Economics:

10th Edition

ISBN: 9781285859460

Author: BOYES, William

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please give every questions answer step by step and take a like

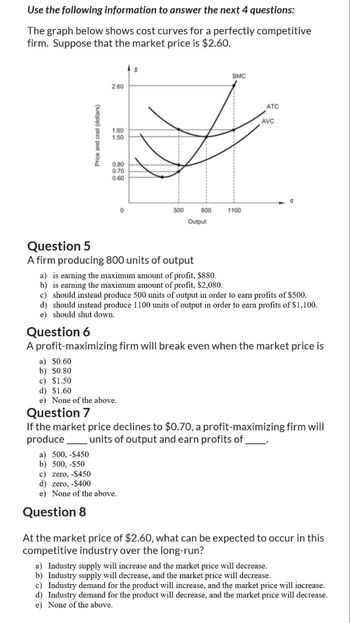

Transcribed Image Text:Use the following information to answer the next 4 questions:

The graph below shows cost curves for a perfectly competitive

firm. Suppose that the market price is $2.60.

Price and cost (dollars)

2.60

1.60

1.50

0.80

0.70

0.60

500

800

1100

Output

SMC

ATC

AVC

Question 5

A firm producing 800 units of output

a) is earning the maximum amount of profit, $880.

b) is earning the maximum amount of profit, $2,080.

c) should instead produce 500 units of output in order to earn profits of $500.

d) should instead produce 1100 units of output in order to earn profits of $1,100.

e) should shut down.

Question 6

A profit-maximizing firm will break even when the market price is

a) $0.60

b) $0.80

c) $1.50

d) $1.60

e) None of the above.

Question 7

If the market price declines to $0.70, a profit-maximizing firm will

produce units of output and earn profits of_

a) 500,-$450

b) 500,-$50

c) zero, -$450

d) zero, -$400

e) None of the above.

Question 8

At the market price of $2.60, what can be expected to occur in this

competitive industry over the long-run?

a) Industry supply will increase and the market price will decrease.

b) Industry supply will decrease, and the market price will decrease.

c) Industry demand for the product will increase, and the market price will increase.

d) Industry demand for the product will decrease, and the market price will decrease.

e) None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hand written solutions are strictly not acceptable.arrow_forwardThe following cost data is for a firm which is selling in a perfectly competitive market: Average fixed Average variable Average total Total Marginal cost S17 product cost S100.00 50.00 33.33 25.00 20.00 cost $17.00 cost $117.00 66.00 47.33 39.25 34.00 2 16.00 15 3 4 15.00 14.25 14.00 14.00 15.71 17.50 13 12 13 16.67 14.29 12.50 11.11 10.00 9.09 7.33 30.67 30.00 14 26 30 35 7 8. 9. 10 11 30.00 30.55 31.60 33.09 35.00 19.44 21.60 41 24.00 48 12 26.67 56 Refer to the data above. If there were 600 identical firms in this industry and total or market demand is as shown below, equilibrium price will be: Quantity demanded 3,000 6,000 9,000 11,000 14,000 19,500 Price $50 42 36 32 20 13 $36arrow_forwardAssume that the cost data in the following table are for a purely competitive producer: TotalProduct AverageFixed Cost AverageVariable Cost AverageTotal Cost Marginal Cost 0 1 $60.00 $45.00 $105.00 $45.00 2 30.00 42.50 72.50 40.00 3 20.00 40.00 60.00 35.00 4 15.00 37.50 52.50 30.00 5 12.00 37.00 49.00 35.00 6 10.00 37.50 47.50 40.00 7 8.57 38.57 47.14 45.00 8 7.50 40.63 48.13 55.00 9 6.67 43.33 50.00 65.00 10 6.00 46.50 52.50 75.00 Instructions: If you are entering any negative numbers be sure to include a negative sign (−) in front of those numbers. Select "Not applicable" and enter a value of "0" for output if the firm does not produce. a. At a product price of $56.00 (i) Will this firm produce in the short run? (Click to select) No Yes (ii) If it is preferable to produce, what will be the profit-maximizing or loss-minimizing output? (Click to select) Not applicable Loss-minimizing…arrow_forward

- Assume that the cost data in the following table are for a purely competitive producer: TotalProduct AverageFixed Cost AverageVariable Cost AverageTotal Cost Marginal Cost 0 1 $ 60.00 $ 45.00 $ 105.00 $ 45.00 2 30.00 42.50 72.50 40.00 3 20.00 40.00 60.00 35.00 4 15.00 37.50 52.50 30.00 5 12.00 37.00 49.00 35.00 6 10.00 37.50 47.50 40.00 7 8.57 38.57 47.14 45.00 8 7.50 40.63 48.13 55.00 9 6.67 43.33 50.00 65.00 10 6.00 46.50 52.50 75.00 a. At a product price of $56.00 (i) Will this firm produce in the short run? yes (ii) If it is preferable to produce, what will be the profit-maximizing or loss-minimizing output? profit- maximizing output = 9 units per firm (iii) What economic profit or loss will the firm realize per unit of output? Profit per unit = $ 16 b. At a product price of $41.00 (i) Will this firm produce in the short run? Yes (ii) If it is preferable to produce, what will be the…arrow_forwardThe diagram shows the demand and the supply curves for textbooks. $25 Price, P Demand $20 curve $15 $12 $10 $8 $6 $5 $0 50 0 10 16 20 24 28 30 Quantity, Q, of books Based on this figure, which of the following statements is correct? The Nash equilibrium price is $8. There are sellers willing to give away their textbooks for free. At a price of $12, 40 books will be sold. At a price of $6, there is an excess demand of 4 books. Supply curve 40 40arrow_forward-Briefly discuss average costs, including how they are calculated, how they are typically appear on a graph, and what they relate to profitability. -Briefly explain what is meant by the term "fixed costs" and provide three examples of same. What determines a firm's level of fixed costs? -Briefly explain what is meant by the term "variable costs" and provide three examples of same. -Briefly explain how the total revenue for a profit-seeking firm is determined.arrow_forward

- Lisa’s Lawn Company (LLC) is a lawn-mowing business in a perfectly competitive market for lawn-mowing services. The following table sets out Lisa’s costs. Quantity (Lawns per hour Total Cost (dollars per lawn) 0 $30 1 40 2 55 3 75 4 100 5 130 6 165 If the market price is $30 per lawn, how many lawns per hour does Lisa’s LLC mow? If the market price is $30 per lawn, what is Lisa’s profit in the short run? If the market price falls to $20 per lawn, how many lawns per hour does Lisa’s LLC mow?arrow_forwardBilly’s Bean Bag Emporium produced 300 bean bag chairs but sold only 275 of the units it produced. The average cost of production for each unit of output produced was $100. The price for each of the 275 units sold was $95. What is the Total profit for Billy’s Bean Bag Emporium? Include in your answer your calculationarrow_forwardCost figures for a hypothetical firm are given in the following table. Use them for the exercises below. The firm is selling in a perfectly competitive market. Output Fixed AFC Variable AVC Total ATC MC Cost Cost cost 1 $50 50/1=50 $30 30/1=30 30+50=80 80/1=80 NA 2 $50 50/2=25 $50 50/2=25 50+50=100 100/2=50 (100-80)/(2-1)=20 3 $50 50/3=16.67 $80 80/3=26.67 50+80=130 130/3=43.33 (130-100)/(3-2)=30 4 $50 50/4=12.50 $120 120/4=30 50+120=170 170/4=42.50 (170-130)/(4-3)=40 5 $50 50/5=10 $170 170/5=34 50+170=220 220/5=44 (220-170)/(5-4) =50 What can you expect from an industry in perfect competition in the long run? That is, what will the price be? What quantity will be produced? What will be the relation between marginal cost, average cost, and price?arrow_forward

- Price and cost (dollars) Use the following information to answer the next 4 questions: The graph below shows cost curves for a perfectly competitive firm. Suppose that the market price is $2.60. 2.60 1.60 1.50 0.80 0.70 0.60 500 800 1100 Output SMC ATC AVC Question A firm producing 800 units of output is earning the maximum amount of profit, $880. is earning the maximum amount of profit, $2,080. should instead produce 500 units of output in order to earn profits of $500. should instead produce 1100 units of output in order to earn profits of $1,100.arrow_forwardNonearrow_forwardPrice and cost (dollars) Use the following information to answer the next 4 questions: The graph below shows cost curves for a perfectly competitive firm. Suppose that the market price is $2.60. 2.60 1.60 1.50 0.80 0.70 0.60 500 800 1100 Output SMC ATC AVC Question 5 (2 points) A firm producing 800 units of output is earning the maximum amount of profit, $880. is earning the maximum amount of profit, $2,080. should instead produce 500 units of output in order to earn profits of $500. should instead produce 1100 units of output in order to earn profits of $1,100.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...

Economics

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:Cengage Learning