Use the photos to solve the problem below

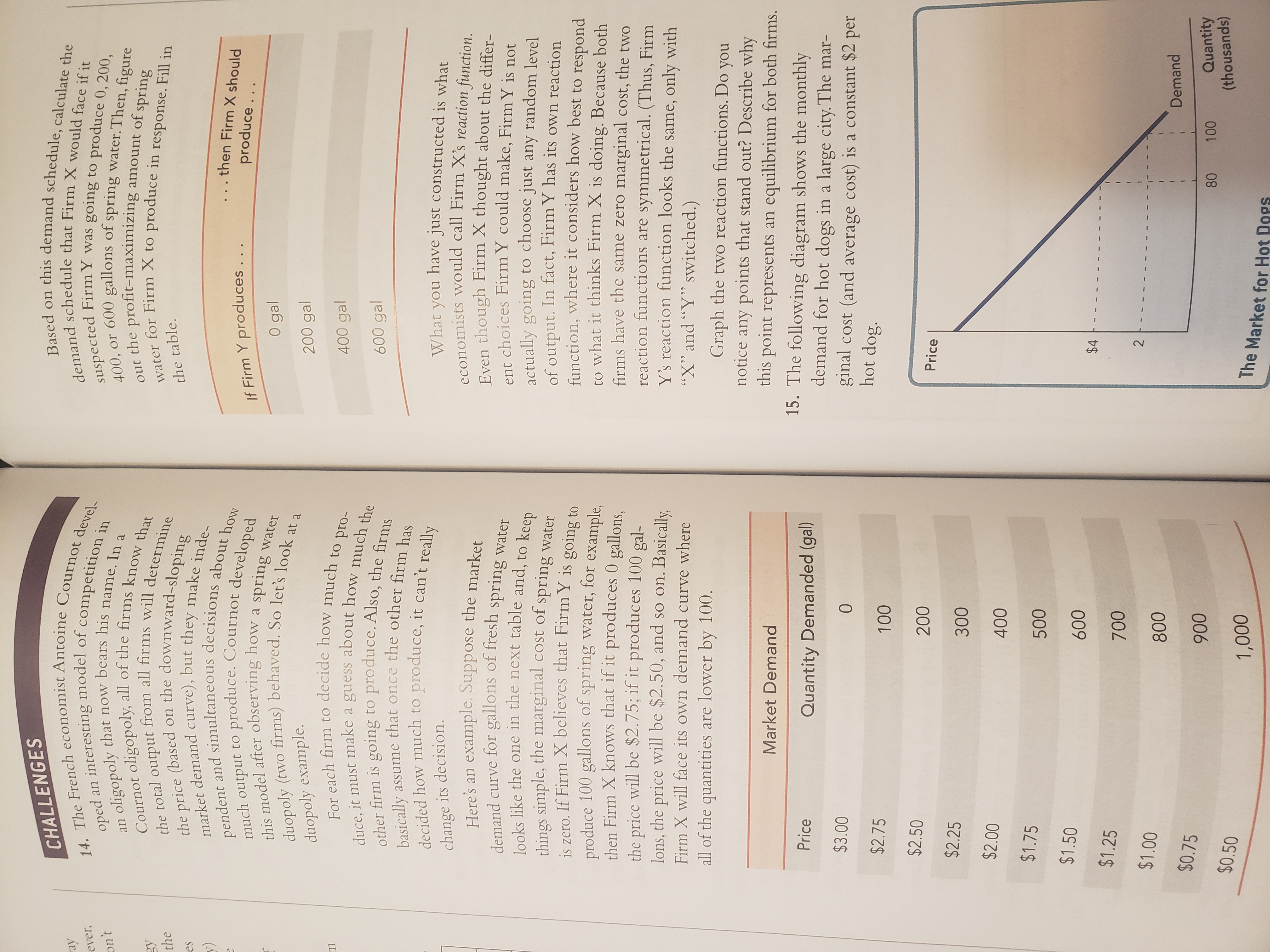

Imagine that firm X chooses their quantity first, then firm Y observes the quantity of firm X and chooses their own quantity. What quantities will they end up choosing? Is there a first or second-mover advantage here?

[You may assume that firm X can only choose quantities that are multiples of 200. This prevents you from having to deal with prices that are not on the schedule. Also it means you've done all the busy work already--assuming you did the assignment last week.....and got it right. So this shouldn't require a lot of calculations, just a little thinking about how equilibrium works in a sequential-move game. Oh, and just give me the quantity for each firm, don't worry about giving me a complete strategy for firm Y.]

Step by stepSolved in 2 steps

- Tim True increase production from 4 to 5 fire engines because the True or False: If Tim's Fire Engines were a competitive firm instead and $105,000 were the market price for an engine, increasing its production would not affect the price at which he can sell engines. False dominates in this scenario.arrow_forwardAlex's Fire Engines is the sole seller of fire engines in the fictional country of Pyrotania. Initially, Alex produced eight fire engines, but he has decided to increase production to nine fire engines. The following graph shows the demand curve Alex faces. As you can see, to sell the additional engine, Alex must lower his price from $80,000 to $40,000 per fire engine. Note that while Alex gains revenue from the additional engine he sells, he also loses revenue from the initial eight engines because he sells them all at the lower price. Use the purple rectangle (diamond symbols) to shade the area representing the revenue lost from the initial eight engines by selling at $40,000 rather than $80,000. Then use the green rectangle (triangle symbols) to shade the area representing the revenue gained from selling an additional engine at $40,000. 200 180 Revenue Lost 160 140 120 Revenue Gained 100 Demand 80 60 40 20 1 2 3 5 6 7 8 9 10 QUANTITY (Fire engines) Alex increase production from 8 to…arrow_forwardIn 2016, Walmart closed 150 stores in the United States and deeply discounted the merchandise in them. Some people bought the merchandise at these low prices and resold it on Amazon, eBay, and other sites. An article in the Wall Street Journal described one reseller who: "sent three employees in a 26-foot truck to the nearest closing Walmart, about 160 miles south. They hauled off $35,000 in merchandise, like Legos and Star Wars pajamas, which he said he expects to sell for as much as $100,000 on Amazon." Source: Greg Bensinger, "Wal-Mart Closures Bring Out the Amazon Sellers," Wall Street Joumal, January 29, 2016. Is the reseller making a $65,000 profit on these goods? Briefly explain. OA. Yes, the seller is making a $65,000 profit because his revenue is $ 100,000 and his cost is $35,000. B. No, the seller is making less than $65,000 because he incurs transactions costs. c. Yes, the seller is actually earning a $100,000 profit because the $35,000 is a sunk cost. D. No, the seller is…arrow_forward

- Behind the Supply Curve: Inputs and Costs Work It Out: Question 2 of 5 The accompanying table shows a car manufacturer's total cost of producing cars. Calculate the variable cost (VC) for the following quantities. VC for a quantity of 0: $ VC for a quantity of 5: $ VC for a quantity of 9: $ 0 Quantity of cars Total Cost $500,000 540,000 560,000 570,000 590,000 620,000 660,000 720,000 800,000 920,000 1,100,00 0 1 2 3 4 5 6 7 8 9 10arrow_forwardOn the graph input tool, change the number found in the Quantity Demanded field to determine the prices that correspond to the production of 0, 6, 12, 15, 18, 24, and 30 units of output. Calculate the total revenue for each of these production levels. Then, on the following graph, use the green points (triangle symbol) to plot the results. Calculate the total revenue if the firm produces 6 versus 5 units. Then, calculate the marginal revenue of the sixth unit produced. The marginal revenue of the sixth unit produced is________. Calculate the total revenue if the firm produces 12 versus 11 units. Then, calculate the marginal revenue of the 12th unit produced. The marginal revenue of the 12th unit produced is_________.arrow_forwardMmarrow_forward

- Am. 106.arrow_forwardOnly typed answerarrow_forward4. Profit maximization in the cost-curve diagram Suppose that the market for black sweaters is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. Hint: After placing the rectangle on the graph, you can select an endpoint to see the coordinates of that point. PRICE (Dollars per sweater) 50 y ATC AVC 45 40 35 30 25 20 15 10 5 0 MC + 02 4 6 8 10 12 14 16 QUANTITY (Thousands of sweaters) 18 20 Profit or Loss ?arrow_forward

- Please explain how to graph this. From the curve of the demand and supply and the factors that affects the grapharrow_forwardCarlos's Fire Engines is the sole seller of fire engines in the fictional country of Pyrotania. Initially, Carlos produced four fire engines, but he has decided to increase production to five fire engines. The following graph shows the demand curve Carlos faces. As you can see, to sell the additional engine, Carlos must lower his price from $105,000 to $90,000 per fire engine. Note that while Carlos gains revenue from the additional engine he sells, he also loses revenue from the initial four engines because he sells them all at the lower price. Use the purple rectangle (diamond symbols) to shade the area representing the revenue lost from the initial four engines by selling at $90,000 rather than $105,000. Then use the green rectangle (triangle symbols) to shade the area representing the revenue gained from selling an additional engine at $90,000. PRICE (Thousands of dollars per fire engine) 150 135 - 120 106 60 45 15 0 + Carlos 0 1 True + 2 False Demand + 6 3 4 5 7 QUANTITY (Fire…arrow_forwardThe following graph plots the marginal cost (MC) curve, average total cost (ATC) curve, and average variable cost (AVC) curve for a firm operating in the competitive market for jumpsuits. COSTS (Dollars) 80 72 64 56 24 16 8 0 0 8 0 MC ATC AVC Price (Dollars per jumpsuit) 4 8 12 36 48 60 ■ 16 24 32 40 48 56 QUANTITY (Thousands of jumpsuits) ☐ Quantity (Jumpsuits) 64 For every price level given in the following table, use the graph to determine the profit-maximizing quantity of jumpsuits for the firm. Further, select whether the firm will choose to produce, shut down, or be indifferent between the two in the short run. (Assume that when price exactly equals average variable cost, the firm is indifferent between producing zero jumpsuits and the profit-maximizing quantity of jumpsuits.) Lastly, determine whether the firm will earn a profit, incur a loss, or break even at each price. 72 80 Produce or Shut Down? Profit or Loss?arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education