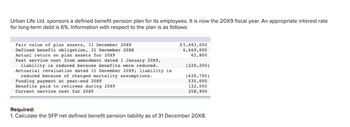

Urban Life Ltd. sponsors a defined benefit pension plan for its employees. It is now the 20X9 fiscal year. An appropriate interest rate for long-term debt is 6%. Information with respect to the plan is as follows: Fair value of plan assets, 31 December 20X8 Defined benefit obligation, 31 December 20X8 Actual return on plan assets for 20X9 Past service cost from amendment dated 1 January 20X9, liability is reduced because benefits were reduced. Actuarial revaluation dated 31 December 20X9; liability is reduced because of changed mortality assumptions. Funding payment at year-end 20X9 Benefits paid to retirees during 20X9 Current service cost for 20x9 $5,483,000 6,669,000 62,800 (220,200) (620,700) 535,000 122,000 258,900 Required: 1. Calculate the SFP net defined benefit pension liability as of 31 December 20X8.

Urban Life Ltd. sponsors a defined benefit pension plan for its employees. It is now the 20X9 fiscal year. An appropriate interest rate for long-term debt is 6%. Information with respect to the plan is as follows: Fair value of plan assets, 31 December 20X8 Defined benefit obligation, 31 December 20X8 Actual return on plan assets for 20X9 Past service cost from amendment dated 1 January 20X9, liability is reduced because benefits were reduced. Actuarial revaluation dated 31 December 20X9; liability is reduced because of changed mortality assumptions. Funding payment at year-end 20X9 Benefits paid to retirees during 20X9 Current service cost for 20x9 $5,483,000 6,669,000 62,800 (220,200) (620,700) 535,000 122,000 258,900 Required: 1. Calculate the SFP net defined benefit pension liability as of 31 December 20X8.

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts are unable to provide you with a solution at this time. Try rewording your question, and make sure to submit one question at a time. We've credited a question to your account.

Your Question:

Transcribed Image Text:Urban Life Ltd. sponsors a defined benefit pension plan for its employees. It is now the 20X9 fiscal year. An appropriate interest rate

for long-term debt is 6%. Information with respect to the plan is as follows:

Fair value of plan assets, 31 December 20X8

Defined benefit obligation, 31 December 20X8

Actual return on plan assets for 20X9

Past service cost from amendment dated 1 January 20X9,

liability is reduced because benefits were reduced.

Actuarial revaluation dated 31 December 20X9; liability is

reduced because of changed mortality assumptions.

Funding payment at year-end 20X9

Benefits paid to retirees during 20X9

Current service cost for 20x9

$5,483,000

6,669,000

62,800

(220,200)

(620,700)

535,000

122,000

258,900

Required:

1. Calculate the SFP net defined benefit pension liability as of 31 December 20X8.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning