ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

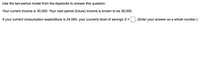

Transcribed Image Text:Use the two-period model from the Appendix to answer this question.

Your current income is 30,000. Your next period (future) income is known to be 36,000.

If your current consumption expenditure is 24,000, your (current) level of savings S =

(Enter your answer as a whole number.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- How does savings change with changes in y2? Provide some intuition behind this result.arrow_forwardSuppose Poornima is an avid reader and buys only comic books. Poornima deposits $3,000 in a bank account that pays an annual nominal interest rate of 10%. Assume this interest rate is fixed-that is, it won't change over time. At the time of her deposit, a comic book is priced at $15.00. Initially, the purchasing power of Poornima's $3,000 deposit is comic books. For each of the annual inflation rates given in the following table, first determine the new price of a comic book, assuming it rises at the rate of inflation. Then enter the corresponding purchasing power of Poornima's deposit after one year in the first row of the table for each inflation rate. Finally, enter the value for the real interest rate at each of the given inflation rates. Hint: Round your answers in the first row down to the nearest comic book. For example, if you find that the deposit will cover 20.7 comic books, you would round the purchasing power down to 20 comic books under the assumption that Poornima will…arrow_forwardCindy takes a summer job and earns an after-tax income of $5,000. Her living expenses during the summer were $1,000. What was Cindy's saving during the summer and the change, if any, in her wealth? >>> If your answer is negative, include a minus sign. If your answer is positive, do not include a plus sign. Cindy's saving during the summer is $arrow_forward

- Exercise 4. You are a manager at a certain factory that designs small gadgets. The factory has been quite successful in the past years. Your CEO is wondering whether or not it is a good idea to expand the factory this year. The cost to expand the factory is $1.5M. Doing nothing will result in expected $3M in revenue if the economy stays good and people continue to buy plenty of gadgets, but only $1M in revenue is expected if the economy is bad. On the other hand, expanding the factory carries an expected $6M in revenue if economy is good and $2M if the economy is bad. Assume there is a 40% chance of a good economy and a 60% chance of a bad economy. Also, assume the costs of operating the factory account to $.5M if the factory is expanded and $.3M if not. a. Illustrate a Decision Tree showing these choices. b. What should you do?arrow_forwardConsumption/Savings 1000 800 600 400 200 S 0 200 400 600 00 1000 1200 1400 1600 -200 Refer to the graph above to answer this question. What is the value of the MPS? A 0.5. B 0.4. 0.25. D 0.2. E -100. Incomearrow_forwardwhat happens when expected profit equal total investmentarrow_forward

- The formula for the is curve can be derived from the formula Y = [CO+MPC(Y-T)]+1+G. When the IS curve is derived, I and G are assumed constant and Y varies based on the interest rate r. Assuming that CO=50B, MPC = 80, T=200B, I = 120B-10B (r), and G = 250B, the derived IS curve is (A),Y=1,300B - 50B (r) B ) Y=1, 400B +40B (r) C) Y=1, 300B +50B (r) D) Y=1, 400B - 50B (r) Using the IS formula you calculated in the problem above, what is the value of Y if r = 10(10%) ? A) 1,000B B) 900B C) 800B D) 700B Using the IS formula that you derived above, what is the value of Y ifr = 12 (12%) ? A) 1,000B B) 900B C) 800B D) 700B Assume that the ,M,d money demand function is (=Y-50r, where is the interest rate. The money supply M is 2,000B and the price level P is 4. Use this information to derive the LM curve function/formula. The LM function/formula is A ) Y=650B + 50B (r) B) Y = 650B +40B (r) C) Y = 500B-60B (r) D) Y = 500B + 50B (r) D) 50. ၁ The formula for the IS curve can be derived from the…arrow_forwardSuppose as a hypothetical scenario that you deposit $400 today into a savings account with a variable interest rate and will collect a payment in one year. True or False: If over the course of the year the interest rate falls, this increases the future value of your investment. True Falsearrow_forwardPlease see attachment and type out the correct answer ASAP with proper explanation of it. Will give you thumbs up only for the correct answer. Thank youarrow_forward

- The COVID-19 pandemic has caused an unprecedented increase in savings in many countries around the world. In the EU, the savings rate of households has jumped from 12.5% to 17%. In 2008-2009, it had moved from 12.5% to 14% (Dossche and Zlatanos 2020). Even if the source of 2020 surge in savings is different from the one of 2008, it is obvious that this increase does not result in more investment and growth. QUESTION: 1. With reference to the paradox of thrift discuss the appropriate approach by the government to get the economy out of economic downturn swiftlyarrow_forwardDefine Purchase of Investment.arrow_forwardI need help in solving this problem.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education