FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

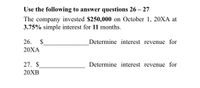

Transcribed Image Text:Use the following to answer questions 26 – 27

The company invested $250,000 on October 1, 20XA at

3.75% simple interest for 11 months.

26.

2$

Determine interest revenue for

20ХА

27. $

Determine interest revenue for

20XB

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- php#lockdown ag question Amount of Annual Investment $4,000 Rate $6,000 12% $13,500 Time $22,250 You have been depositing money into an account yearly based on the following amounts, rates and times What is the value of that investment account at the end of that period? NOTE: Enter amounts rounded to two decimals (e.g., 78.76 or 40.00). 14 years 15% 10% FV 10 years 20% 8 years SJKarrow_forwardPart 1 How long will it take to save $1701.00 by making deposits of $146.00 at the end of every year into an account earning interest at 7% compounded annually? State your answer in years and months ( from 0 to 11 months). Question content area bottom Part 1 It will take enter your response here year(s) and enter your response here month(s).arrow_forwardVitalSource Account Center: Use X chapter05/4/2/28/6/40/2/2/4 G Sign in - Google Accounts Determine the future value of the following single amounts: 1234 Invested Amount $15.000 20,000 30,000 50,000 Interest Rate 6% 8 12 4 No. of Periods 12 ខសង 10 20 12 QA Aug 13, 2023, 12:15 PMarrow_forward

- QUESTION 5 Hansco borrowed $5635 paying interest at 4.05% compounded annually. If the loan is repaid by payments of $279 made at the end of each year. Find the number of payments. Round your answer to 8 decimal places. Sample input 6.43215678arrow_forwardWhich Schedule must the taxpayer use to claim a payment made for alimony? Multiple Choice Schedule 1. Schedule 2. Schedule 3. The taxpayer does not need to use a Schedule.arrow_forward0-90 days 91-180 days 180+days Total Assets 15000 25000 60000 100,000 Liabilities &NW 35000 15000 50000 100,000 Assume that interest rates on interest sensitive assets are currently 12% and interest sensitive liabilities are 9%. Also assume that interest rates on fixed assets are 15% and fixed liabilities are 11%. Calculate the following for 91 to 180 days: 1. Interest Sensitive Gap 2. Net Interest Income 3. Interest Sensitive Ratio 4. Relative IS Gap Write only your final answers in the box given below here to searcharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education