ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Not sure if what I have is correct and don’t know what to put for the rest of the problems and don’t know where to put CS, PS, CS and PS w/ rent control and deadweight loss

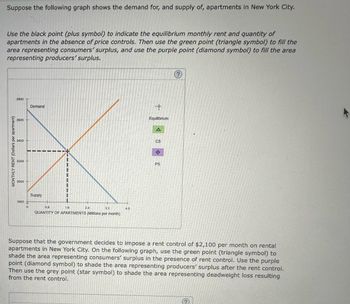

Transcribed Image Text:Suppose the following graph shows the demand for, and supply of, apartments in New York City.

Use the black point (plus symbol) to indicate the equilibrium monthly rent and quantity of

apartments in the absence of price controls. Then use the green point (triangle symbol) to fill the

area representing consumers' surplus, and use the purple point (diamond symbol) to fill the area

representing producers' surplus.

MONTHLY RENT (Dollars per apartment)

2800

2600+

2400

2200

2000

1800

0

Demand

Supply

0.8

3.2

QUANTITY OF APARTMENTS (Millions per month)

1.6

24

14.0

Equilibrium

A

CS

PS

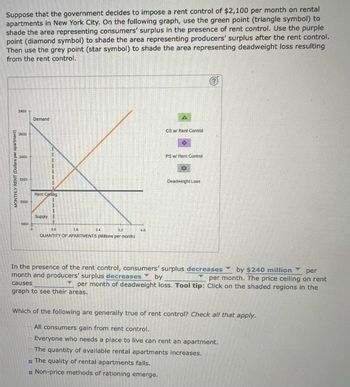

Suppose that the government decides to impose a rent control of $2,100 per month on rental

apartments in New York City. On the following graph, use the green point (triangle symbol) to

shade the area representing consumers' surplus in the presence of rent control. Use the purple

point (diamond symbol) to shade the area representing producers' surplus after the rent control.

Then use the grey point (star symbol) to shade the area representing deadweight loss resulting

from the rent control.

K

Transcribed Image Text:Suppose that the government decides to impose a rent control of $2,100 per month on rental

apartments in New York City. On the following graph, use the green point (triangle symbol) to

shade the area representing consumers' surplus in the presence of rent control. Use the purple

point (diamond symbol) to shade the area representing producers' surplus after the rent control.

Then use the grey point (star symbol) to shade the area representing deadweight loss resulting

from the rent control.

MONTHLY RENT (Dollars per apartment)

2800

2600

2400

2200

2000

1800

0

Demand

Rent Celling

I

Supply

0.8

3.2

QUANTITY OF APARTMENTS (Millions per month)

1.6

2.4

graph to see their areas.

40

CS w/ Rent Control

◇

PS w/ Rent Control

XX

Deadweight Loss

In the presence of the rent control, consumers' surplus decreases by $240 million per

month and producers' surplus decreases by

per month. The price ceiling on rent

causes

per month of deadweight loss. Tool tip: Click on the shaded regions in the

Which of the following are generally true of rent control? Check all that apply.

All consumers gain from rent control.

Everyone who needs a place to live can rent an apartment.

The quantity of available rental apartments increases.

The quality of rental apartments falls.

Non-price methods of rationing emerge.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Price P3 P₂ P1 0 -Tax- A D Q₁ B Q₂ S D Quantityarrow_forwardFigure 1. The graph depicts the market for plastic containers. Price 16- 14- 12- 10 8- 6 200 500 650 Social Cost Private Cost Demand Quantity Refer to Figure 1. In order to reach the social optimum, the government could O offer a subsidy of $8 per unit on the production of plastic containers. O impose a tax of $8 per unit on the production of plastic containers. O offer a subsidy of $4 per unit on the production of plastic containers. O impose a tax of $4 per unit on the production of plastic containers.arrow_forwardUsing the attached table, the equilibrium price before the tax is imposed is . The equilibrium price after the tax is imposed is a b Question 19 с d Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. $140, $160 $160, $140 $140, $150 Price (S) 100 $160, $150 120 140 160 180 200 220 Quantity Quantity Quantity Demanded Supplied Supplied w/Tax 600 530 575 540 550 550 525 560 570 500 475 450 580 590 495 505 515 525 535 545 555arrow_forward

- Your grandmother likes old-fashioned yard salesand doesn’t understand why everyone is so excitedabout eBay. Explain to her why the creation of amarket that enables people who don’t live in thesame town to buy and sell used goods increasestotal surplus over the yard-sale market.arrow_forwardWhat is the deadweight loss if there is an $8 price floor? Price of asparagus (S/pound) 4500 6000 1500 6500 O 1000 $10 9 8 7 6 5. 4- 3- 2- 1 S D 0 1 2 3 4 5 6 7 8 9 10 Quantity of asparagus (1,000s of pounds)arrow_forwardWAGE(Dollars per hour) 20 18 16 14 12 10 8 6 4 2 0 0 40 80 120 160 200 240 280 320 380 400 LABOR (Number of workers) Levied on Employers (Dollars per hour) 4 Supply Tax Proposal 0 2 berand I I Levied on Workers Graph Input Tool Market for Laboratory Aides Wage (Dollars per hour) (Dollars per hour) 0 4 2 Labor Demanded (Number of workers) Demand Shifter Tax Levied on Employers (Dollars per hour) For each of the proposals, use the previous graph to determine the new number of laboratory aides hired. Then compute the after-tax amount paid by employers (that is, the wage paid to workers plus any taxes collected from the employers) and the after-tax amount earned by laboratory aides (that is, the wage received by workers minus any taxes collected from the workers). Quantity Hired (Number of workers) 4 248 0 Labor Supplied (Number of workers) Supply Shifter Tax Levied on Workers (Dollars per hour) After-Tax Wage Paid by Employers (Dollars per hour) 152 After-Tax Wage Received by Workers…arrow_forward

- 1. Use the following graph, calculate the costs and benefits of a subsidy. 20 200 165 108 80 23 60 88 S S-Sub SMBarrow_forwardPDemand QDemand PSupply QSupply $10 0 $1 2 $9 3 $2 4 $8 6 $3 6 $7 9 $4 8 $6 12 $5 10 $5 15 $6 12 $4 18 $7 14 If the Government creates a quota of 6 units to reduce the consumption of the dangerous product, what will the price of the good be in the marketplace? How much deadweight loss is there? How much of the deadweight loss came from the consumers?arrow_forward6. What are the possible benefits of rent control?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education