ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Respond to the question with a concise and accurate answer, along with a clear explanation and step-by-step solution, or risk receiving a downvote.

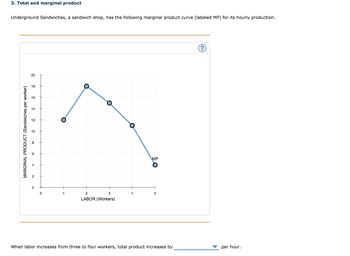

Transcribed Image Text:3. Total and marginal product

Underground Sandwiches, a sandwich shop, has the following marginal product curve (labeled MP) for its hourly production.

MARGINAL PRODUCT (Sandwiches per worker)

20

18

16

14

0

2

LABOR (Workers)

MP

When labor increases from three to four workers, total product increases by

(?.

per hour.

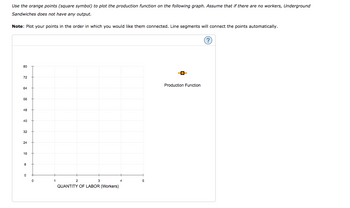

Transcribed Image Text:Use the orange points (square symbol) to plot the production function on the following graph. Assume that if there are no workers, Underground

Sandwiches does not have any output.

Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically.

80

72

64

56

48

40

32

24

16

8

0

0

1

3

2

QUANTITY OF LABOR (Workers)

5

-O

Production Function

(?)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Why is cost-minimization analysis most likely to be useful for managers?arrow_forwardExplain the relevancy of reaction time to “real life.” Provide one example in real life where reaction time could affect one’s life positively or negatively. Why is reaction time important? Please include references.arrow_forwardYou serve 3,000 private-pay patients and 1,000 health maintenance organization (HMO) members. Your fixed costs are $50,000 and your incremental cost is $50. You currently charge private-pay patients $75 and HMO members $60. This line of business is profitable. Profits would increase if you stopped serving HMO members. You should stop serving HMO members if fixed costs increased to $60,000. All of the abovearrow_forward

- Which one applies to an impatient individual? Have high discount factors Have low discount rates More likely to become a physician More likely to become a surferarrow_forwardUse the following figure to answer the question below. Corn 80 Production Possibilities Frontier A Point A in the figure above is B 00 80 Green Beansarrow_forwardWhich of the following about emotional influence on decision making is true? People generally make rational decisions that maximize desirable outcomes in the absence of emotions Only emotions that are relevant to the decision at hand have any influence on that decision People tend to overestimate their predicted negative emotions resulting from a decision's outcomes People are equally angry about unfair offers in the ultimatum game from computers and from other human playersarrow_forward

- A new vaccine offers protection against otitis media. Administering the vaccine to 10,000,000 children under age 5 would reduce otitis media cases from 14,000,000 to 11,000,000. The vaccine costs $100 per patient. What is the cost per case avoided? Round your answer to the nearest unit. Enter a numeric value as a non-numeric value will be converted to 0 thus potentially making your answer wrong. Do not enter a comma or any other sign for the same reason. Iarrow_forwardThe small family company that you manage has invested $35,000 in developing a new product, but the development is not quite finished. At a recent meeting, your family company management team predicts that the introduction of competing products has reduced the expected sales of your new product to $30,000. If your company receives zero profit for an unfinished product, and if it would cost $10,000 to finish development and make the product, you go ahead and do so. The most your family company should spend to complete development is O should; $30,000 O should; $20,000 O should; $10,000 O should not; $0arrow_forwardHow might imperfect information impact price? Group of answer choices Because buyers cannot determine the true quality of a product, they might tend to bid up the prices. Because they might not be able to present all the information about a product, sellers might temporarily lower the price to make potential buyers think the product is of excellent quality. Imperfect information might tend to cause prices to be perfectly elastic. Buyers cannot distinguish which goods have a higher quality and might be less likely to pay higher prices for that good.arrow_forward

- Opportunity Cost a) never exists if there are alternatives. b) is irrelevant to rational choice c) is the value of the next best alternative foregone in making a choice d)never applies to government or public policyarrow_forwardWhat is loss aversion? Group of answer choices The tendency to focus more on the loss than the gain. The tendency of an individual to invest all of their resources to avoid losing. The ability of humans to exercise complete self control in high stakes situations to avoid losing. The temptation company’s face to invest in questionable techniques to avoid losing money.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education