FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

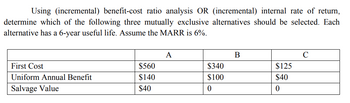

Transcribed Image Text:Using (incremental) benefit-cost ratio analysis OR (incremental) internal rate of return,

determine which of the following three mutually exclusive alternatives should be selected. Each

alternative has a 6-year useful life. Assume the MARR is 6%.

First Cost

Uniform Annual Benefit

Salvage Value

$560

$140

$40

A

$340

$100

0

B

$125

$40

0

C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider three mutually exclusive alternatives, each with a 15-year useful life. If the MARR is 12%, which alternative should be selected? Solve the problem by benefit–cost ratio analysis.arrow_forwardA cost analysis is to be made to determine what, if anything, should be done in a situation offering three "do-something" and one "do-nothing" alternatives. Estimates of the costs and benefits are as follows: End-of- Uniform Useful- Life Benefit Salvage (years) Value Useful First Alternatives Cost Annual Life -$500 $135 -600 100 250 5 -700 100 180 10 4 Use Present Worth Analysis with the Least Common Multiple Method to select the best alternative. Use MARR=6%. (Note: You MUST describe your answers with conversion factor notations and you DON'T NEED TO calculate the values of PW for supporting a decision. Simply describe your selection criterion with PW expressions.) 1.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- solve, dont use excel. dont write the answer in a paper becuse of the handwriting. thanksarrow_forwardQuestion No. r The following information is provided for five mutually exclusive alternatives that have 20-year useful lives. If the minimum attractive rate of return is 6%, which alternative should be selected using IROR Method? Alternatives B Cost 4,000 2,000 6,000 1,000 9,000 Uniform Annual Benefit 639 410 761 117 785 IROR 15% 20% 11% 10% 6% IROR (B-D) IROR (A-D) IROR (A-B) IROR (C-B) IROR (C-A) IROR (E-C) IROR (E-A) -5% 29% 18% 10% 9% 2% 14%arrow_forwardSolve it correctly please. I will rate accordingly.arrow_forward

- Problem 2. Based on benefit to cost ratio, determine which project should be chosen. Please work out in excel spreadsheet.arrow_forwardAt 10% interest, what is the nearest benefit/cost ratio for the following private sector project: Initial Cost 200,000 Additional costs at the EoY 1-2 30.000 Annual Benefits at the EoY 1-10 90,000 Salvage Value 40,000 Project Life 10 Note: Consider the following equation setup: FW(Bene fits) = Annual Bene fits (F/A, 10%, 10) FW(Costs) = Instial Costs + Additional Costs - (F/A, 10%, 2) (F/P, 10%, 8)- Salvage Value %3D 10% Compound Interest Factors F/P P/F A/F A/P F/A P/A 1 1.100 0.9091 1.0000 1.1000 1.000 0.909 2 1.210 0.8264 0.4762 0.5762 2.100 1.736 3 1.331 0.7513 0.3021 0.4021 3.310 2.487 4. 1.464 0.6830 0.2155 0.3155 4.641 3.170 1.611 0.6209 0.1638 0.2638 6.105 3.791 9. 1.772 0.5645 0.1296 0.2296 7.716 4.355 1.949 0.5132 0.1054 0.2054 9.487 4.868 8. 2.144 0.4665 0.0874 0.1874 11.436 5.335 6. 2.358 0.4241 0.0736 0.1736 13.580 5.759 10 2.594 0.3855 0.0627 0.1627 15.937 6.145 11 2.853 0.3505 0.0540 0.1540 18.531 6.495 12 3.138 0.3186 0.0468 0.1468 21.384 6.814 13 3.452 0.2897 0.0408…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education