Question

Accounting

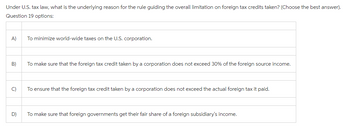

Transcribed Image Text:Under U.S. tax law, what is the underlying reason for the rule guiding the overall limitation on foreign tax credits taken? (Choose the best answer).

Question 19 options:

A)

B)

C)

D)

To minimize world-wide taxes on the U.S. corporation.

To make sure that the foreign tax credit taken by a corporation does not exceed 30% of the foreign source income.

To ensure that the foreign tax credit taken by a corporation does not exceed the actual foreign tax it paid.

To make sure that foreign governments get their fair share of a foreign subsidiary's income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- demonstrate an understanding of accounting principles and practices; apply Generally Accepted Accounting Principles (GAAP) in the accounting cycle demonstrate the relationship between GAAP and accounting practices describe the roles of various agencies (e.g., CPA Ontario, Ontario Securities Commission, Canada Revenue Agency) and their effects on accounting practices.arrow_forwardhow does a company maintain its capitalarrow_forwardfrom the companies act 2004 jamaica help me explain the ranking of claims in a winding uparrow_forward

- Structural subordination occurs when O There is a holding company and a group lends to its operating subsidiary One group lends to a holding company and there is no debt at its operating subsidiaries One group lends to an operating subsidiary on an unsecured basis O One group lends to a holding company and another group lends to its operating subsidiaryarrow_forwardWhat are the duties of a Company Secretary? What is a Company?arrow_forward- Explain when an accounting period starts for corporation tax purposes.arrow_forward

arrow_back_ios

arrow_forward_ios