Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

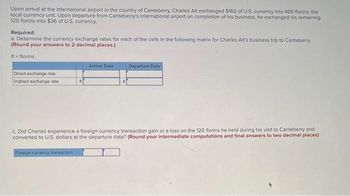

Transcribed Image Text:Upon arrival at the international airport in the country of Canteberry, Charles Alt exchanged $160 of U.S. currency into 400 florins, the

local currency unit. Upon departure from Canteberry's international airport on completion of his business, he exchanged his remaining

120 florins into $36 of U.S. currency.

Required:

a. Determine the currency exchange rates for each of the cells in the following matrix for Charles Alt's business trip to Canteberry.

(Round your answers to 2 decimal places.)

fl=florins:

Direct exchange rate

Indirect exchange rate

n

Arrival Date

fl

Departure Date

c. Did Charles experience a foreign currency transaction gain or a loss on the 120 florins he held during his visit to Canteberry and

converted to U.S. dollars at the departure date? (Round your intermediate computations and final answers to two decimal places)

Foreign currency transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Vikramarrow_forwardTex Hardware sells many of its products overseas. The following are some selected transactions. Tex sold electronic subassemblies to a firm in Denmark for 160,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1710. Collection was made on July 3 when the rate was Dkr 1 = $0.1713. On July 22, Tex sold copper fittings to a company in London for £36,000 with payment due on September 20. Also, on July 22, Tex entered into a 60-day forward contract to sell £36,000 at a forward rate of £1 = $1.630. The forward contract is not designated as a hedge. The spot rates follow: July 22 £1 = $1.580 September 20 £1 = $1.612 Tex sold storage devices to a Canadian firm for C$75,000 (Canadian dollars) on October 11, with payment due on November 10. On October 11, Tex entered into a 30-day forward contract to sell Canadian dollars at a forward rate of C$1 = $0.730. The forward contract is not designated as a hedge. The spot rates were as follows: October 11 C$1 =…arrow_forwardBefore boarding his flight to Zurich, Switzerland, Ian purchased CHF900 from his bank when the exchange rate was C$1 = CHF0.9753. However, Ian had to cancel the trip. Ian returned to the bank to convert the Swiss currency back into Canadian dollars. If the exchange rate changed to C$1 = CHF0.984, how many Canadian dollars would Ian have lost in these transactions? Assume the bank has a 1.00% commission on both the sale and the purchase of the funds. C Round to the nearest cent Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for surearrow_forward

- Upon arrival at the international airport in the country of Canteberry, Charles Alt exchanged $340 of U.S. currency into 850 florins, the local currency unit. Upon departure from Canteberry's international airport on completion of his business, he exchanged his remaining 110 florins into $33 of U.S. currency. Required: a. Determine the currency exchange rates for each of the cells in the following matrix for Charles Alt's business trip to Canteberry. (Round your answers to 2 decimal places.) fl= florins Direct exchange rate Indirect exchange rate fl Foreign currency transaction Arrival Date fl Departure Date c. Did Charles experience a foreign currency transaction gain or a loss on the 110 florins he held during his visit to Canteberry and converted to U.S. dollars at the departure date? (Round your intermediate computations and final answers to two decimal places)arrow_forwardThe U.S Company, In the month of January 15 sold machinery on account to a retailer Australia. The invoice price was 250,000 US dollars and the exchange rate for the Australia dollar was $0.576. Select one:a. Cash A/c Dr 144,000$Sales A/c Cr 144,000$b. Cash A/c Dr 250,000$Sales A/c Cr 250,000$c. Accounts Receivable 250,000$ Sales 250,000$ d. Accounts receivable A/c Dr 144,000$Sales A/c Cr 144,000$arrow_forwardIberico plc, a Spanish firm whose functional currency is EUR, bought goods from a British supplier at a cost of 10,000 GBP paid in cash. The exchange rate on the date of sale was 1 GBP = 1.2 EUR. Which the journal entry shall Iberico plc prepare regarding the purchase? Select one: a. DR Inventories 12,000 EUR, CR Cash 10,000 GBP b. DR Inventories 12,000 EUR, CR Cash 12,000 EUR C. DR Inventories 12,000 GBP, CR Cash 12,000 GBP d. DR Inventories 10,000 GBP, CR Cash 10,000 GBP Clear my choicearrow_forward

- Vitamin, Inc. is a U.S.-based manufacturer and wholesaler. On 10/15/20x1, Vitamin made its first international sale. They sold $450,000 of products to a non-U.S. customer. Vitamin, Inc. agreed to allow the customer to pay for the purchase in its own currency, the FC. To avoid a penalty, the foreign buyer must make payment to Vitamin by February 2, 20x2. At the time of the sale, the FC/$ spot rate was FC1.97=$1 Vitamin, Inc. has a December 31 year-end. At 12/31/20x1, the foreign currency spot rate was FC1.95 = $1. Required: For Vitamin, Inc., Give the journal entries for the 10/15/20x1 sale. Give the journal entries for the foreign currency sale at 12/31/ 20x1, when the company closes its books and prepares its financial statements. Give the journal entries for the receipt of payment on the sale on 2/2/20x2. At that date, the foreign currency spot rate was FC 2.00 = $1.arrow_forwardIf an American purchases a ticket from Scandinavian Airlines, paying by a personal check, which of the following entries would be the result? Group of answer choices a. a credit in Norway's service account b. a debit in Norway's service account c. a credit in the U.S. unilateral transfers account d. a debit in the U.S. unilateral transfers accountarrow_forwardConcord Company, a U.S. company, made credit sales to four customers in Asia on September 15, 2018, and received payment on October 15, 2018. Information related to these sales is shown below: Concord Company Sales Transactions September 15, 2018 Customer Location Invoice Price Currency Prima Industries Ltd Mumbai 7,195,000 Indian rupees (INR) Samal Island Group Cebu City 5,417,000 Philippine peso (PHP) Yokama Properties Inc Osaka 11,210,000 Japanese yen (JPY) Kinabalu Trading Ltd Johur Bahru 414,000 Malaysian ringgit (MYR) The Concord Company’s fiscal year ends on September 30. Required: 1. Use historical exchange rate information available on the Internet x-rates, Historical Lookup, to find the exchange rates between the U.S. dollar and each foreign currency for September 15, September 30, and October 15, 2018. 2. Determine the foreign exchange gains and losses that Concord Company would have recognized in net income in the fiscal years ended September 30, 2018 and September 30,…arrow_forward

- Vitamin, Inc. is a U.S.-based manufacturer and wholesaler. On 10/15/20x1, Almira made its first international sale. They sold $450,000 of products to a non-U.S. customer. Vitamin, Inc. agreed to allow the customer to pay for the purchase in its own currency, the FC. To avoid a penalty, the foreign buyer must make payment to Vitamin by February 2, 20x2. At the time of the sale, the FC/$ spot rate was FC1.97=$1 Vitamin, Inc. has a December 31 year-end. At 12/31/20x1, the foreign currency spot rate was FC1.95 = $1. Required: Explain how Vitamin, Inc. can use: (a) forward exchange contracts and (b) foreign exchange options their foreign currency risk. In your explanation, discuss the type of: (a) forward exchange contract or (b) foreign currency option contracts, they would obtain to hedge their foreign currency risk. No journal entries are required. For Vitamin, Inc.’s foreign customer, explain the type of foreign currency risk the s/he accepts relating to their purchase from…arrow_forwardEmily Karlsen is a currency trader in Sydney and has 1 million Australian dollar (or the U.S. dollar equivalent) available. She considers 180 day arbitrage opportunities and retrieves the following current foreign exchange rates and interest rates: (Note that Australian dollar is regarded as the home currency.) Spot exchange rate in Sydney: $A1.1764/$US 6-month forward rate in Sydney: $A1.2575/$US U.S. dollar interest rate: 5.0 percent per annum Australian dollar interest rate: 7.0 percent per annum In the absence of transaction costs, is covered interest arbitrage (CIA) possible in the above case? If yes, calculate how much profit Emily Karlsen could make (annualized rate of return over her initial investment).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education