Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

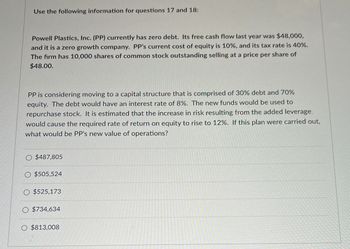

Transcribed Image Text:Use the following information for questions 17 and 18:

Powell Plastics, Inc. (PP) currently has zero debt. Its free cash flow last year was $48,000,

and it is a zero growth company. PP's current cost of equity is 10%, and its tax rate is 40%.

The firm has 10,000 shares of common stock outstanding selling at a price per share of

$48.00.

PP is considering moving to a capital structure that is comprised of 30% debt and 70%

equity. The debt would have an interest rate of 8%. The new funds would be used to

repurchase stock. It is estimated that the increase in risk resulting from the added leverage

would cause the required rate of return on equity to rise to 12%. If this plan were carried out,

what would be PP's new value of operations?

O $487,805

$505,524

O $525,173

O $734,634

O $813,008

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- XYZ anticipates earning $1,500,000 and paying $300,000 in dividends this year. XYZ's capital structure is 20% debt and 80% equity and its tax rate is 35%. Compute the equity breakpoint to the nearest dollar. Your Answer:arrow_forwardDairy Isle has a value of $59,000 in a good economy and $48,000 in a recession. The firm has $50,000 of debt. The probability of a recession is 32 percent. The firm is considering a project that would change the firm values to $63,000 in a good economy and $46,000 in a recession. Which one of these statements correctly describes the effects of this project? The project transfers $640 from bondholders to stockholders. The bondholders are unaffected by the project. The shareholders gain an amount equal to 68 percent of the increase in the firm's value. The shareholders gain $2,080 while the bondholders are unaffected. The bondholders and stockholders equally share the increase in firm valuation.arrow_forwardBA eBook Tartan Industries currently has total capital equal to $6 million, has zero debt, is in the 25% federal-plus-state tax bracket, has a net income of $4 million, and distributes 40% of its earnings as dividends. Net income is expected to grow at a constant rate of 6% per year, 480,000 shares of stock are outstanding, and the current WACC is 14.00%. The company is considering a recapitalization where it will issue $5 million in debt and use the proceeds to repurchase stock. Investment bankers have estimated that if the company goes through with the recapitalization, its before-tax cost of debt will be 9% and its cost of equity will rise to 16.5%. a. What is the stock's current price per share (before the recapitalization)? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. Assuming that the company maintains the same payout ratio, what will be its stock price following the recapitalization? Assume that shares are repurchased at the price…arrow_forward

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 40% long-term debt, 15% preferred stock, and 45% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 26%. Debt The firm can sell for $1005 a 13-year, $1,000-par-value bond paying annual interest at a 6.00% coupon rate. A flotation cost of 2.5% of the par value is required. Preferred stock 7.00% (annual dividend) preferred stock having a par value of $100 can be sold for $98. An additional fee of $5 per share must be paid to the underwriters. Common stock The firm's common stock is currently selling for $80 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.50 ten years ago to the $4.92 dividend payment, D0, that the company just recently made. If…arrow_forwardDuke Inc. is considering to change its capital structure of a $1 million:$3 million debt-equity mix (in terms of market values), by taking out a $3 million loan which is used to pay a large dividend to shareholders. The firm’s tax rate is 40%. After the dividend has been paid, what will be the firm’s total equity value?arrow_forwardWestern Electric Utility Company faces increasing needs for capital. Fortunately, it has an A (low) credit rating. The corporate tax rate is 30 percent. Western’s treasurer is trying to determine the corporation’s current weighted average cost of capital to assess the profitability of capital budgeting projects. Historically, the corporation’s earnings and dividends per share have increased at about a 6.0 percent annual rate. Western Electric’s common stock is selling at $60 per share, and the company will pay a $4.50 per share dividend (D1). The company’s $100 preferred stock has been yielding 9 percent in the current market. Flotation costs for the company have been estimated by its investment dealer to be $1.50 for preferred stock. The company’s optimum capital structure is 40 percent debt, 10 percent preferred stock, and 50 percent common equity in the form of retained earnings. Refer to the table below on bond issues for comparative yields on bonds of equal risks to Western…arrow_forward

- Mokoko Ltd. is considering a number projects and thus need to estimate its cost of capital in order to estimate their NPV. The company’s current dividend is $2.25 per share, which has grown steadily at 6% each year for over a decade and is expected to continue doing so. Its stock currently trades at $26 and there are 2 million shares outstanding. The company’s 100,000 preferred shares trade at $22 and pay annual dividends of $3. Cash and marketable securities on the company’s balance sheet total $30.5 million and the firm pays a tax rate of 30%. Their existing long-term debt (face value of $100 million, semi-annual payments) pays a 9.5% coupon and has 12 years remaining before maturity. Due to current conditions, the required rate of return (yield to maturity) on this debt is 11% and any new debt issuance would be required to offer the same yield to investors (there is no term premium for 1 year vs 12 year debt). What is Mokoko Ltd's Debt/Equity ratio? Assuming the firm wants to…arrow_forwardLemansky Enterprises is considering a change from its current capital structure. The company currently has an all-equity capital structure and is considering a capital structure with 35 percent debt. There are currently 5,000 shares outstanding at a price per share of $50. EBIT is expected to remain constant at $29,680. The interest rate on new debt is 11 percent and there are no taxes. a. Rebecca owns $10,000 worth of stock in the company. If the firm has a 100 percent payout, what is her cash flow? Note: Do not round intermediate calculations and round your answer to 2 decimal places, 32.16. b. What would her cash flow be under the new capital structure assuming that she keeps all of her shares? Note: Do not round intermediate calculations and round your answer to 2 decimal places, 32.16. c. Suppose the company does convert to the new capital structure. Show how Rebecca can maintain her current cash flow. Note: Do not round intermediate calculations and round your answer to the…arrow_forwardLemansky Enterprises is considering a change from its current capital structure. The company currently has an all-equity capital structure and is considering a capital structure with 50 percent debt. There are currently 4,000 shares outstanding at a price per share of $80. EBIT is expected to remain constant at $32,960. The interest rate on new debt is 9 percent and there are no taxes. a. Rebecca owns $28,000 worth of stock in the company. If the firm has a 100 percent payout, what is her cash flow? Note: Do not round intermediate calculations and round your answer to 2 decimal places, 32.16. b. What would her cash flow be under the new capital structure assuming that she keeps all of her shares? Note: Do not round intermediate calculations and round your answer to 2 decimal places, 32.16. c. Suppose the company does convert to the new capital structure. Show how Rebecca can maintain her current cash flow. Note: Do not round intermediate calculations and round your answer to the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education