ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

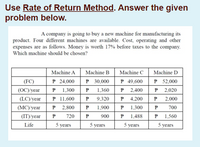

Transcribed Image Text:Use Rate of Return Method. Answer the given

problem below.

A company is going to buy a new machine for manufacturing its

product. Four different machines are available. Cost, operating and other

expenses are as follows. Money is worth 17% before taxes to the company.

Which machine should be chosen?

Machine A

Machine B

Machine C

Machine D

(FC)

P 24,000

P 30,000

P 49,600

P 52,000

(OC)'year

P 1,300

1,360

P 2,020

P

P

2,400

P 11,600

P 2,800

(LC)/year

P

9,320

P

4,200

P 2,000

(МC) year

1,900

1,300

700

(IT) уear

P

720

900

1,488

1,560

Life

5 years

5 years

5 years

5 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1.10 Convert to hexadecimal and then to binary. (a) 1305.37510 (b) 111.3310 (c) 301.1210 (d) 1644.87510arrow_forwardWeekly Usage Annual Maintenance (hours) 13 10 14 18 22 27 25 31 40 38 Expense 17.0 22.0 25.0 27.0 37.0 34.0 33.0 39.0 51.5 40.0arrow_forwardYou as a businessperson have one million dollars to invest. One option is to invest your money. in a saving account that gives you 8% annual interest rate. But you decide to open a book store instead. You need to rent a place for $7900 per month and hire two workers and pay them each $6000 monthly. The other expenses such as purchases and overhead are $6500 per month. Your store generates $395,000 sales per year. How much is your economic profit? Which business do you choose? explainarrow_forward

- Q1).Using AW method compare between the following alternatives: Operating and maintenance Alt. F.C. Income at the Annual nd S.V. Useful life i. end of 2 yearIncome A 35000 3500 2800 7000 8 8% B. 32000 1500 4700 2500 8%arrow_forwardPlease do in excel pleasearrow_forwardIma Good-Student enrolls in ENGR 3202. She had considered purchasing a new vehicle but decides that she can buy a good used vehicle and invest the difference in the stock market. Ima sells her current vehicle for $5000 and buys a low-mileage vehicle for $15000 in cash, no financing needed. She also realizes that she needs to account for maintenance and operation costs. Those costs are estimated to be $2000 per year and increase by $100 per year. She will keep the vehicle for years and sell it for an estimated $3000. If her MARR is 8%, what is the present value of this cash flow? O a. $-23000 O b. $-23400 O c. $-18000 O d. -$18400arrow_forward

- A car lease agreement requires the following: down payment $2500 first month’s payment $346 security deposit $330 freight & PDI $765 federal air tax $110 How much is required upon signing the agreement (including 14% tax)?arrow_forwardI need 2 year of Finanical Report of International company and report must b odit with anothor company stam its only for finance projectarrow_forwardPlease provide steps by step answer with proper explanation with final answer.... Don't use chat GPTarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education