FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

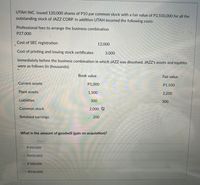

Transcribed Image Text:UTAH INC. issued 120,000 shares of P10 par common stock with a fair value of P2,550,000 for all the

outstanding stock of JAZZ CORP. In addition UTAH incurred the following costs:

Professional fees to arrange the business combination

P27,000

Cost of SEC registration

12,000

Cost of printing and issuing stock certificates

3,000

Immediately before the business combination in which JAZZ was dissolved, JAZZ's assets and equities

were as follows (in thousands):

Book value

Fair value

Current assets

P1,000

P1,100

Plant assets

1,500

2,200

Liabilities

300

300

Common stock

2,000

Retained earnings

200

What is the amount of goodwill (gain on acquisition)?

O P 450,000

O P(450,000)

P 500,000

O P(550,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Johannes Inc. acquired 80 percent of Corner Brook Ltd. common shares on January 1, Year 4, for $744,000. At that date, the fair value of the non-controlling Interest was $186,000. Corner Brook's balance sheet contained the following amounts at the time of the combination: Cash Accounts Receivable Inventory Construction Work in Progress Other Assets (net) Total Assets 66,000 140,000 40,000 Accounts Payable $ 106,000 Bonds Payable 610,000 950,000 Common Shares ($10 par value) Retained Earnings 400,000 530,000 450,000 $1,646,000 $ 1,646,000 Total Liabilities & Equities During each of the next three years, Corner Brook reported net income of $120,000 and paid dividends of $60,000. On January 1, Year 6, Johannes sold 8,800 of the Corner Brook shares for $260,000 in cash. Johannes used the equity method in accounting for its ownership of Corner Brook. Required: (a) Compute the balance in the Investment account reported by Johannes on January 1, Year 6, before its sale of shares. (Omit $ sign…arrow_forwardMunabhaiarrow_forwardOn the 1/01/x3, J Group acquired 2 025 000 of the 4 500 000 ordinary R1 shares in Entity PA for R5 695 000. At acquisition, PA had retained earnings of R1 400 000. When preparing the J Group's consolidated financial statements for the year end date of 31/12/x3, accountants at the group entity are working with the following information: In the x3 financial year, Entity PA made a profit after tax of R 1 230 000; In the x3 financial year, PA paid a dividend totaling R45 000 to its shareholders; At the end of the x3 financial year, the group's investment in PA is found to have impaired by R94 000. Based on this information, calculate the group's investment in associate figure, in its consolidated financial statements dated 31/12/x3.arrow_forward

- On the 1/01/x3, J Group acquired 2 025 000 of the 4 500 000 ordinary R1 shares in Entity PA for R5 695 000. At acquisition, PA had retained earnings of R1 400 000. When preparing the J Group's consolidated financial statements for the year end date of 31/12/x3, accountants at the group entity are working with the following information: In the x3 financial year, Entity PA made a profit after tax of R 1 230 000; In the x3 financial year, PA paid a dividend totaling R45 000 to its shareholders; At the end of the x3 financial year, the group's investment in PA is found to have impaired by R94 000. Based on this information, calculate the group's investment in associate figure, in its consolidated financial statements dated 31/12/x3.arrow_forwardi need the answer quicklyarrow_forwardOn January 1, 20X1, Cleo Company purchased an 80% interest in Sai Inc. for $1,000,000. The equity balances of Sai at the time of the purchase were as follows: Common stock ($10 par) $100,000 Paid-in capital in excess of par 400,000 Retained earnings 500,000 Any excess of cost over book value is attributable to goodwill. No dividends were paid by either firm during 20X6. The following trial balances were prepared for CLeo Company and its subsidiary, Sai Inc., on December 31, 20X6: Pinto Sands Cash 120,000 70,000 Accounts receivable 240,000 197,000 Inventory 200,000 176,000 Land 600,000 180,000 Buildings and equipment 1,100,000 800,000 Accumulated depreciation (180,000) (120,000) Investment in Sands 1,000,000 Accounts payable (110,000) (50,000) Common stock, $10 par (800,000) (100,000) Paid-in capital in excess of par…arrow_forward

- On January 2, 20Y4, Whitworth Company acquired 40% of the outstanding stock of Aloof Company for $340,000. For the year ended December 31, 20Y4, Aloof Company earned income of $180,000 and paid dividends of $10,000. On January 31 20Y5, Whitworth Company sold all of its investment in Aloof Company stock for $405,000. Journalize the entries for Whitworth Company for the purchase of the stock, the share of Aloof income, the dividends received from Aloof Company, and the sale of the Aloof Company stock. If an amount box does not require an entry, leave it blank. Jan. 2, 20Y4 - Purchase Dec. 31, 20Y4 - Income Dec. 31, 20Y4 - Dividends Jan. 31, 20Y5 - Salearrow_forwardPeanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, are as follows: Peanut Company Snoopy Company Debit Credit Debit Credit Cash $ 130,000 $ 80,000 Accounts Receivable 165,000 65,000 Inventory 200,000 75,000 Investment in Snoopy Company 355,000 0 Land 200,000 100,000 Buildings and Equipment 700,000 200,000 Cost of Goods Sold 200,000 125,000 Depreciation Expense 50,000 10,000 Selling and Administrative Expense 225,000 40,000 Dividends Declared 100,000 20,000 Accumulated Depreciation $ 450,000 $ 20,000 Accounts Payable 75,000 60,000 Bonds Payable 200,000 85,000 Common Stock 500,000 200,000 Retained Earnings 225,000 100,000 Sales 800,000…arrow_forwardBristle Co. acquired 75 percent of Silver Corporation's common stock on December 31, 20X8, for $300,000. The fair value of the non-controlling interest at that date was determined to be $100,000. Silver's balance sheet immediately before the combination reflected the following balances: Cash and Receivables $40,000 Inventory 70,000 Land 90,000 Buildings and Equipment (net) 250,000 Total Assets $450,000 Accounts Payable $30,000 Income Taxes Payable 40,000 Bonds Payable 100,000 Common Stock 100,000 Retained Earnings 180,000 Total Liabilities and Stockholders' Equity $450,000 A careful review of the fair value of Silver's assets and liabilities indicated that inventory, land, and buildings and equipment (net) had fair values of $65,000, $100,000, and, $300,000 respectively. Goodwill is assigned proportionately to Bristle and the non- controlling shareholders. What amount of goodwill will be reported in the consolidated balance sheet immediately following the acquisition? a. $0 b. $120,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education