Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

| Use the information below to answer the following questions. |

| U.S. $ EQUIVALENT | CURRENCY PER U.S. $ | |

| Polish Zloty | .2994 | 3.3406 |

| Euro | 1.2456 | .8028 |

| Mexican Peso | .0752 | 13.2998 |

| Swiss Franc | 1.0352 | .9660 |

| Chilean Peso | .002071 | 482.80 |

| New Zealand Dollar | .8080 | 1.2376 |

| Singapore Dollar | .8004 | 1.2494 |

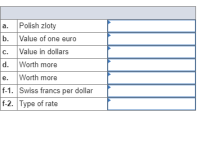

| a. | If you have $275, how many Polish zloty can you get? (Do not include the Polish zloty sign (Z). Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| b. | How much is one euro worth in U.S. dollars? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) |

| c. | If you have 4.10 million euros, how many dollars do you have? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 1,234,567.) |

| d. | Which is worth more, a New Zealand dollar or a Singapore dollar? |

| e. | Which is worth more, a Mexican peso or a Chilean peso? |

| f-1. | How many Swiss francs can you get for a euro? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) |

| f-2. | What do you call this rate? |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Using the WSJ quotations in the image provided here: Define and provide an indirect quote between Japanese yen (JPY) and the U.S. dollar, where Japan is designated as the home country.arrow_forwardUse the information below to answer the following questions. U.S. $ EQUIVALENT CURRENCY PER U.S. $ Polish Zloty .2989 3.3456 Euro 1.2379 .8078 Mexican Peso .0752 13.2993 Swiss Franc 1.0299 .9710 Chilean Peso .002071 482.80 New Zealand Dollar .8083 1.2371 Singapore Dollar .8007 1.2489 a. If you have $280, how many Polish zloty can you get? (Do not include the Polish zloty sign (Z). Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. How much is one euro worth in U.S. dollars? (Do not round intermediate calculations and round your answer to 4 decimal places, e.g., 32.1616.) c. If you have 4.60 million euros, how many dollars do you have? (Do not round intermediate calculations and round your answer to…arrow_forwardAssume the exchange rate is 1.05 Swiss francs per U.S. dollar. How many U.S. dollars are needed to purchase 1,250 Swiss francs? Multiple Choice $1,315.79 $1,190.48 $1,128.80 $1,140.00 $1,318.46arrow_forward

- The following are the foreign currency positions of an FI, expressed in the foreign currency: Currency Assets Liabilities FX Bought FX Sold Swiss franc (Sf) Sf 132,600 Sf 54,570 Sf 12,750 Sf 17,850 British pound (£) £ 42,500 £ 21,500 £ 15,500 £ 22,000 Japanese yen (¥) ¥ 8,200,000 ¥ 3,500,000 ¥ 1,600,000 ¥ 9,100,000 The exchange rate of dollars for Sf is 1.02, of dollars for British pound is 1.31, and of dollars for yen is .00953.The following are the foreign currency positions converted to dollars: Currency Assets Liabilities FX Bought FX Sold Swiss franc (Sf) $ 130,000 $ 53,500 $ 12,500 $ 17,500 British pound (£) $ 55,675 $ 28,165 $ 20,305 $ 28,820 Japanese yen (¥) $ 78,146 $ 33,355 $ 15,248 $ 86,723 a. What is the FI’s net exposure in Swiss francs stated in Swiss francs (Sf) and in dollars ($)?b. What is the FI’s net exposure in British pounds stated in British pounds (£) and in…arrow_forwardUse the information below to answer the questions that follow. U.S. $ EQUIVALENT CURRENCY PER U.S. $ .6394 .9793 U.K. Pound (£) Canada dollar a. Which would you rather have, $100 or £100? b. Which would you rather have, $100 Canadian or £100? c-1. What is the cross-rate for Canadian dollars in terms of British pounds? (Do not include the Canadian dollar sign, C$. Round your answer to 4 decimal places, e.g., 32.1616.) c-2. What is the cross-rate for British pounds in terms of Canadian dollars? (Do not include the pound sign, £. Round your answer to 4 decimal places, e.g., 32.1616.) c-1. Cross-rate c-2. Cross-rate 1.5640 1.0211 с 1€ /Can$arrow_forwardChapter 18, Question 4. Attached is a similar question with answers. Please answer in similar formatarrow_forward

- please help me to solve this questionarrow_forwardYou observed the following quotes between Canadian dollars (C$), euros (€) and Swiss francs (CHF) on 3/1/XX: C$1=€.90, C$.70/CHF On 3/2/XX, quotes for each currency were as follows: C$1.15-€1, CS.75/CHF You converted 600,000 Swiss francs into euros on 3/1. On 3/2 you converted your euros back to Swiss francs. How many francs would you have on 3/27 Round intermediate steps to four decimals. O 715,555.56 665357.14 246,521.74 579,587.4arrow_forwardYou are given the following quotes: U.S. dollar/Mexican Peso = 0.2501 U.S. dollar/Australian Dollar = 0.7448 U.S dollar/Chinese Yuan = 0.1352 What is the Chinese Yuan/Australian Dollar cross rate?arrow_forward

- These are currency quotes found on a foreign market: GH 4.30/$, and GH 4.55/$. ii. Which currency is depreciating in value?arrow_forwardSuppose that the quote for Euro is 1.1120-44/EUR. If you want to buy 259, which of the following is closest to that amount of Euros that you will need to pay? O a. EUR 232.41 O b. EUR 288.32 O. EUR 232.91 O d. EUR 288.01 O e. EUR 288.63arrow_forwardUse the following information on the U.S. dollar value of the euro to answer the question. Forward Rate for Spot Rate April 30, 2024 Delivery $1.130 $1,140 October 20, 2023 November 1, 2023 December 31, 2023 April 30, 2024 Select one: 1.148 1.100 1.170 On October 30, 2023, a US company receives a purchase order from a customer in Spain. Under the sale terms, the customer will pay the company €100.000 on April 30; 2024 On October 30, the US company also enters a forward contract to sell €100,000 on April 30, 2024. The company delivers the merchandise to the customer on November 1, On April 30, the company receives €100,000 from the customer and sells it using the forward contract. The company's accounting year ends December 31. What net gain or loss is recognized in 2023, in addition to sales revenue? esc a $500 net loss b. 1800 net gain, c. $800 net loss d. $500 net gain 3.145 1165 1.170 * 8: MacBook Air & FL 40 # 6-41 16 W 19 F M marrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education