ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

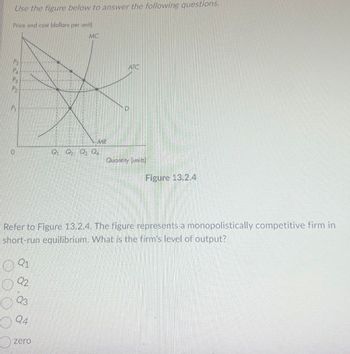

Transcribed Image Text:Use the figure below to answer the following questions.

Price and cost (dollars per unit)

MC

Ps

РА

P₂

P

0

Q1

Q2

Q3

Q4

QQ₂ Q3 Q

zero

MR

Refer to Figure 13.2.4. The figure represents a monopolistically competitive firm in

short-run equilibrium. What is the firm's level of output?

ATC

Quantity (units)

Figure 13.2.4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer the question on the basis of the following short run demand and cost data for a specific firm. Cost Data (2) Price $ 80 76 Demand Data (1) Price 72 68 • decrease. • increase. $ 35 30 25 . 20 15 2 3 10 5 4 5 6 (3) Quantity 7 8 2 3 4 5 64 60 56 In the long run, the number of firms in this monopolistic competitive industry will most likely Multiple Choice 6 Total Output 7 8 Total Cost stay the same. The answer cannot be determined from the given data. $45 55 70 90 115 145 180arrow_forwardThe accompanying graph depicts average total cost (ATC) marginal cost (MC), marginal revenue (M), and demand (D) 50 facing a monopolistically competitive firm MC 45 Place point A at the firm's profit maximizing price and quantity 40 35 What is the firm's total cost? ATC 30 25 total cost: 20 15 What is the firm's total revenue? 10 5 total revenue: $ MR 0 5 10 15 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 95100 Quantity What is the firm's total profit? profit: $ Price and Cost ($)arrow_forwardFill in the missing data for this Monopolistically Competitive firm. Don't forget to answer the questions below the chart. I. Average Total Marginal Total Marginal Total Total Quantity Price Revenue Revenue Cost Cost Cost Profit 50 na na -50 1 48 75 2 46 45 37 4 31 135 25 15 32 38 7 175 253 /////// 8. 144 311 9 90 379 /////I/ 10 459 This firm's fixed costs are? Assuming no inflation, we would predict this firm's price to rise/fall/ stay the same. Explain your answer.arrow_forward

- Part II | The graph below shows a monopolistically competitive firm in the short run. $ 10 6 4 MC ATC 10 25 30 9. What is the firm's profit-maximizing price and quantity? 10. How much profit does that firm make at that price and quantity? 60arrow_forwardA small, local restaurant in St. Augustine, FL, serves scrambled eggs for breakfast. The market for breakfast scrambled eggs is monopolistically competitive. The following graph shows the demand, MR, MC, and ATC curve of this local restaurant. Use the graph to answer questions 3 to 7. Price (P) per plate $10 7 5 3 2 0 MC MR 50 80 100 ATC Number of plates of scrambled eggs served per day (Q)arrow_forwardQ. 2arrow_forward

- Dana is a dot-com entrepreneur who has established a Web site at which people can design and buy awatch. Dana pays $200 a month for a Web server and Internet connection. The watches that customers design are made to order by another firm, and Dana pays this firm $60 a watch. Dana has no other costs. The table shows the demand schedule for Dana's watches. What is Dana's profit-maximizing output, price, and economic profit? Dana's profit-maximizing output is Dana's profit-maximizing price is $ Dana's economic profit is $ a month. watches a month. a watch. Price (dollars per watch) 100 80 60 40 20 0 Quantity (watches per month) 0 20 40 60 80 100arrow_forwardThe graph shows the demand curve, marginal revenue curve, and marginal cost curve of Java Time, Inc., a producer of espresso machines in monopolistic competition. Draw a point at the firm's the profit-maximizing price and quantity. Label it 1. Draw an arrow that shows Java Time's markup. Draw the average total cost curve such that Java Time does not have excess capacity. Label it. Draw a point at the intersection of the ATC curve and the MC curve. Label it 2. Java Time's markup is $a machine. 240 220- 200- 180- 160- 140 120- 100- 80- 60- 40- 20- 04 0 Price and cost (dollars per machine) MC 100 200 300 400 Quantity (espresso machines per week) D MR 500arrow_forwardIn the long run, the positive economic profits earned by the monopolistic competitor will attract a response either from existing firms in the industry or firms outside. As those firms capture the original firm’s profit, what will happen to the original firm’s profit-maximizing price and output levels? Show on a grapharrow_forward

- Marginal revenue and marginal cost intersect at point Multiple Choice C. d. a. b.arrow_forwardhellparrow_forwardThe graph below shows cost and revenue curves for a monopolistic competitor producing different amounts of chairs. On the graph, suppose that: A = $55, B = $21, C = $15, E = $7, F = 13, and G = 31 Price BL BCE CP MC ATC EH MR F G Quantity Calculate the maximum profit the firm can earnarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education