FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![7

Instructions

Key Code:

[Key code here]

8

9 Answers are entered in the cells with gray backgrounds.

10 Cells with non-gray backgrounds are protected and cannot be edited.

11 An asterisk (*) will appear to the right of an incorrect entry.

12

13

14 A.

15

Break-Even (in accounts)

%3D

16

17

18

19

20

21

22

24

million (rounded) accounts

Supporting calculations:

Revenue per account (in millions):

Total revenue (in millions)

Total accounts (in millions)

Revenue per account (in millions)

30

31

32

33

34

Variable cost per account (in millions):

Variable

Full Amount

Percentage

35

Cost of revenue (in millions)

36

Selling, gen., admin. exp. (in millions)

37

Total variable costs

38

Divided by number of accounts

Variable cost per account (in millions)

39

40

Total fixed costs (in millions):

41

42

Fixed

Full Amount

Percentage

43

Cost of revenue (in millions)

44

Selling, gen., admin. exp. (in millions)

45

Depreciation

46

Total fixed costs (in millions)

47

48

49

50 B.

51

Break-even (in $ revenue, in millions):

52

Total costs

53

Divided by number of accounts

54

Break-even

million

55](https://content.bartleby.com/qna-images/question/92ab3c20-a3cd-4c1e-8775-52ac5ed4d4cf/908d93a0-db59-413d-80fc-1480d9467bcb/89hko3j_thumbnail.png)

Transcribed Image Text:7

Instructions

Key Code:

[Key code here]

8

9 Answers are entered in the cells with gray backgrounds.

10 Cells with non-gray backgrounds are protected and cannot be edited.

11 An asterisk (*) will appear to the right of an incorrect entry.

12

13

14 A.

15

Break-Even (in accounts)

%3D

16

17

18

19

20

21

22

24

million (rounded) accounts

Supporting calculations:

Revenue per account (in millions):

Total revenue (in millions)

Total accounts (in millions)

Revenue per account (in millions)

30

31

32

33

34

Variable cost per account (in millions):

Variable

Full Amount

Percentage

35

Cost of revenue (in millions)

36

Selling, gen., admin. exp. (in millions)

37

Total variable costs

38

Divided by number of accounts

Variable cost per account (in millions)

39

40

Total fixed costs (in millions):

41

42

Fixed

Full Amount

Percentage

43

Cost of revenue (in millions)

44

Selling, gen., admin. exp. (in millions)

45

Depreciation

46

Total fixed costs (in millions)

47

48

49

50 B.

51

Break-even (in $ revenue, in millions):

52

Total costs

53

Divided by number of accounts

54

Break-even

million

55

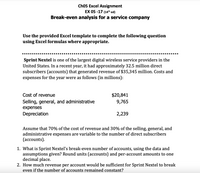

Transcribed Image Text:Ch05 Excel Assignment

EX 05 -17 (14th ed)

Break-even analysis for a service company

Use the provided Excel template to complete the following question

using Excel formulas where appropriate.

..... ..

Sprint Nextel is one of the largest digital wireless service providers in the

United States. In a recent year, it had approximately 32.5 million direct

subscribers (accounts) that generated revenue of $35,345 million. Costs and

expenses for the year were as follows (in millions):

Cost of revenue

$20,841

9,765

Selling, general, and administrative

expenses

Depreciation

2,239

Assume that 70% of the cost of revenue and 30% of the selling, general, and

administrative expenses are variable to the number of direct subscribers

(асcounts).

1. What is Sprint Nextel's break-even number of accounts, using the data and

assumptions given? Round units (accounts) and per-account amounts to one

decimal place.

2. How much revenue per account would be sufficient for Sprint Nextel to break

even if the number of accounts remained constant?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Home Depot, Inc. (HD), is the world's largest home improvement retailer and one of the largest retailers in the United States based on sales volume. Home Depot operates over 2,200 stores that sell a wide assortment of building, home improvement, and lawn and garden items. Home Depot recently reported the following end-of-year balance sheet data (in millions): Year 3 Year 2 Year 1 Total assets $42,549 $39,946 $40,518 Total liabilities 36,233 30,624 27,996 Total stockholders' equity 6,316 9,322 12,522 Compute the ratio of liabilities to stockholders' equity for all three years. Round to two dec- imal places. a. b. What conclusions regarding the margin of protection to creditors can you draw from the trend in this ratio for the three years?arrow_forwardBelow is financial information for the last year for a company that has a number of fast-food stores: Revenue from operations: $10,450,200 9,927,690 Operating costs: Cost of capital: RRR: 12% 15% Average assets: $4,180,080 Required: Calculate several measures that can be used for the financial perspective of a BSC.arrow_forward9arrow_forward

- Break-Even Analysis for a Service Company Rotelco is a digital wireless service provider in the United States. In a recent year, it had approximately 100 direct subscribers (accounts) that generated revenue of $52,800. Costs and expenses for the year were as follows: Cost of revenue Selling, general, and administrative expenses Depreciation $25,300 14,300 5,800 Assume that 75% of the cost of revenue and 30% of the selling, general, and administrative expenses are variable to the number of direct subscribers (accounts). In part (a) and (b), round all interim calculations to two decimal place and final answers to the nearest whole number. a. What is Rotelco's break-even number of accounts, using the data and assumptions above? accounts b. How much revenue per account would be sufficient for Rotelco to break even if the number of accounts remained constant? per accountarrow_forwardRequired information [The following information applies to the questions displayed below.] Megamart provides the following information on its two investment centers. Investment Center Electronics Income $ 3,114,000 2,261,000 Average Assets $ 17,300,000 13,300,000 Sporting goods Sales $ 41,520,000 18,088,000 1. Compute return on investment for each center. Using return on investment, which center is most efficient at using assets to generate income? 2. Assume a target income of 11% of average assets. Compute residual income for each center. Which center generated the most residual income? 3. Assume the Electronics center is presented with a new investment opportunity that will yield a 14% return on investment. Should the new investment opportunity be accepted? The target return is 11%. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute return on investment for each center. Using return on investment, which center is most efficient…arrow_forwardneed both answerarrow_forward

- Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill’s data are expressed in dollars. The electronics industry averages are expressed in percentages. TannenhillCompany ElectronicsIndustryAverage Sales $800,000 100 % Cost of goods sold 512,000 70 Gross profit $288,000 30 % Selling expenses $176,000 17 % Administrative expenses 64,000 7 Total operating expenses $240,000 24 % Operating income $48,000 6 % Other revenue 16,000 2 $64,000 8 % Other expense 8,000 1 Income before income tax $56,000 7 % Income tax expense 24,000 5 Net income $32,000 2 % a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers.arrow_forwardSubject:- financearrow_forwardеВook updates now or try tonight? Lat Break-Even Analysis for a Service Company Sprint Corporation is one of the largest digital wireless service providers in the United States. In a recent year, it had approximately 32.6 million direct subscribers (accounts) that generated revenue of $33,600 million. Costs and expenses for the year were as follows (in millions): Cost of revenue $13,389 Selling, general, and administrative expenses 7,774 Depreciation 8,783 Assume that 70% of the cost of revenue and 30% of the selling, general, and administrative expenses are variable to the number of direct subscribers (accounts). In part (a) and, (b), round all interim calculations and final answers to one decimal place. a. What is Sprint's break-even number of accounts, using the data and assumptions given? 26.9 X million accounts b. How much revenue per account would be sufficient for Sprint to break even if the number of accounts remained constant? 932.6 X million per accountarrow_forward

- Nextel Communications, Inc. is one of the largest digital wireless service providers in the United States. In a recent year, it had 8,666,500 accounts that generated revenues of $7,689,000,000. Costs and expenses were as follows: Cost of revenue$ 2,869,000,000 Selling, general and administrative expenses 3,020,000,000 Depreciation 1,746,000,000 Assume that 65% of the cost of revenue and 55% of the selling, general and administrative expenses are variable to the number of accounts.Required: a) What is Nextel’s break-even number of accounts using the data and assumptions above? Round any per-unit computations to the nearest dollar. b) How much revenue per account would be sufficient for Nextel to break even if the number of accounts remained constant?arrow_forwardSolve this problemarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education