FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

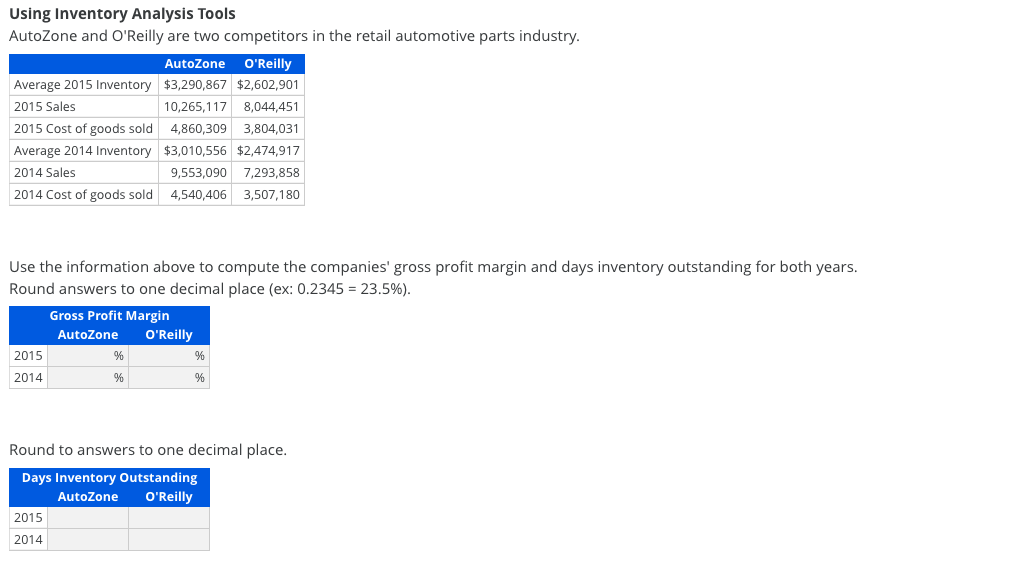

Transcribed Image Text:Using Inventory Analysis Tools

AutoZone and O'Reilly are two competitors in the retail automotive parts industry.

AutoZone

O'Reilly

Average 2015 Inventory $3,290,867 $2,602,901

2015 Sales

10,265,117

8,044,451

2015 Cost of goods sold

4,860,309

3,804,031

Average 2014 Inventory $3,010,556 $2,474,917

2014 Sales

9,553,090 7,293,858

2014 Cost of goods sold

4,540,406 3,507,180

Use the information above to compute the companies' gross profit margin and days inventory outstanding for both years.

Round answers to one decimal place (ex: 0.2345 = 23.5%).

Gross Profit Margin

AutoZone

O'Reilly

2015

2014

Round to answers to one decimal place.

Days Inventory Outstanding

O'Reilly

AutoZone

2015

2014

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Similar questions

- vsarrow_forwardDollar-Value LIFO On January 1, 2015, Sato Company adopted the dollar-value LIFO method of inventory costing. Sato's ending inventory records appear as follows: Year Current Cost Index 2015 2016 2017 2018 $39,400 53,700 Feedback 56,680 67,200 Year Ending inventory 2015 $ 39,400✔ 2016 $ 2017 $ 2018 $ Required: Compute the ending inventory for the years 2015, 2016, 2017, and 2018, using the dollar-value LIFO method. Do not round your intermediate calculations. If required, round your answers to the nearest dollar. Date 12/31/15 12/31/16 X Check My Work You should review the calculations for dollar-value LIFO before you begin this exercise. The following partially completed table will help you to organize the information and calculations. 12/31/17 12/31/18 X 100 120 Ending Inventory at Current Costs (given) 130 140 53,700 X Base Year Cost Index Current Year Cost Index 100 120 Inventory Increase at Base-Year Base-Year Costs Costs 39,400 (Decrease) at 44,750 5,350 Relevant Cost Index…arrow_forwardProblem 5-6A (Algo) Moravanti Italian Imports has four employees and pays biweekly. Assume that box 2 is not checked for L. Torabi and R. Beninati and is checked for G. Fisher and J. Tillman. Required: On Form W-4, complete Step 2, the Multiple Jobs Worksheet (when applicable) to obtain the amount for Step 4(c). Calculate the federal income tax withholding using the wage-bracket tables with Forms W-4 from 2020 or later in Appendix C. Note: Round your intermediate calculations and final answers to 2 decimal places. Employee L. Torabi Filing Status S Dependents None Annual Salary Spouse Annual Salary and Pay Frequency Federal Income Tax per Period $ 42,500 Not applicable R. Beninati S One Other $ 51,500 Not applicable G. Fisher MJ Three <17 $ 48,000 $80,000 per biweekly J. Tillman MJ Two <17 SA 39,650 $23,790 per weeklyarrow_forward

- Inventory Analysis QT, Inc. and Elppa Computers, Inc. compete with each other in the personal computer market. QT assembles computers to customer orders, building and delivering a computer within four days of a customer entering an order online. Elppa, on the other hand, builds computers for inventory prior to receiving an order. These computers are sold from inventory once an order is received. Selected financial information for both companies from recent financial statements follows (in millions): QT Elppa Sales $52,560 $65,800 Cost of goods sold 43,800 62,050 Inventory, beginning of period 1,856 7,339 Inventory, end of period 2,056 8,539 a. Determine for both companies (1) the inventory turnover and (2) the number of days' sales in inventory. Round your calculations and answers to one decimal place. Assume 365 days a year. QT Elppa 1. Inventory turnover 2. Number of days' sales in inventory days daysarrow_forwardNonearrow_forwardReview Decision Maker's Perspective Analysis Case 8-5: Compare inventory management using ratios; Kohl's' and Dillards in your textbook. Complete the required calculation and evaluation for either Kohl's or Dillards (you only have to choose one). Next obtain an annual report from one company in an industry other than department stores and compare the management of that company's investment in inventory against either Kohl's or Dillards. Make sure to identify the company you research and what industry they are in. What commonalities and differences do you see in how the companies manage their investment in inventory? Include your initial calculation and evaluation, for either Kohl's or Dillards, along with your additional research in your initial post. You can use EDGAR to obtain annual reports.arrow_forward

- Give me correct answer with explanation.harrow_forwardEffects of Inventory Costing Methods Jefferson Enterprises has the following income statement data available for the year: Sales revenue $737,200 Operating expenses 243,700 Interest expense 39,500 Income tax rate 34% Jefferson uses a perpetual inventory accounting system and the average cost method. Jefferson is considering adopting the FIFO or LIFO method for costing inventory. Jefferson's accountant prepared the following data: If Average Cost Used If FIFO Used If LIFO Used Ending inventory $65,950 $78,500 $40,100 Cost of goods sold 399,050 386,500 424,900 Required: 1. Compute income before taxes, income taxes expense, and net income for each of the three inventory costing methods. (Round to the nearest dollar.) Average Cost FIFO LIFO Income before taxes $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 Income tax expense $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 Net income $fill in the blank 7 $fill in…arrow_forwardes Sparrow Company uses the retail inventory method to estimate ending inventory and cost of goods sold. Data for 2024 are as follows: Beginning inventory Purchases Freight-in Purchase returns. Net markups Net markdowns Normal spoilage ormal spoilage Sales Sales returns Cost $ 97,000 363,000 9,700 7,700 Estimated ending inventory at retail Estimated ending inventory at cost Estimated cost of goods sold 5,546 Retail $ 187,000 587,000 11,700 16,700 12,700 3,700 8,700 547,000 10,700 The company records sales net of employee discounts. Employee discounts for 2024 totaled $4,700. 2. Estimate Sparrow's ending inventory and cost of goods sold for the year using the retail inventory method and the conventional application. Note: Round Cost-to-retail percentage to 2 decimal places and final answers to the nearest whole dollar amount. Conventional applicationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education