FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

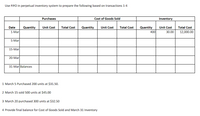

Transcribed Image Text:Use FIFO in perpetual inventory system to prepare the following based on transactions 1-4

Purchases

Cost of Goods Sold

Inventory

Date

Quantity

Unit Cost

Total Cost

Quantity

Unit Cost

Total Cost

Quantity

Unit Cost

Total Cost

1-Mar

400

30.00

12,000.00

5-Mar

15-Mar

20-Mar

31-Mar Balances

1 March 5 Purchased 200 units at $31.50.

2 March 15 sold 500 units at $45.00

3 March 20 purchased 300 units at $32.50

4 Provide final balance for Cost of Goods Sold and March 31 Inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Complete the following table using the perpetual FIFO method of inventory flow. Cost of Goods Sold Purchases Date Qty Unit Cost Total Cost Qty July 2 600 $12.00 5 200 $13.00 300 325 $14.00 300 $ 150 $ $13.00 50 $ 205 $ 120 $ 180 $ 330 $15.00 70 5 7 10 12 18 22 25 28 31 31 Bal 250 0 0 Unit Cost 00 Total Cost $ $ $ $ Qty $ $ $ Inventory Unit Cost 000 Total Cost $ $ $ $ $ 000arrow_forwardBeginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 24 units @ $10 5 Sale 17 units 17 Purchase 10 units @ $15 30 Sale 8 units Assuming a perpetual inventory system and the last-in, first-out method: a. Determine the cost of the goods sold for the September 30 sale.$fill in the blank 1arrow_forwardPerpetual inventory using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory 200 units at $40 Oct. 7 Sale 180 units Oct. 15 180 units at $45 Oct. 24 Sale 150 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of goods sold on October 24 and (b) the inventory on October 31. Purchase a. Cost of goods sold on October 24 b. Inventory on October 31arrow_forward

- erpetual Inventory Using LIFO Beginning inventory, purchases, and sales for Item 88-HX are as follows: Mar. 1 Inventory 110 units @ $20 8 Sale 88 units 15 Purchase 122 units @ $23 27 Sale 102 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of goods sold on Mar. 27 and (b) the inventory on Mar. 31. a. Cost of goods sold on Mar. 27 $fill in the blank 1 b. Inventory on Mar. 31 $fill in the blank 2 I asked this before 42 is not being accepted as the answer.arrow_forwardPerpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item ER27 are as follows: May 1 Inventory 72 units @ $17 9 Sale 58 units 13 Purchase 76 units @ $19 28 Sale 22 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on May 28 and (b) the inventory on May 31. a. Cost of merchandise sold on May 28 b. Inventory on May 31arrow_forwardhelppppp Hemming Co. uses a perpetual inventory system A.) Determine the cost assigned to ending inventory and to the cost of goods sold using FIFO. B.) Determine the cost assigned to ending inventory and to the cost of goods sold using LIFO. c.) Compute the gross margin for FIFO and LIFO methodarrow_forward

- Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as follows: 37 units @ $17 Oct. 1 7 15 24 Inventory Sale Purchase Sale 28 units 31 units @ $18 16 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of the goods sold on October 24 and (b) the inventory value on October 31. a. Cost of the goods sold on October 24 b. Inventory value on October 31arrow_forwardPerpetual Inventory Using LIFO Beginning inventory, purchases, and sales for Item PK95 are as follows: July 1 Inventory 90 units @ $30 Sale 72 units Purchase 100 units @ $32 11 21 Sale 84 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on July 21 and (b) the inventory on July 31. a. Cost of merchandise sold on July 21 b. Inventory on July 31arrow_forwardRequlred Informatlon [The following information applies to the questions displayed below.] Hemming Co. reported the following current-year purchases and sales for Its only product. Date Activities Units Acquired at Cost 300 units @ $14.00 Units sold at Retail = $ 4, 200 Jan. 1 Beginning inventory Jan. 10 Sales Mar.14 Purchase Mar.15 Sales 250 units e $44.00 520 units e $19.00 9,880 468 units e $44.00 July3e Purchase Oct. 5 Sales 500 units e $24.00 12,000 480 units @ $44.00 Oct. 26 Purchase 200 units @ $29.00 5,800 %3D Totals 1,520 units $31,88e 1,19e units Required: Hemming uses a perpetual Inventory system. 1. Determine the costs assigned to ending Inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross margin for FIFO method and LIFO method.arrow_forward

- Use data below to calculate the cost of ending inventory using the LIFO periodic inventory system method.January 1 Beginning Inventory 20 units at $20 eachJanuary 10 Purchase 24 units at $25 eachJanuary 31 Purchase 25 units at $28 eachOn January 31, ending Inventory consisted of 32 units. a. $750 b. $680 c. $700 d. $600arrow_forwardHomework i s Date January 1 January 10 March 14 March 15 July 30 October 5 October 26. Date Required information [The following information applies to the questions displayed below.] Hemming Company reported the following current-year purchases and sales for its only product. Units Acquired at Cost @$13.20 = @$18.20 = @$23.20 = @$28.20 Activities Beginning inventory Sales Purchase Sales Purchase. Sales Purchase. Totals a) Cost of Goods Sold using Specific Identification Available for Sale Activity Saved # of units 8,372 11,136 5,076 $28,280 Cost of Goods Sold Cost Per Unit Hemming uses a periodic inventory system. Ending inventory consists of 40 units from the March 14 purchase, 80 units from the July 30 purchase, and all 180 units from the October 26 purchase. Using the specific identification method, calculate the following. Help COGS Save & Exit Subre Units Sold at Retail 240 units 410 units 450 units 1,100 units Check my work Ending Inventory Units @ $43.20 @$43.20 @$43.20 Ending…arrow_forwardPerpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Delta are as follows: July 1 Inventory 50 units at $15 7 Sale 44 units 15 Purchase 90 units at $18 24 Sale 40 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on July 24 and (b) the inventory on July 31. a. Cost of merchandise sold on July 24 $fill in the blank 1 b. Inventory on July 31 $fill in the blank 2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education