366,000 3:14 acerarrow_forwardSuppose a corporation has the following shares outstanding: 1. $800,000 in 6% Preferred Stock ($100 par value) 2. $3,200,000 in Common Stock ($10 par value) No dividends were declared for the years 2020 and 2021. Two scenarios are presented below and each is independent of each other. Scenario 1: As of December 31, 2022, a dividend of $250,000 is declared. Indicate the amount that the preferred shareholders will receive if the share is cumulative and non-participating (cumulative and non-participating). Answer: Scenario 2: As of December 31, 2022, a dividend of $800,000 is declared. Indicate the amount that the preferred shareholders will receive if the share is cumulative and non-participating up to 11% in total (cumulative and non-participating). Answer:arrow_forwardThe shareholders' equity section of Charles Corporation at December 31, 2024, included the following: $4 preferred shares, cumulative, 10,000 shares authorized, 4,000 shares issued $400,000 Common shares, 500,000 shares authorized, 350,000 shares issued 2,000,000 Dividends were not declared on the preferred shares in 2024 and are in arrears. On September 15, 2025, the board of directors of Charles Corporation declared all of the annual dividends on the preferred shares for 2024 and 2025, to shareholders of record on October 1, 2025, payable on October 15, 2025. The amount of total dividends declared on preferred shares on September 15, 2025, is $32,000. $16,000. $20,000. ○ $64,000.arrow_forward

- Crane, Inc. has $500,000, $0.80, no par value preferred shares (50,000 shares) and $1,000,000 of no par value common shares outstanding (80,000 shares). No dividends were paid or declared during 2021 and 2022. The company wants to distribute $582,500 in dividends on December 31, 2023. Calculate the amount of dividends to be paid to each group of shareholders (i.e., preferred and common), assuming the preferred shares are non-cumulative and non-participating. Preferred Common Total dividends $ $ Save for Latarrow_forwardPlease show the solution in good accounting form. 5. How much is the TOTAL treasury share capital? 6. How much is the Retained earnings, END? 7. How much is the Retained earnings, end - UNAPPROPRIATED?arrow_forwardPlease don't provide answer in image format thank you.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education