FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Using the tax table in Exhibit 4-6, determine the amount of taxes for the following situations:

Federal Tax Tables

a. A head of household with taxable income of $75,762.

b. A single person with taxable income of $75,062.

c. A married person filing a separate return with taxable income of $75,780.

Transcribed Image Text:Таx Rate

Schedules

If Taxable

income is

Married Married Head of

filing

jointly* sepa-

rately

At

least

Single

But

less

than

filing

a

house-

hold

Your tax is-

Schedule Y-1–If your filing status is Married filing jointly or Qualifying widow(er)

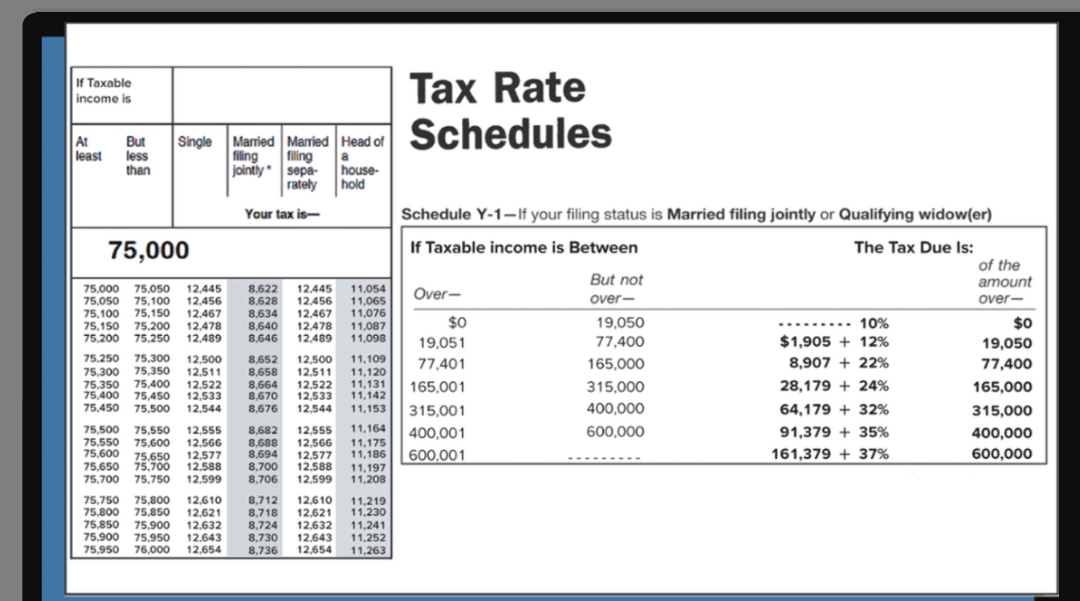

75,000

The Tax Due Is:

of the

If Taxable income is Between

But not

аmount

75,000

75,050

75.100

75,050

75,100

75,150

75,200

75,250

12,445

12,456

12,467

12,478

12,489

8,622

8,628

8.634

12,445

12,456

12,467

12,478

12,489

11,054

11,065

11,076

11,087

11,098

Over-

over-

over-

$0

19,050

10%

$0

75,150

75,200

8,640

8,646

19,051

77,400

$1,905 + 12%

19,050

75,300

75,350

75,400

75,400 75,450

75,500

75,250

8,652

8,658

8,664

8,670

8,676

11,109

12,500

12,511

12,522

12,533

12,544

12,500

12,511

12,522

12,533

12,544

77,401

165,000

8,907 + 22%

77,400

75,300

75,350

11,120

11,131

11,142

11,153

165,001

315,000

28,179 + 24%

165,000

75,450

315,001

400,000

64,179 + 32%

315,000

75,500

11,164

12,555

12,566

12,577

12,588

600,000

75,550

75,600

75,650

75,700

75,750

12,555

12,566

12,577

12,588

12,599

8,682

8,688

8,694

8,700

8,706

400,001

91,379 + 35%

400,000

75,550

75,600

75.650

11,175

11,186

600,001

161,379 + 37%

600,000

11,197

11,208

75,700

12,599

75,800

75,850

8,712

8,718

8,724

12,610

12,621

12,632

12,643

12,654

75,750

75,800

12,610

12,621

12,632

11,219

11,230

75,850

75,900

75,900

75,950

76,000

12,643

12,654

11,241

11,252

11,263

8,730

75,950

8,736

Expert Solution

arrow_forward

Step 1

Table used:

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the tax table to determine each of the following values if your adjusted gross income is $20,000. Your tax liability if you are filing single using the standard deduction of $12,500 and have no adjustments, itemized deductions, or tax credits. Your tax liability if you are filing single using the standard deduction of $12,500, have a child tax credit of $500 and no other adjustments, deductions or credits.arrow_forwardHanasabenarrow_forwardFind the gross income, the adjusted gross income, and the taxable income. A taxpayer earned wages of $61,300, received $880 in interest from a savings account, and contributed $2,200 to a tax-deferred retirement plan. He was entitled to a personal exemption of $4050 and had deductions totaling $6,930. OA. $62,180; $59,980; $55,930 OB. $64,380; $60,330; $53,400 OC. $62,180; $59,980; $49,000 D. $64,380; $60,330; $55,930 Harrow_forward

- Question2: Income tax The taxable income of Ahmed, Badriya and Sameer is $20,000, $45,000, $100,000 respectively. Use the following tax rates: 5% for income from 0 - $20,000 10% for income from $20,001 - $50,000 15% for income above $50,000 Calculate the tax payable by each person. Explain the type of taxation system applicable in this situation. Is this system of taxation fair? Explain why this system is being criticised?arrow_forwardCalculate the tax payable if an individual taxpayer has the following amounts of taxable income. Include Medicare Levy and Medicare Levy surcharge, where applicable. $17,000 – Non-resident (not a working holiday maker). $95,000 – Non-resident, (not a working holiday maker. $100,000 – Resident, with no private health insurance. $245,000 - Resident; with private health insurance.arrow_forwardIf an individual itemizes deductions on his or her tax return, he or she may: a. deduct the gross unreimbursed medical expenses paid for the year b. deduct the net unreimbursed medical expenses paid for the year c. deduct 80% of the gross unreimbursed medical expenses paid for the year d. deduct 80% of the net unreimbursed medical expenses paid for the yeararrow_forward

- Vipul karrow_forwardDetermine the tax liability for tax year 2018 in each of the following instances in each case assume that the taxpayer can only take the standard deduction a single tax payer not head of household with a G.I. of 23,493 and one depenentarrow_forwardWage-bracketed tax tables are: Select one: Charts that list all of the deductions and credits filers can use on their tax returns. Charts that provide the amounts to be deducted for income taxes based on earnings, marital status, and number of allowances claimed. Interactive tablets offered by the IRS. Charts that lists all of the tax deductions available to filers.arrow_forward

- 1arrow_forward3kk.arrow_forwardRefer to the 2023 individual rate schedules in Appendix C. Required: What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $66,900 taxable income? What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $192,300 taxable income? What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $461,300 taxable income?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education