Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

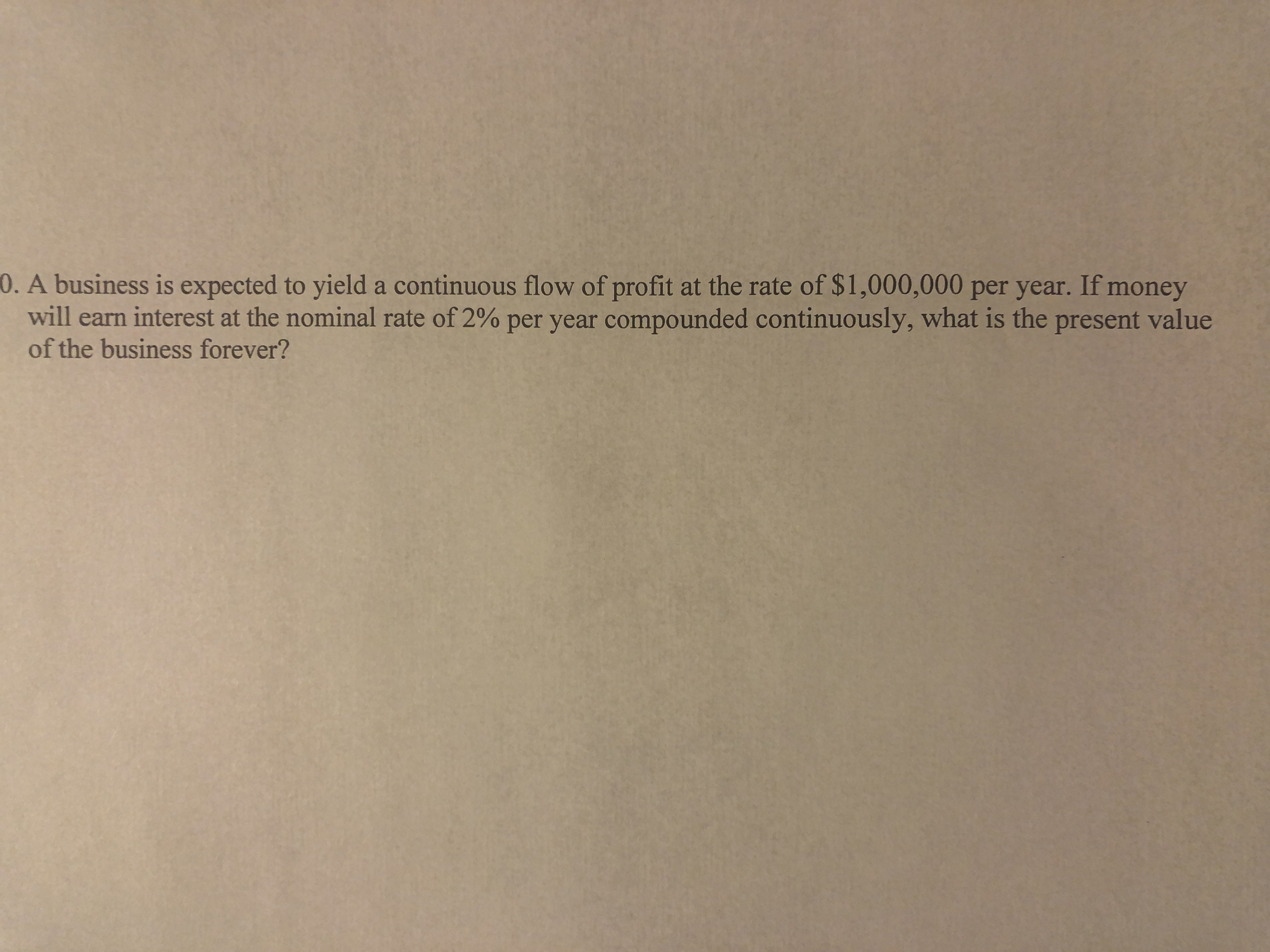

Transcribed Image Text:usiness is expected to yi

earn interest at the nom

ne business forever?

Expert Solution

arrow_forward

Step 1

Given information :

Profit earned per year = $ 1,000,000

Nominal rate of interest = 2%

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Cathi needs to cover $4,500 per m to generate per month in order tha O $4,500 O $6,924 O $6,075 O $1,575 O $12,858 personal living expenses with the profits from her business Approximately how much profit does Cathe's business need "take home" the $4,500 per month she needs to cover her personal expenses if Cathi's estimated tax rate is 35%?arrow_forwardAssume that your father is now 50 years old, plans to retire in 10 years, and expects to live for 25 years after he retires - that is, until age 85. He wants his first retirement payment to have the same purchasing power at the time he retires as $40,000 has today. He wants all of his subsequent retirement payments to be equal to his first retirement payment. (Do not let the retirement payments grow with inflation: Your father realizes that if inflation occurs the real value of his retirement income will decline year by year after he retires). His retirement income will begin the day he retires, 10 years from today, and he will then receive 24 additional annual payments. Inflation is expected to be 6% per year from today forward. He currently has $125,000 saved and expects to earn a return on his savings of 9% per year with annual compounding. To the nearest dollar, how much must he save during each of the next 10 years (with equal deposits being made at the end of each year, beginning…arrow_forwardToday, you turn 21. Your birthday wish is that you will be a millionaire by your 40th birthday. In an attempt to reach this goal, you decide to save $20 a day, every day until you turn 40. You open an investment account and deposit your first $20 today. What rate of return must you earn to achieve your goal?arrow_forward

- Today, you turn 21. Your birthday wish is that you will be a millionaire by your 40th birthday. In an attempt to reach this goal, you decide to save $20 a day, every day until you turn 40. You open an investment account and deposit your first $20 today. What rate of return must you earn to achieve your goal?arrow_forward13. Moreon the time value of money The time value of money concept can be applied in various situations and is a fundamental concept underlying other financial concepts. Consider the following example of the application of this concept. Charles is a divorce attorney who practices law in New York City. He wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $550 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $5,000 and never have to pay annual membership dues. Obviously, the lifetime membership isn’t a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it’s a great deal. Suppose that the appropriate annual…arrow_forwardWhy are these long-term assets important to the success of your employer or your future business?arrow_forward

- DIRECTIONS Use the information below to fill out a consumer equity form and calculate the net worth for each family. Net worth can be a useful tool to measure your financial progress from year to year. Your net worth is a grand total of all assets what vou own) minus liabilities (what vou owe: debts). It's important to understand that vour income Isn tine only Tactor that determines your wealtn. Occupation Annual Income Retirement Investments Real Estate Vehicles Credit Card Debt Emergency Fund Checking Account Household Items FAMILY A FAMILY B Nurse and Sales Appliance Installer $105,000 combined $45,000 $35,000 $22,000 Owns a house appraised at $224,000 with a mortgage balance of $202.000 Owns a house appraised at $180,000 with a mortgage balance of $126,000 New truck with Blue Book value Used sedan with retail value of $32,000; owes $35,000 of $9,500; paid for Used SUV with a retail value of $17,500; owes $14,500 $13,000 None $1.000 $5.000 $2,500 $650 Antiques: $5,000 Electronics:…arrow_forwardAssume the total cost of a college education will be $395,000 when your child enters college in 18 years. You presently have $65,000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child’s college education? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward1. Assume that your father is now 50 years old, that he plans to retire in 10 years, and that he expects to live for 25 years after he retires-that is, until age 85. He wants his first retirement payment to have the same purchasing power at the time he retires as GH¢ 40,000 has today. He wants all of his subsequent retirement payments to be equal to his first retirement payment. (Do not let the retirement payments grow with inflation: Your father realizes that the real value of his retirement income will decline year by year after he retires.) His retirement income will begin the day he retires, 10 years from today, and he will then receive 24 additional annual payments. Inflation is expected to be 5% per year from today forward. He currently has GH¢ 100,000 saved up; and he expects to earn a return on his savings of 8% per year with annual compounding. To the nearest dollar, how much must he save during each of the next 10 years (with equal deposits being made at the end of each year,…arrow_forward

- Bhupatbhaiarrow_forwardc) How much income did Theresa lose?arrow_forwardAssume that your father is now 50 years old, plans to retire in 10 years, and expects to live for 25 years after he retires - that is, until age 85. He wants his first retirement payment to have the same purchasing power at the time he retires as $50,000 has today. He wants all his subsequent retirement payments to be equal to his first retirement payment. (Do not let the retirement payments grow with inflation: Your father realizes that if inflation occurs the real value of his retirement income will decline year by year after he retires). His retirement income will begin the day he retires, 10 years from today, and he will then receive 24 additional annual payments. Inflation is expected to be 4% per year from today forward. He currently has $75,000 saved and expects to earn a return on his savings of 10% per year with annual compounding. How much must he save during each of the next 10 years (with equal deposits being made at the end of each year, beginning a year from today) to…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education