Concept explainers

Using a spreadsheet generate your own set of Discount and

Tables for, say, all discount rates between 1% and 20% (at 1 percentage

point intervals) and for time periods 1 to 30 (at one time period

intervals), as well as time periods 50 and 100. You should generate these

tables by inserting the numbers for the time periods in the first column

of each row and the discount rates in the first row of each column, and

then inserting the appropriate formula into one cell of the table – year 1

at 1% - and then copying it to all other cells in the matrix. (Hint: Do not

forget to anchor the references to periods and discount rates using the

“$” symbol.)

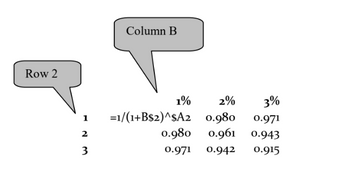

Answer: Write the discount formula into spreadsheet as shown below and then copy

across 20 columns (headed 1% through 20%) and down 50 rows (headed 1 to 50).

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- Use a calculator to evaluate an ordinary annuity formula nt 1 +I 1 A = m %3D for m, r, and t (respectively). Assume monthly payments. (Round your answer to the nearest cent.) $100; 6%; 10 yr A = $ Need Help? Read Itarrow_forwardFor TVM calculator: Write each known variable’s value as it appears in the calculator and use a question mark for the missing variable. Then, in the space provided write the missing variable’s value, as it appears in the calculator. Finally, write your final answer in context, with units, as a complete sentence. Donald is looking to invest in an account earning an interest rate of 1.75% compounded weekly and make weekly payments. If he wants $21,000 in 10 years, what do his payments need to be? N=520 I= 1.75 PV=? PMT=? FV= 21,000 P/Y=52 C/Y=52 Missing Variable Value __________________ Context Sentence:arrow_forwardComplete the following table for the simple discount notes. Use the ordinary interest method. (Round your answers to the nearest cent.) amount due of maturity discount rate time bank discount proceeds 3200 6.25% 125 days ? ?arrow_forward

- Please help me answer numbers 2, 4, 6, 8 & 10 with solutions.arrow_forwardnnuity. Fill in the missing present values in the following table for an ordinary annuity: Future Value ate Data Table (Click on the following icon O in order to copy its contents into a spreadsheet) it Valuo $298 01 S3.396 92 S615 39 $2.459 07 6% 12% 2.5% 07% 18 0. 27 260 0. Print Done Check Aarrow_forwardUse future value and present value calculations (an online calculator, app, financial calculator, or spreadsheet software) to determine the following: Use Exhibit 1-A, Exhibit 1-B and Exhibit 1-C. a. The future value of a $710 savings deposit after nine years at an annual interest rate of 8 percent. Note: Round FV factor to 3 decimal places and final answer to nearest whole dollar. b. The future value of saving $3,200 a year for three years at an annual interest rate of 7 percent. Note: Round discount factor to 3 decimal places and final answer to nearest whole dollar. c. The present value of a $3,400 savings account that will earn 4 percent interest for six years. Note: Round PV factor to 3 decimal places and final answer to nearest whole dollar. a. Future value b. Future value c. Present valuearrow_forward

- Use a calculator to evaluate the present value of an annuity formula 1-(1+ 4) -nt P = m for the values of the variables m, r, and t (respectively). Assumen= 12. (Round your answer to the nearest cent.) $50; 5%; 7 yr %24arrow_forwardFuture Value of an Annuity Find the future value of the following annuities. The first payment in these annuities is made at the end of Year 1, so they are ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press FV, and find the FV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $600 per year for 10 years at 14%. $ $300 per year for 5 years at 7%. $ $600 per year for 5 years at 0%. $ Now rework parts a, b, and c…arrow_forwardInstructions: Show COMPLETE solution/proof with correct answer. All elements should be included and drawn correctly and; all elements should be labeled with reference and value.arrow_forward

- Growing annuities are a series of payments that grow at a rate.arrow_forwardPlease answer fast i give you upvote.arrow_forwardWaiting periods. Fill in the number of periods for the following table,, using one of the three methods below: In (FV/PV) In (1 + r) a. Use the waiting period formula, n = b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. Present Value 760.13 Future Value $ 1,585.01 Interest Rate 3% Number of Periods years (Round to the nearest whole number.)arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education