FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

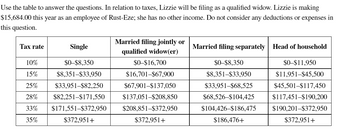

Use the table to calculate how much money Lizzie will owe in taxes under a progressive tax program. Give your answer to two decimals.

Calculate how much money Lizzie will owe in taxes under a proportional, or flat, tax rate of 30%30%. Give your answer to two decimals.

Transcribed Image Text:Use the table to answer the questions. In relation to taxes, Lizzie will be filing as a qualified widow. Lizzie is making

$15,684.00 this year as an employee of Rust-Eze; she has no other income. Do not consider any deductions or expenses in

this question.

Tax rate

Single

10%

$0-$8,350

15%

$8,351-$33,950

25%

$33,951-$82,250

28% $82,251-$171,550

33% $171,551-$372,950

35%

$372,951+

Married filing jointly or

qualified widow(er)

$0-$16,700

$16,701-$67,900

$67,901-$137,050

$137,051-$208,850

$208,851-$372,950

$372,951+

Married filing separately

$0-$8.350

$8,351-$33,950

$33,951-$68,525

$68,526-$104,425

$104,426-$186,475

$186,476+

Head of household

$0-$11,950

$11,951-$45,500

$45,501-$117,450

$117,451-$190,200

$190,201-$372,950

$372,951+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Now consider another hypothetical tax code. Assume the tax rate on the first $15,000 of taxable income is 10% and the tax rate on any additional income is 18%. The standard deduction ($6,350) and personal exemption ($4,050) still apply. In other words: . For taxable income from $0 to $15,000, you pay 10% of your taxable income in taxes, plus . For taxable income above $15,000, you pay 18% of your taxable income. 1. If your total income before exemptions were $10,000 how much would you pay in taxes? 2. If your total income were $20,000 how much would you pay in taxes? 3. If your total income were $50,000 how much would you pay in taxes? 4. Write a function to model the total tax paid, T(x), with a total income of x dollars. 5. Create a graph that shows taxes paid as a function of total income for the total income between $0 and $60,000. 6. How many different slopes are on this graph?arrow_forwardSuppose you are28 and married. You and your spouse file for income taxes jointly. You are in the 25% tax bracket. You are considering a few personal investment issues. Which of the following strategies is most tax efficient for your situation? ______ a.Invest all your income inside your regular taxable investment account. b.First, fully fund your 401 (k) account, then invest the rest in the IRA and Roth IRA account, finally invest the remaining money, if any,in your regular taxable investment account. c.Fully fund your 401 (k) account, and then invest all the rest money in your regular taxable investment account. d.First, fully fund your IRA and Roth IRA account, then fund your401 (k) account, finally invest the remaining money, if any, in your regular taxable investment account.arrow_forwardSuppose a tax is such that an individual with an income of $10,000 pays $2000 of tax, a person with an income of $20,000 pays $3000 of tax, a person with an income of $30,000 pays $4000 of tax, and so forth. What is each person’s average tax rate? Is this tax regressive, proportional, or progressive?arrow_forward

- If a person with a 24 percent tax bracket makes a deposit of $6,500 to a tax-deferred retirement account, what amount would be saved on current taxes? Current tax savingsarrow_forwardif a taxpayer is in the 12% tax bracket, how much will they pay on $1,200 in CD interest?arrow_forwardIf you live in a state that needs to collect $18 million in property taxes and has a tax rate of 2.77%, what is that states taxable valuearrow_forward

- Your income is $10,000 over the cutoff for the next lowest tax bracket. Your average tax rate is 10%. Your marginal tax rate is 25%. You contribute $3,000 to a traditional IRA and your contribution is fully deductible, should you decide to go that way. You decide, in fact, to make this a traditional IRA. How much did your contribution actually cost you, in after-tax dollars?arrow_forwardUse the 2016 marginal tax rates to compute the tax owed by the following person. A single man with a taxable income of $14,000 and a $3500 tax credit Click the icon to view the 2016 marginal tax rates. ..... The tax owed is dollars. (Type an integer or a decimal. Round to the nearest cent as needed.)arrow_forwardPlease help me with e and f. Thanks!arrow_forward

- You have a choice between a tax deduction of $1,000 or a refundable tax credit of $300. What factors/circumstances will determine which option is the better choice for you?arrow_forwardWhat would be the average tax rate for a person who paid taxes of $6,435 on a taxable income of $40,780? (Enter your answer as a percent rounded to 2 decimal places.)arrow_forward25. Please make sure answer in decimals. im leaving an example downarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education