FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Font

171

Paragraph

LZ

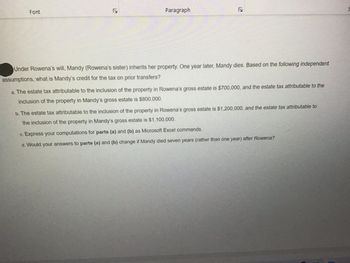

Under Rowena's will, Mandy (Rowena's sister) inherits her property. One year later, Mandy dies. Based on the following independent

assumptions, what is Mandy's credit for the tax on prior transfers?

a. The estate tax attributable to the inclusion of the property in Rowena's gross estate is $700,000, and the estate tax attributable to the

inclusion of the property in Mandy's gross estate is $800,000.

b. The estate tax attributable to the inclusion of the property in Rowena's gross estate is $1,200,000, and the estate tax attributable to

the inclusion of the property in Mandy's gross estate is $1,100,000.

c. Express your computations for parts (a) and (b) as Microsoft Excel commands.

d. Would your answers to parts (a) and (b) change if Mandy died seven years (rather than one year) after Rowena?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alicia sold her personal residence to Rick for $300,000. Before the sale, Alicia paid the real estate tax of $4,380 for the calendar year. For income tax purposes, the deduction is apportioned as follows; $2,160 for Alicia and $2,220 for Rick. What is Ricks basis in the residence?arrow_forwardIn October 2023, Jackie, a single taxpayer, sold IBM stock for $12,000, which she purchased four years ago for $4,000. She also sold GM stock for $14,000, which cost $17,500 three years ago, and she had a short-term capital loss of $1,800 on the sale of land. The tax rates on long-term capital gains are as follows: Income Level Long-Term Capital Gains Rates Married filing jointly $0–$89,250 0% $89,251–$553,850 15% > $553,850 20% Single $0–$44,625 0% $44,626–$492,300 15% > $492,300 20% Head of household $0–$59,750 0% $59,751–$523,050 15% > $523,050 20% Married filing separately $0–$44,625 0% $44,626–$276,900 15% > $276,900 20% If Jackie's other taxable income (salary) is $78,000, what is the amount of Jackie's tax on these capital transactions? fill in the blank 1 of 1$arrow_forwardPaige had $100,000 of income from wages and $3,650 of taxable interest. Paige also made contributions of $2,300 to a tax-deferred retirement account. Paige has 4 dependents and files as head of household.What is Paige's total income?What is Paige's adjusted gross income?For Paige's filing status, the standard deduction is $18,000. What is Paige's taxable income?arrow_forward

- Juliana purchased land three years ago for $90,100. She made a gift of the land to Tom, her brother, in the current year, when the fair market value was $126,140. No Federal gift tax is paid on the transfer. Tom subsequently sells the property for $113,526. a. Tom's basis in the land is $ 90,100 V and he has a realized gain -v of $ 23,246 x on the sale. b. Assume, instead, that the land has a fair market value of $81,090 on the date of the gift, and that Tom sold the land for $77,036. Tom's basis in the land is $ 113,256 x and he has a realized loss V of 12,614 X on the sale.arrow_forwardScott and Rachel are married and will file a joint return for 2021. During the year, Rachel sold 500 shares of XYZ stock. She had owned the shares since 2018, and her gain on the sale was $4,885. The couple's taxable income is $124,000. At what rate will the gain on the sale of the stock be taxed?arrow_forwardAt death, Francine owns an interest in a passive activity property (adjusted basis of $160,000, suspended losses of $16,000, and fair market value of $170,000). What is deductible on Francine’s final income tax return?arrow_forward

- Which of the following taxpayers may report the sale of their property as an installment sale? (a) Franklin. He sold a tractor to Roberto for $9,000. Roberto made two payments, one payment of $3,500 on May 15 and one payment of $5,500 on September 15 of the tax year. Franklin paid $7,000 for the tractor when it was new; it had fully depreciated before he sold it. (b) Janet. She sold her entire inventory, valued at $8,000, to Marvin for $12,000. Marvin intends to pay Janet $4,000 per year, plus interest, for the next three years. (c) Juan. He sold a plot of land for $50,000. He purchased the land for $45,000 and paid $10,000 to improve it. His buyer intends to pay for the land over five years. (d) Sara. She sold a rental condominium for $125,000. She purchased it for $90,000 and had claimed $20,000 in depreciation. Her buyer intends to pay her $20,000 per year plus 6% interest for five years.arrow_forwardCraig and Karen Conder purchased a new home on May 1 of year 1 for $200,000. At the time of the purchase, it was estimated that the real property tax rate for the year would be 1 percent of the property's value. How much in property taxes on the new home are the Conders allowed to deduct under each of the following circumstances? Assume the Conders' itemized deductions exceed the standard deduction before considering property taxes and the property tax is the only deductible tax they pay during the year. Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. Required: The property tax estimate proves to be accurate. The seller and the Conders paid their share of the tax. The full property tax bill is paid to the taxing jurisdiction by the end of the year. The actual property tax bill was 1.05 percent of the property's value. The Conders paid their share of the estimated tax bill and the entire difference between the 1 percent estimate…arrow_forwardGinger agreed to pay the full deed transfer tax on the $600,000 sale of her property in Miami-Dade County. How much will Ginger owe for the deed transfer tax? $2,500 $3,600 $4,200 $4,000arrow_forward

- Voytek transfers land worth $200,000 with an adjusted basis of $17,000 to his wife Gosha for her birthday. The land was purchased 3 years ago. Assume no gift tax was paid on the transfer. a) Does Gosha have gross income as a result of the gift? Yes or No. No? b If the answer is no, Explain why. c)What is Gosha basis in the land? d)What is Gosha holding period in the land?arrow_forwardDuring the current income tax year a taxpayer, Adele Ho, made a capital gain of $100,000 from the sale of land and a capital loss of $10,000 from the sale of shares. She also has prior year carry forward capital losses from the sale of shares that total $30,000. Adele elects to use the capital gains tax (CGT) discount method to determine her net capital gain. What is Adele’s assessable net capital gain for the current income tax year? a. $60,000 b. $30,000 c. $15,000 d. $45,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education