ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

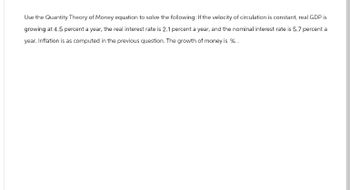

Transcribed Image Text:Use the Quantity Theory of Money equation to solve the following: If the velocity of circulation is constant, real GDP is

growing at 4.5 percent a year, the real interest rate is 2.1 percent a year, and the nominal interest rate is 5.7 percent a

year. Inflation is as computed in the previous question. The growth of money is %.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Money velocity in the country of Ecoland is always stable. In 2019 (the base year), the money supply was $250 billion. In 2020, the money supply increased to $350 billion, the price level increased by 25 percent, and nominal GDP equaled $1400 billion. By how much did real GDP increase between 2019 and 2020? A) $15 billion B) $ 50 billion C) $12.5 billion D) $150 billionarrow_forwardWhat are the three basic functions of momey? Describe how rapid inflation can undermine money's ability to perform each of the three functions.arrow_forward21.According to the quantity theory of money, ultimate control over the rate of inflation in the United States is exercised by: A)the Organization of Petroleum Exporting Countries (OPEC). B)the U.S. Treasury. C)the Federal Reserve. D)private citizens. 22.According to the quantity theory of money, if money is growing at a 10 percent rate and real output is growing at a 3 percent rate, but velocity is growing at increasingly faster rates over time as a result of financial innovation, the rate of inflation must be: A)increasing. B)decreasing. C)7 percent. D)constant. 23.If the money supply increases 12 percent, velocity decreases 4 percent, and the price level increases 5 percent, then the change in real GDP must be ______ percent. A)3 B)4 C)9 D)11 24.Percentage change in P is approximately equal to the percentage change in: A)M. B)M minus percentage change in Y. C)M minus percentage change in Y plus percentage change in velocity. D)M minus…arrow_forward

- State whether the following statements are true, false, or uncertain and explain. -Over the past 30 years, country A experienced an average money growth rate of 5 percent and an average inflation rate of 4 percent. This pattern is inconsistent with the quantity theory of money (QTM) -Chase Bank removed the ATM machine located in the lobby of Susan’s building. The Baumol-Tobin model of money demand predicts that Susan’s demand for money will go uparrow_forwardSuppose the velocity of money is 10 transactions per year, the price level for 2015 is $6, and real GDP in 2015 is $4,000,000. If the central bank holds the money supply constant and output grows by 10%, what will nominal GDP be in 2016? Answer:arrow_forwardWe would expect that the level of income that would equate total demand for and total supply of money would be: (a) roughly at the level of the Fed’s interest rate target; (b) lower the lower the interest rates; (c) equal to the level that would equate realized investment with realized savings; (d) higher the lower the interest rate (or lower the higher the interest rate)arrow_forward

- QUESTION THREE Assuming a constant velocity of money while the money supply is growing 10% per year, real GDP is growing at 4% per year, and the real interest rate is r = 8%. Assume that actual Inflation is equal to expected inflation. a) Find the value of the nominal interest rate in this economy b) If the central bank increases the money growth rate by 4% per year, find the change in the nominal interest rate Ai C) Suppose the growth rate of Y falls to 2% per year. What will happen to inflation? What must the central bank do if it wishes to keep inflation constant?arrow_forwardSuppose the velocity of circulation (V) is constant. The annual growth rate of real GDP is 3%. The money supply grows by 5% per year. Suppose the nominal interest rate is 1%, how much is the real interest rate?arrow_forwardUse the Quantity Theory of Money: MV = P.Y An economy has a real output of 5,474 and a money supply of $39,571. On average, each dollar is spent 2.3 times. What is the price level for this economy? Round your answer to two decimal places.arrow_forward

- Two tools the Federal Reserve would use to implement the decision to increase the federal funds would be Open market operations and the IOER rate. Show in a graph of the federal funds market the effect the tools mentioned above have on this market. What effect do the two tools used have on the interest rates faced by firms and households? What do you expect to happen to the money supply? What do you expect to happen to the inflation rate? How would you expect all these decisions to affect employment in the economy? How do the effects on the money supply and inflation rate align with what the Fed was hoping to attain(to achieve maximum employment and inflation at the rate of 2 percent over the longer run)?arrow_forwardAn economy has a money supply of 1,052, money velocity of 10, and output of 1,048. How much will the price level change if output and money supply remain the same and the money velocity rises to 16? Round your answer to the nearest two decimal place.arrow_forwardFind the velocity of money when ?=$522M=$522, ?=105P=105, and ?R=$23YR=$23. M is the money supply, v is the velocity of money, P is the price level, and YR is the real gross domestic product (GDP). Round your answer to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education