FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

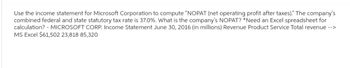

Transcribed Image Text:Use the income statement for Microsoft Corporation to compute "NOPAT (net operating profit after taxes)." The company's

combined federal and state statutory tax rate is 37.0%. What is the company's NOPAT? *Need an Excel spreadsheet for

calculation? - MICROSOFT CORP. Income Statement June 30, 2016 (in millions) Revenue Product Service Total revenue -->

MS Excel $61,502 23,818 85,320

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ss.2arrow_forwardPlease answer both a and b I will provide you positive responsearrow_forwardData table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) TABLE 1.2: Tax Rates and Income Brackets for Joint Returns (2018) Tax Rates 10% 12% 22% 24% 32% 35% 37% Taxable Income Joint Returns $0 to $19,050 $19,051 to $77,400 $77,401 to $165,000 $165,001 to $315,000 $315,001 to $400,000 $400,001 to $600,000 Over $600,000 Iarrow_forward

- 1arrow_forwardFill in the missing numbers for the following statement of comprehensive income. (Input all amounts as positive values. Omit $ sign in your response.) Sales Costs Depreciation EBIT Taxes (34%) Net income Calculate the OCF. OCF $ What is the CCA tax shield? CCA tax shield 733,500 503,300 89,400arrow_forwardCalculate economic profit based on the following information: WACC = 7.60%; Total Assets = $1,366; Net Income = $266; EBIT = $327; Payroll Payable = $20; Total Equity = $1,395; Rate = 10%; Cash = $66; Accounts Payable = $25; Bank Debt with interest rate of 7% = $45. (Hint: Accounts Payable and Payroll Tax Payable are the only non-interest bearing liabilities). O 15.85% O 13.60% O 14.28% O 15.04% O 11.58% O 13.50% O-13.50% O 23.45% O -7.60% O-15.85% O 13.85%arrow_forward

- Income Statement Bullseye, Inc.'s 2008 income statement lists the following income and expenses: EBIT = $907.000, Interest expense = $93,000, and Net income = $580,000. What is the 2008 Taxes reported on the income statement? Multiple Cholce $814,000 $327,000 There Is not enough Informatlon to calculate 2008 Taxes. $234,000 1 10:09 AM 44°F Mostly sunny pe here to search 11/5/2021 DELLarrow_forwardnet income? Find net incomearrow_forwardPendleton had the following partial income statement. What is Pendleton's net income if the tax rate is 21%? b Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. $22,500 d $15,775 C $17,775 Sales Cost of goods sold Gross profit Salary expense Rent expense Entertainment $16,275 Business meal with clients Federal income tax Net income $97,000 ($28,000) $69,000 ($41,000) ($5,000) ($2,000) ($1,000) ? ?arrow_forward

- 1arrow_forwardDuval Manufacturing recently reported the following information:Net income $600,000ROA 8%Interest expense $225,000Duval’s tax rate is 35%. What is its basic earning power (BEP)?arrow_forwardOak Corporation has the following general business credit carryovers: 2016 $7,250 2017 21,750 2018 8,250 2019 25,750 Total carryovers $63,000 The general business credit generated by activities during 2020 equals $50,400 and the total credit allowed during the current year is $87,000 (based on tax liability). a. Enter the amount (if any) of each year's carryover utilized in 2020. Year Amount ofCarryoverUtilized 2016 $ 2017 $ 2018 $ 2019 $ 2020 $ b. What is the amount of any unused credits carried forward to 2021?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education