FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

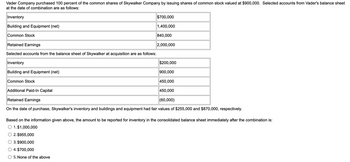

Transcribed Image Text:Vader Company purchased 100 percent of the common shares of Skywalker Company by issuing shares of common stock valued at $900,000. Selected accounts from Vader's balance sheet

at the date of combination are as follows:

Inventory

Building and Equipment (net)

Common Stock

$700,000

1,400,000

840,000

Retained Earnings

Selected accounts from the balance sheet of Skywalker at acquisition are as follows:

Inventory

Building and Equipment (net)

Common Stock

Additional Paid-In Capital

Retained Earnings

(60,000)

On the date of purchase, Skywalker's inventory and buildings and equipment had fair values of $255,000 and $870,000, respectively.

2,000,000

$200,000

900,000

450,000

450,000

Based on the information given above, the amount to be reported for inventory in the consolidated balance sheet immediately after the combination is:

O 1. $1,000,000

O 2. $955,000

O 3. $900,000

4. $700,000

5. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What amount will be reported as non-controlling interest?arrow_forwardPhone Corporation acquired 70 percent of Smart Corporation’s common stock on December 31, 20X4, for $98,000. At that date, the fair value of the noncontrolling interest was $42,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Item Phone Corporation Smart Corporation Cash $ 52,300 $ 39,000 Accounts Receivable 99,000 59,000 Inventory 136,000 92,000 Land 66,000 49,000 Buildings & Equipment 417,000 268,000 Less: Accumulated Depreciation (151,000) (73,000) Investment in Smart Corporation 98,000 Total Assets $ 717,300 $ 434,000 Accounts Payable $ 141,500 $ 27,000 Mortgage Payable 300,800 288,000 Common Stock 72,000 40,000 Retained Earnings 203,000 79,000 Total Liabilities & Stockholders’ Equity $ 717,300 $ 434,000 At the date of the business combination, the book values of Smart’s assets and liabilities approximated fair value except for inventory, which had a fair value of…arrow_forwardPeace Computer Corporation acquired 75 percent of Symbol Software Company’s stock on January 2, 20X3, by issuing bonds with a par value of $85,250 and a fair value of $102,750 in exchange for the shares. Summarized balance sheet data presented for the companies just before the acquisition follow: Peace Computer Corporation Symbol Software Company Book Value Fair Value Book Value Fair Value Cash $ 216,000 $ 216,000 $ 62,000 $ 62,000 Other Assets 406,000 406,000 137,000 137,000 Total Debits $ 622,000 $ 199,000 Current Liabilities $ 82,000 82,000 $ 62,000 62,000 Common Stock 290,000 62,000 Retained Earnings 250,000 75,000 Total Credits $ 622,000 $ 199,000 Required: Prepare a consolidated balance sheet immediately following the acquisition.arrow_forward

- Please Provide Correct Answerarrow_forwardPeanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $310,500 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $345,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Cash Accounts Receivable Inventory Investment in Snoopy Company Land Buildings and Equipment Cost of Goods Sold Depreciation Expense Selling & Administrative Expense Dividends Declared Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total Peanut Company Debit $ 174,000 181,000 211,000 353,700 206,000 707,000 187,000 41,000 220,000 89.000 $2,369,700 Credit $450,000 63,000 188,000 492,000 313,900 789,000 73.800 $2,369,700 Snoopy Company Debit $ 87,000 82,000 76,000 95,000 188,000 120,000 9,000 27,000 34,000 $718,000 Credit $18,000 48,000 69,000 196,000 149,000 238,000 0 $718,000 Required: a. Prepare any equity…arrow_forwardSUBJECT : Accountingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education