FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What number 10 I had put 2770 and 2070 it’s was wrong

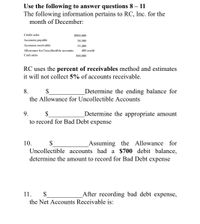

Transcribed Image Text:Use the following to answer questions 8

The following information pertains to RC, Inc. for the

month of December:

11

-

Credit sales

$900,000

Accounts payable

38,500

Accounts receivable

55,400

Allowance for Uncollectible accounts

400 credit

Cash sales

300,000

RC uses the percent of receivables method and estimates

it will not collect 5% of accounts receivable.

8.

$

Determine the ending balance for

the Allowance for Uncollectible Accounts

9.

Determine the appropriate amount

to record for Bad Debt expense

_Assuming the Allowance for

Uncollectible accounts had a $700 debit balance,

determine the amount to record for Bad Debt expense

10.

$

11.

$

After recording bad debt expense,

the Net Accounts Receivable is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the range of the following set of values. 48 42 55 28 112 79 95 27 36 14 96 193 191arrow_forwardY8 17 and 18 Important: Don't include signs like $ or % in your answers. Pay close attention to the rounding instructions. For example, if the question instructs you to "round to the nearest cent" or "round to two decimal places", and the answer you found is $12,678.04678, you need to submit 12678.05. Some questions may ask you to round to the nearest whole number or nearest dollar, in which case the answer would be 12678. Tolerance: Be careful with rounding and do not round until you arrive at the final answer. Answer tolerance is ±1 at the last digit based on the decimal place accuracy required by that question. For example, if a question asks you to round to the nearest cent (two decimal places) and the correct is $1,235.06, answers within ± 0.01 ($1,235.05 to $1,235.07) will count as correct. As another example, if a question asks you to round a percent answer to one decimal place and the correct answer is 4.6%, answers within ± 0.1% (4.5% to 4.7%) will count as correct.…arrow_forwardFind v in question c and find c in question darrow_forward

- Find the sum of the terms: 26 O 74.23 69.38 O 71.12 O 70.29 O 72.97 (1+0.04)² + 26 (1 +0.04)³ 26 (1+0.04)4 (Round intermediate calculations to 5 decimal places, e.g. 5.27525 and your final answer to 2 decimal places, e.g. 52.75.)arrow_forwardwhere does the $1628 come from?arrow_forward88 MULTIPLE CHOICE Question 2 Listen Given 0=787°, what is the measure of the coterminal angle? A 67° B 23° C 157° D 113°arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education