FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Evaluate the performance of the two divisions assuming UEI uses return on investment (ROI).

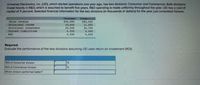

Transcribed Image Text:Universal Electronics, Inc. (UEI), which started operations one year ago, has two divisions: Consumer and Commercial. Both divisions

Invest heavily in R&D, which is assumed to benefit five years. R&D spending is made uniformly throughout the year. UEI has a cost of

capital of 11 percent. Selected financial information for the two divisions (in thousands of dollars) for the year just completed follows.

Consumer

$54,000

10,650

35,500

4,200

4,200

Comnercial

Sales revenue

Divisional income

$85,000

11,925

39,750

4,000

Divisional investment

Current liabilities

R&D

4,200

Required:

Evaluate the performance of the two divisions assuming UEI uses return on investment (ROI).

ROI of Consumer division

ROI of Commercial division

Which division performed better?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the major shortcoming of using income from operations as a performance measure for investment centers?arrow_forwardExplain the meaning of the undernoted measures that may be used for divisional performance measurement and investment decision-making. Discuss the advantages and problems associated with: Residual incomearrow_forward3 Investment center analysis; ROI and residual income Romano Corporation has three operating divisions and requires a 12% return on all investments. Selected information is presented here: Division X Division Y Division Z Revenues $1,000,000 Operating income. Operating assets... Margin.... $ 120,000 $ 500,000 $100,000 $300,000 12% Turnover .. 1 turn 2 turns ROI..... Residual income . $25,000arrow_forward

- The major advantage of residual income as a performance measure is that it gives consideration to not only a minimum rate of return on investment but also the total magnitude of income from operations earned by each division. True Falsearrow_forwardExercise 10-12 Evaluating New Investments Using Return on Investment (ROI) and Residual Income (LO10-1, LO10-2] Selected sales and operating data for three divisions of different structural engineering firms are given as follows: Division A $ 6,300,000 $ 1,260,000 340,200 Division B $ 10,300,000 $ 5,150,000 968,200 18.80% Division C $ 9,400,000 $ 1,880,000 24 Sales Average operating assets Net operating income Minimum required rate of return 2$ 249,100 20.00% 17.00% Required: 1. Compute the return on investment (ROI) for each division using the formula stated in terms of margin and turnover. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an investment opportunity that would yield a 20% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept or…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education